WILL SANTA COME IN DECEMBER?

Seasonality is another branch of technicals and it is important to note that December has been a strong month historically for equity gains.

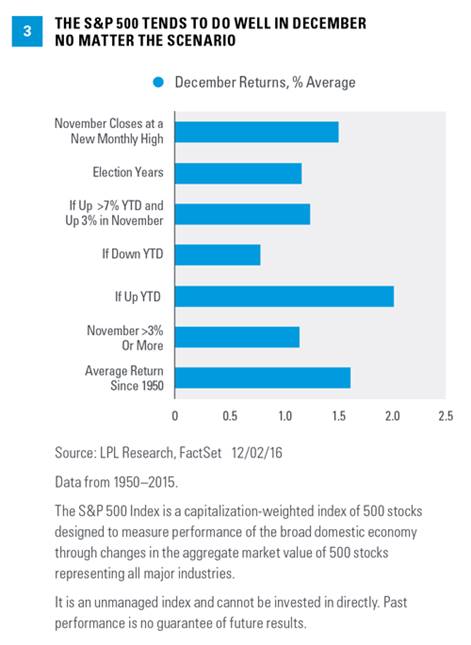

· Going back to 1950, no month has sported a better average return than the 1.6% return seen in December.

· Interestingly, returns in December jumped to 2.0% when the S&P 500 was up year to date heading into the month, versus up only 0.8% if down year to date.

· If November has a big gain, does it steal some of Santa’s thunder? It looks like it has done so slightly, as when November gained more than 3% (like 2016), the average return in December dipped to 1.2%.

· When November closed at a monthly new all-time high (like 2016), December gained another 1.5%.

· Lastly, election years have been up 1.2% in December; and when November was up 3% or more and the year-to-date return was more than 7% (like 2016), December still gained 1.3% on average.

As Figure 3 shows, equities usually gain in December under various scenarios, and the worst scenario below (down year to date) doesn’t even count this year.

It is worth pointing out that December monthly return has been negative each of the past two years for the S&P 500, but going all the way back to 1928, it has never been down three consecutive years. That bodes well for 2016, along with these two impressive stats as well:

· December has never closed as the worst month of the year for the S&P 500. It has closed as the 10th or 11th worst month a few times, but never the worst. January was the worst month in 2016 at -5.1%, so even if things are bad this month, history has shown that they probably won’t be worse than the 5.1% drop in January.