Income-oriented funds can take various forms, and sometimes in unconventional ways. Take the JPMorgan Equity Premium Income Fund, for example, essentially a U.S. large-cap equity product that began the year with stakes in non-dividend paying stocks such as Alphabet Inc., O’Reilly Automotive Inc. and Amazon.com. And among some of the fund’s other 90 or so equity holdings are those that pay tiny dividends, such as the 0.16% yield recently offered by Thermo Fisher Scientific Inc. The fund’s income yield from its equity holdings adds up to roughly 2% at best, a relatively unimpressive number.

Yet the fund recently sported a chunky 30-day SEC yield of 7.87%, which means the income is coming from elsewhere. And the fund got its extra yield from premiums generated by selling options on equity-linked notes (ELNs)—a debt instrument tied to a stock, a basket of stocks or an index. These notes are issued by counterparties such as banks, broker-dealers or their affiliates.

Options premiums provide recurring cash flow to the fund that distributes income to investors monthly, and the fund’s portfolio managers posit that investing in ELNs containing written call options can potentially reduce the fund’s volatility. On the flip side, the call options written on ELNs reduce the fund’s ability to fully profit from the gains in the value of its equity portfolio.

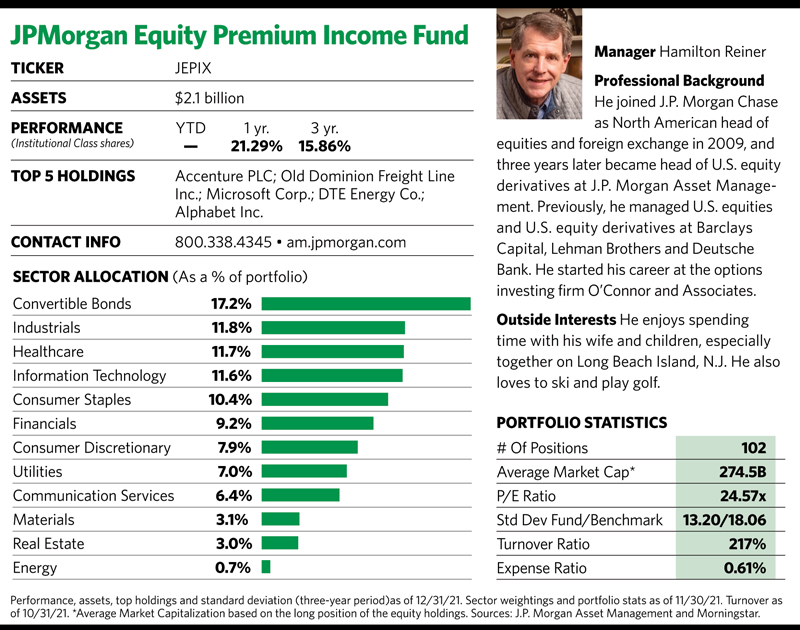

That’s reflected in the performance of the JPMorgan Equity Premium Income Fund, which began trading in August 2018. According to Morningstar, the fund’s average three-year return of 15.9% (through December 31) trailed the 25.9% return on the Morningstar U.S. Market Total Return Index during that period. J.P. Morgan Asset Management uses the S&P 500 as the fund’s bogey for the equity portion of the portfolio; either way, the fund has seriously underperformed its benchmark.

But that misses the point, because this product’s raison d’être is to provide investors with substantial income while keeping them invested in equities. ELNs, which recently represented 10 of the portfolio’s roughly 100 holdings, are central to that strategy.

“In today’s environment, where interest rates are at negative real yields, how can we help people own an asset class they think has more appreciation and do it in a way where they won’t get shaken out? That’s the basis of our hedged equity strategy,” says Hamilton Reiner, managing director at J.P. Morgan Asset Management and co-portfolio manager of the fund.

Reiner, who leads the company’s U.S. equity derivatives business, is the architect of the fund’s strategy and manages the options part of the portfolio. His partner, Raffaele Zingone, handles the equities.

As Reiner explains it, when he joined J.P. Morgan Asset Management 10 years ago he began working on a hedged equity strategy aimed at combining stocks and options to enable investors to hold more equities but do it in a more cautious or defensive manner.

“If you have a hedge in place, you can help clients and investors get and stay invested,” he says, adding that the premiums from written call options address the need for investment income.

“It’s an outcome-oriented strategy where income is the outcome,” Reiner says.

Monthly Income

Some investors view options as arcane, complicated and, thus, risky. But Reiner notes that options strategies have been around a long time and have been used by farmers, oil companies and others to achieve certain financial goals. He likens his fund’s options overlay strategy to farmers who use options to lock in a certain price on their crops, whether or not prices rise above that in the future.

The fund’s strategy, Reiner explains, results in investors’ forgoing some of the market’s upside in return for having an incremental amount of income today. He adds that the strategy avoids using leverage, which can result in substantial performance gains, but at significantly increased risk.