First, we need to define upmarket…Upmarket is where clients are wealthier than most of the clients a wealth manager currently works with. These more affluent clients generate more revenues on a per-client basis.

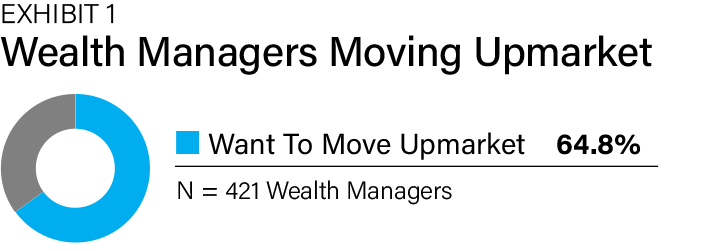

There is a lot of discussion about wealth managers going upmarket. A survey of 421 wealth managers shows that 65% want to move upmarket, which they define as working with more affluent clients (Exhibit 1). For a comprehensive list of concerns, see What are the Key Concerns of Financial Advisors?

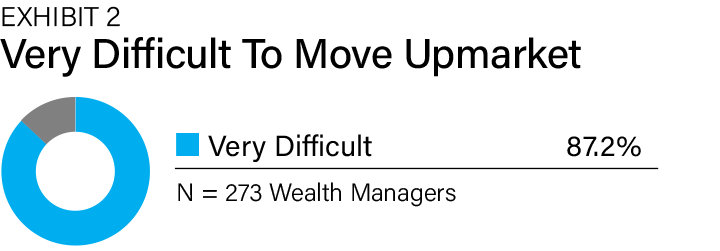

Although there is considerable interest in growing their practices with more affluent clients, slightly more than 85% of these wealth managers have found it very difficult to move their practices upmarket (Exhibit 2). In effect, they have generally been unsuccessful in cultivating wealthier clients than those that characterize their book of business.

Major Factors Holding Wealth Mangers Back

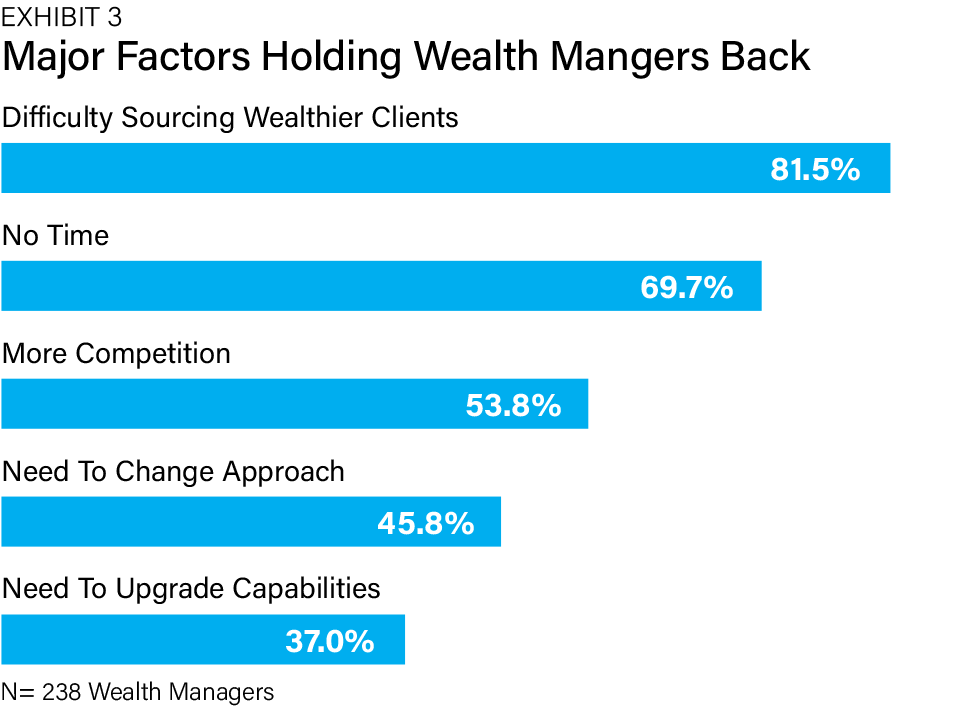

Factor analysis enabled us to determine why many wealth managers cannot move upmarket (Exhibit 3). Topping the list is an inability to source wealthier clients. While they tend to connect with clients that mirror their current clientele, slightly more than 80% cannot connect with wealthier individuals and families.

Decades of research with wealth managers tell us that finding new clients is consistently one of their most significant obstacles to success. While there are proven business development methodologies that can enable them to connect with increasingly wealthier clients, up to billionaires, relatively few wealth managers use them. Moreover, wealth managers tend not to be very systematic or persistent when using many of these methodologies. It is often like those New Year resolutions that are forgotten in a few weeks.

The most effective way to get new clients is through referrals. These are either client referrals or referrals from centers of influence, such as accountants and attorneys. Regarding client referrals, they tend to be more lateral than upmarket. Referrals from clients are more often than not to individuals and families similar to the person making the referral, which usually constitutes most of the wealth manager’s current clients.

On the other hand, referrals from centers of influence have a substantially greater potential of being meaningfully wealthier than the wealth manager's existing clients. When implemented well, some business development methodologies will enable wealth managers to create strategic relationships with centers of influence that ensure they are introduced to more affluent clients than they usually work with. While many wealth managers know this is the best path to moving upmarket, most do not follow it.

A contributing factor is a lack of time. Many wealth managers are very busy with their practices' day-to-day operations, so they cannot devote the time to being strategic. One version of the phrase goes: “They are working in their practices, not on their practices.” If they cannot commit the time to take steps to move upmarket, they will not move upmarket.

A lack of time is highly correlated with difficulty sourcing wealthier clients. Specifically, building strategic relationships with centers of influence takes time and patience. If wealth managers are extremely busy keeping their practices running, it may be impossible for them to focus on creating the necessary strategic relationships with accountants and attorneys that will result in being referred to more affluent clients.

About half the wealth managers see greater competition regarding wealthier clients. Without question, more and more wealth managers are increasingly interested in working with the wealthy and, more so, the ultra-wealthy. While these wealth managers have experience successfully competing for the clients they primarily work with, they will likely face sterner competition for more affluent clients. Many of them are unsure how to handle this situation.

Related to this point is that a similar percentage of wealth managers realize they must change their approach to work with more affluent clients. For example, the ultra-wealthy individual with $20 million of investable assets tends to be more demanding than a client with a $500,000 IRA rollover. Even when the client with the $500,000 IRA rollover is just as challenging, wealth managers are likely more concerned about losing the $20 million AUM client. Extreme client responsiveness is necessary for most wealth managers who want to move upmarket, and not all of them can follow through effectively.

About a third of the wealth managers say they must upgrade their capabilities. The business and personal lives of the wealthy can be complex. Being able to help them deal with complexity is essential. Wealth managers moving upmarket must be able to provide state-of-the-art wealth management solutions as appropriate. Unfortunately, the range of expertise many wealth managers can deliver is limited. For example, several life insurance arbitrage strategies that can benefit a growing segment of the ultra-wealthy are not widely known. Similarly, many wealth managers lack access to various carefully vetted alternative investments, which are increasingly in demand by the ultra-wealthy.

Conclusions

The appeal of working with wealthier clients—moving upmarket—is considerable. However, there are strong indicators that only a small percentage of wealth managers can transition to working with more affluent clients. Those who succeed will readjust their thinking and commit, which entails putting in the requisite time and effort.

These wealth managers will likely become adept at creating strategic relationships with centers of influence. They will also require the resources to provide exceptional value to the affluent. Those wealth managers who implement the proper actions will move upmarket and have exceptionally profitable practices.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners, a leading financial advisor firm. Russ Alan Prince is a strategist for family offices and the ultra-wealthy. He has co-authored 70 books in the field, including Making Smart Decisions: How Ultra-Wealthy Families Get Superior Wealth Planning Results.