So, if a client is interested in lifetime protection, term life can be cost prohibitive and will not even be available in later life, particularly if he has had uninsurable health issues.

The Cost Of Permanent Life

In contrast, a level premium for the life of a policy can apply to various types of permanent life by design, and many current permanent life products permit flexible paid-up so that premium payment can stop at specified time prior to policy maturity.

For example, I’m reviewing an IUL policy for a 32-year-old male client. He plans to start a family within 3 years, and his insurance plan includes a $1 million 30-year term life and a $1 million IUL policy. The current annual premium for a 32-year-old male in good health is approximately $890 for a 30-year term. The IUL policy would cost $8,774 per year in premium for 30 years at an assumed return of 6 percent.

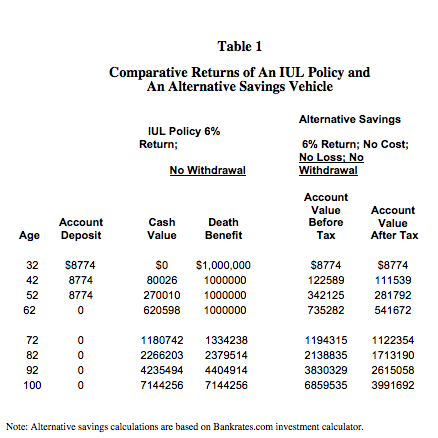

By age 62, the term policy will expire. The IUL policy will have $620,598 cash value in the policy and $1 million in death benefit. By age 70, the cash value will grow to $1,037,251 and the death benefit will increase to $1,203,211. By age 100, the cash value will grow to $7,144,256, and the death benefit will be the same as the policy would have matured at age 95. The internal rate of return over the life of the policy is 5 percent-6 perecent,tax free. These numbers are based on the scenario that there will be no withdrawal and the cash value has already accounted for all the fees and costs of the policy. Table 1 shows the benefits of the policy from age 32 to 100.

Note that this policy is presented as one of many types of permanent life to illustrate the cost and benefits of permanent life. There are many types of permanent life with different cost and corresponding benefits. IUL policies are considered to be relatively more expensive than other types, but the benefits with regard to cash value are also potentially higher.

A Lower Cost Alternative

Pursuant to the adage “buy term and invest the savings,” is there a cheaper way to invest the same amount of money? What would be the result of a savings or investment alternative to this IUL policy in the example?

Comparing apple to apple, Table 1 shows the potential returns of an alternative savings vehicle that invests the same amount of the IUL premium at the same 6 percent rate of return for 30 years with no cost, no loss and no withdrawal. As most savings accounts are subject to tax, the data show the returns for both the before and after tax scenarios, assuming a combined 28 percent tax rate (22 percent federal and 6 percent state).