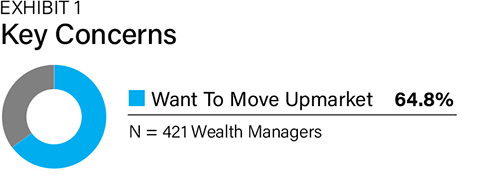

A survey of 421 wealth managers shows that 65% want to move upmarket, which they define as working with more affluent clients (Exhibit 1). In all likelihood, relatively few wealth managers will even move upmarket.

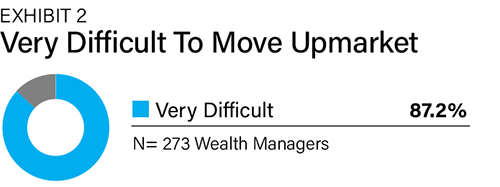

Although there is considerable interest in growing their practices with more affluent clients, slightly more than 85% of these wealth managers have found it very difficult to move their practices upmarket (Exhibit 2). In effect, they have generally been unsuccessful in cultivating wealthier clients than those that characterize their book of business. It is difficult for many wealth managers to source and win the business of the wealthy with any degree of consistency. To explain why this is the case, see Why Wealth Managers Fail to Move Upmarket.

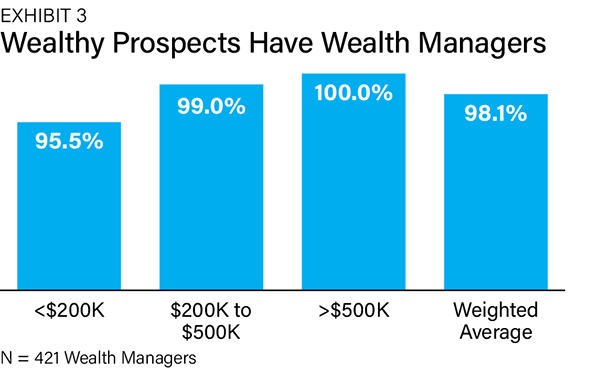

A significant obstacle for most wealth managers to move upmarket by working with the wealthy is that most of the wealthy already work with wealth managers, and those who do not will likely continue to do it themselves. Unless the investment portfolios set up by their current wealth managers are severely underperforming for an extended period or the wealth managers are unresponsive to their clients, the wealthy tend to maintain the relationships. Inertia, and for most of the wealthy, more pressing life demands work in favor of staying with the professionals they are presently engaging.

What does this mean for wealth managers who want to break these bonds? Wealth managers who aim to work with more affluent clients must mitigate the presence of the wealthy’s current wealth manager.

Approaches Used When The Wealthy Have A Wealth Manager

Nearly all wealth managers have encountered situations in which wealthy prospects pointed out that they already have wealth managers (Exhibit 3).

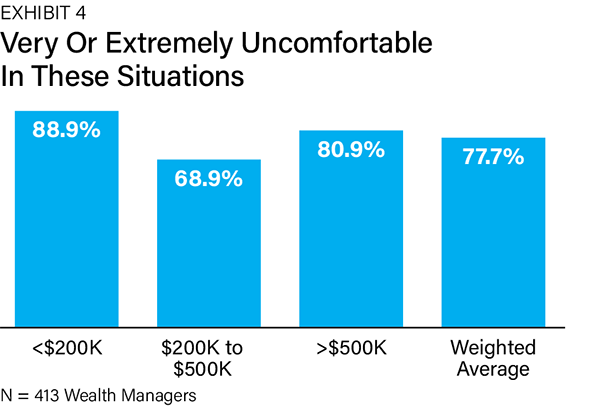

Since this is the norm, how wealth managers manage this situation is critical. Three-quarters of the wealth managers find the situation very or extremely uncomfortable (Exhibit 4). They are uncomfortable responding and tend to lack a cohesive approach to dealing with these situations.

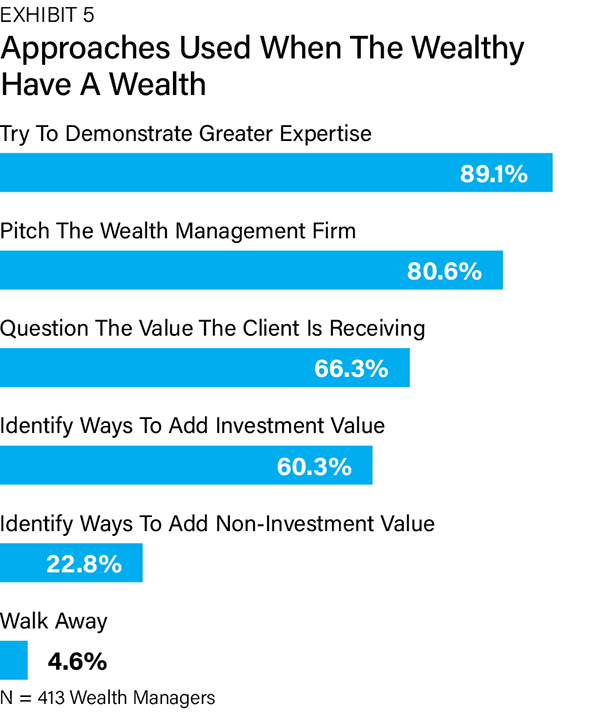

The surveyed wealth managers were asked how they handle situations when wealthy prospects point out they have wealth managers. Wealth managers will use different approaches to win over these prospects (Exhibit 5). Most are looking to demonstrate their expertise, including pitching their wealth management.

All the approaches, save for walking away, can conceivably enable wealth managers to displace the wealthy’s current wealth managers. However, some methodologies prove very effective in replacing a wealthy individual’s or family’s existing team of professionals, including wealth managers.

A Proven Solution

Being able to consistently win business from the wealthy even though they have wealth managers starts with recognizing that most wealthy are poorly served. While some reasons for this situation are the wealthy themselves, a bigger factor is usually the professionals they rely on. The implication for wealth managers is that although the wealthy commonly already have relationships with wealth managers, they are probably not getting superior results.

Truly believing the wealthy are poorly served usually nullifies the sense of discomfort when the wealthy explain their services are not needed and that they are already being taken care of. Moreover, recognizing that most of the wealthy are poorly served gives wealth managers the confidence to use proven methodologies like the following three-step process to disentangle existing relationships. While the methodology has proven to be exceedingly effective, there are two major caveats:

• In some ways, the wealthy prospect is being poorly served. Although this is very likely, it does not always mean it is true.

• The current wealth manager is so embedded that the wealthy prospect would rather not consider getting superior results and, by design or delusion, will not change. A typical example is when the client’s wealth manager is a close relative.

While these situations occasionally arise, they are rare in the scheme of things. Therefore, for most wealth managers, using the following three-step process leads to getting business from the wealthy even when they have a strong relationship with a wealth manager:

• Step 1: Discovery. Wealth managers can develop deep insights into wealthy prospects using open-ended questions and probing. The aim is to understand expressed and latent objectives, the rationale for the objectives, essential experiences, good and bad, with professionals, the best approach to working with professionals, and so on.

• Step 2: Outcome validation. Discovery results in rapport and understanding of what matters to the wealthy prospects. However, most people have several, if not more, issues that matter. Again, wealth managers use open-ended questions to prune and refine the list. In the end, the desired outcomes are specified and validated. Additionally, at this time, the wealthy prospect decides whether to engage the new wealth manager.

• Step 3: Narrative. Although the wealthy prospect has agreed to become a client, it is still necessary to ensure they are entirely comfortable with the new wealth manager's orientation and approach. When there is alignment, the current wealth manager becomes somewhat minimized if not wholly displaced.

Conceptually, this three-step process is simple, elegant, and incredibly effective. Operationally, it is complicated, rough, and incredibly effective because people are complicated and rough. This process has many moving parts, and the nuances are critical. Nevertheless, when done well, it almost always results in business for the new wealth manager, to the chagrin of the client’s current wealth manager. It works so well because, at its core, it’s all about finding ways to add significant value.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners, a leading financial advisor firm.

Russ Alan Prince is a strategist for family offices and the ultra-wealthy. He has co-authored 70 books in the field, including Making Smart Decisions: How Ultra-Wealthy Families Get Superior Wealth Planning Results.