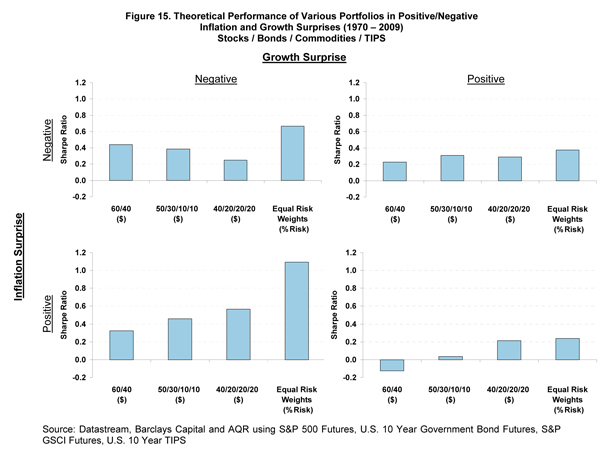

Of course, the four asset classes studied are not the comprehensive set of assets that may be included in a portfolio. It is possible to build a more diversified equal risk-weighted portfolio with the inclusion of additional assets.

Section III. Evaluation of Other Liquie Potential Inflation Hedges

Up to this point we considered the four main asset classes - Equity, Government Bonds, TIPS and Commodities which are core assets in most institutional investor portfolios. We have also analyzed these assets in a portfolio context to examine the inflation sensitivity of various strategic allocations. However, many institutional investors may wish to target inflation hedging without altering their current strategic asset allocation. Therefore, in this section we expand the set of liquid strategies which may be considered in a portfolio specifically designed to serve as an efficient inflation hedge (we focus on the liquid universe of assets for data availability and comparison purposes). This analysis is most relevant for investors seeking to add inflation protection to their portfolio without altering their core strategic allocation. For example, an investor with a traditional stocks and bonds portfolio may be prevented from dramatically altering that allocation for governance reasons and might seek a pure inflation protection strategy to add at a more modest weight.

Adding to the previous analysis of the four primary asset classes, we analyze other strategies that may be considered by institutional investors when analyzing the inflation hedging potential of individual assets. Specifically, we present inflation breakevens (TIPS - Nominal Government Bonds), infrastructure-related equities, commodity-related equities, REITS, gold futures, Timber (lumber futures) and a strategy that invests in a basket of emerging currencies. The previous section showed that equities are not effective hedges against inflation over the short- and medium-term. As a result, we focus on beta-neutral portfolios of equity related assets (infrastructure, commodity related equities and REITS)14 by hedging their passive equity beta in order to isolate the inflation effect on each individual asset.

We include Inflation Breakevens since they may be the most direct hedge against inflation (as measured by CPI). Moreover, an Inflation Breakeven position is not directly affected by real interest rate moves. This is in sharp contrast to both nominal bonds and TIPS. An Inflation Breakeven position is comprised of a long position in an inflation-linked bond and a corresponding short position in a duration-matched nominal government bond. The return on an Inflation Breakeven position if held to maturity should include the difference between realized and expected inflation, a negative premium due to the insurance-like protection from inflation risk that nominal bond holders are compensated for, and a positive premium due to liquidity risk as TIPS are generally less liquid than nominal government bonds. Changes in inflation expectations and TIPS' associated risk premia will affect the price of the breakeven position prior to maturity. An increase in inflation expectations, for example, will cause the price of nominal bonds to fall, resulting in a capital gain for the Inflation Breakeven position. It is important to note that an Inflation Breakeven strategy has a negative expected return since it is primarily an insurance-related payoff which requires compensation to the providers of this insurance, which in this case are nominal bond holders.

Gold, lumber, REITS, commodities and infrastructure-related equities are often mentioned as potential inflation hedges as their cash flows are derived from real assets. The basket of emerging currencies can be thought of as a negative dollar bet that pays a risk premium over the long term. In cases of isolated or high relative U.S. inflation, the dollar is expected to depreciate relative to other currencies. Emerging currencies are especially interesting hedges if inflation is accompanied by a rise in commodity prices as emerging markets are large commodity exporters. Emerging market currencies tend to pay a "default risk" premium which is not related per se to U.S. inflation and therefore has a positive expected return, in contrast to a pure Inflation Breakeven strategy which has an expected cost.

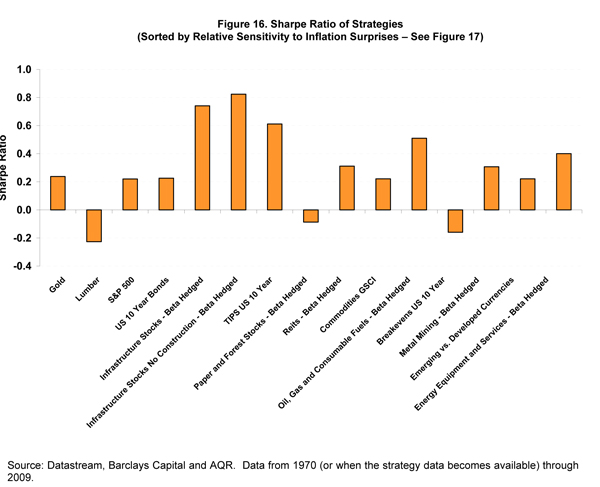

Figure 16 shows the absolute realized Sharpe Ratio of each individual asset class studied. Figures 17, 18, and 19 present their performance based on the three inflation hedging metrics. To facilitate easy comparison of strategies across different performance metrics we sort assets in all figures by the relative performance in inflation surprise environments.

The most notable inflation hedging strategies across all categories are Inflation Breakevens, emerging currencies, commodities and commodity-related equities. Inflation Breakevens, as previously pointed out, have negative long-term expected returns, as the investor "pays" an inflation protection premium to nominal bond holders (since the Breakeven position requires a short position in nominal bonds). The other strategies studied had historically positive excess returns which is partially explained by other risk premia associated with those strategies.

Contrary to common wisdom, assets like REITS, lumber and infrastructure equities did not show strong inflation hedging properties. This may be due to the extraneous risks these assets are also affected by such as real supply and demand factors. Gold is often a default asset that investors turn to when inflation uncertainty increases. However, as can be seen from the results, gold primarily reacts to changes in inflation expectations ahead of actual realized inflation. Therefore, the inflation hedging power of gold may be realized in a period preceding an actual increase in realized inflation. If investors add gold to a portfolio once early signs of increasing inflation are anticipated, they risk not realizing gold's inflation hedging characteristics.