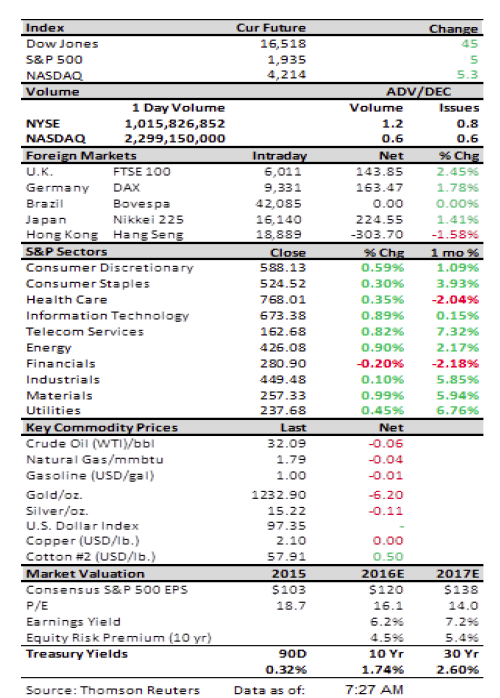

As many of you know, we have a proprietary way of measuring the stock market’s “internal energy.” That measurement tells us if there is enough energy to support a decent move in the markets either up or down. As often lamented, however, regrettably said indicator does not tell us the direction of the move. The quid pro quo is that when the energy level is low it suggests there is not enough energy to support much of a move in either direction. Accordingly, we wrote this last Thursday:

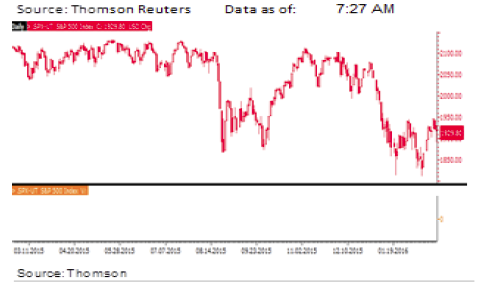

Last week the stock market did not actually run out of money late week, but it did run out of “internal energy.” Indeed, in (last) Thursday’s report we noted the stock market’s “internal energy” had been pretty much used up with the S&P 500’s 120-point romp from its successful test of the January 20, 2016 intraday “print low” of ~1812 into Wednesday’s ~1930 high. That nearly 7% rally, in a mere four sessions, caused our “internal energy” indicator to suggest the equity markets were going to have to rebuild said energy if we are going to

take another stable at the upside.

We also wrote, “Moreover, our model that targeted the week of February 14th for a trading low is now indicating the equity markets should have a sideways move, with small pullbacks, into the first week of March.” This week’s Monday Mash (+229) made me question the quip “small pullbacks,” but we stuck with our first week of March “call.” Likewise, the past two sessions caused us to again question the phrase “small pullbacks,” yet hereto we are sticking with our first week of March “call,” which was a tough position yesterday morning with the Dow Industrials’ move down of ~ 266 points. As for yesterday’s housing numbers, while the media painted them as “bad,” they were in line with the six-month moving average. Also on the negative “spin cycle” was yesterday’s Services PMI, which fell below 50 (49.8), but that was largely due to last month’s huge

snowstorm.

“Last week the stock market did not actually run out of money late week, but it did run out of ‘internal energy.’

Indeed, in [last] Thursday’s report we noted that the stock market’s ‘internal energy’ had been pretty much used up.”

Continuing with the media’s negative narrative were worries that President Obama is going to use executive authority to regulate drug prices. In our view that has about as much chance of happening as John Boehner returning as the Speaker of the House! Nevertheless, the stock market seemed to be worried about something over the past two sessions, although Wednesday’s comeback fit pretty well with our near-term trading strategy. Net, net, the Dow has traversed some 840 points since last Friday’s close, but has gained a mere 93 points, indeed . . . out of energy. This morning the message is no different with the preopening S&P futures flat. And that’s the way it is here in Houston as I get ready to attend the Presidential debate tonight; rotten tomatoes anyone?

Jeffrey D. Saut is chief investment strategist at Raymond James.