If you read financial news long enough, you’re sure to come across that phrase “stock picker’s market,” although there’s considerable difference of opinion about what that means. Many people, including the great founder of Vanguard Group Inc. John Bogle, reject the idea out of hand. After all, they argue, money made by one stock picker is lost by another, so no market can be good for both.

Academics have studied various precise definitions to see if stock-picking equity mutual funds beat their benchmarks more in some types of markets than others. This work has not led to firm consensus, but there is marginal statistical evidence that high individual stock volatility, low index volatility, low pairwise correlations among individual stocks and high dispersion among stock returns help active managers relative to benchmarks.

If this is correct, we had a pretty good stock-pickers’ market from the end of 2016 to Sept. 30, 2020, but things have changed. The opposite of a stock pickers’ market is often said to be a quant equity market. When stock prices are deviating from long-term historical relations, pickers thrive, but when fundamental factors drive markets, quants are kings. At least that’s the theory.

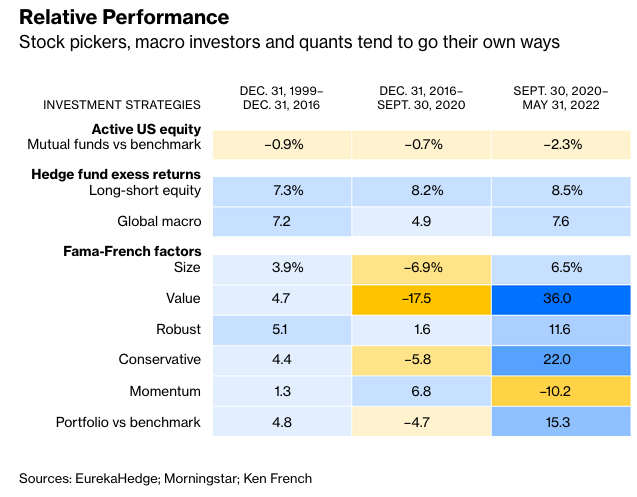

Actively managed U.S. equity mutual funds have underperformed their benchmarks by an annualized average of 2.3% per year since Sept. 30, 2020, compared with 0.7% over the period from Dec. 31, 2016 to Sept. 30, 2020. The latter figure is roughly the average expense ratio of these funds. Over the long term, actively managed equity mutual funds tend to underperform their benchmarks by somewhat more than their expense ratio, so 2016 – 2020 was a better-than-average period, but hardly anything to celebrate as a stock-pickers’ market. Since Sept. 30, 2020, however, it seems to be a stock pickers’ nightmare.

But perhaps the good stock pickers work for hedge funds, not public mutual funds. From Dec. 31, 1999 to Dec. 31, 2016, long-short equity hedge funds—stock picking funds—had annualized excess returns of 7.3% per year. These returns are not as reliable as public mutual fund returns for many reasons, and experience suggests average hedge fund investors usually do a bit worse than the published indexes. Still, we can look at relative numbers. From Dec. 21, 2016 to Sept. 30, 2020, long-short equity hedge funds had an annualized average return of 8.2%, twice as good as the prior 17 years, enough to dub the period a stock-pickers’ market. But their annualized excess return since Sept. 30, 2020 has been even better, 8.5%, so we may still be in good stock-picker territory.

Long-short equity hedge funds focus on individual stocks, global macro hedge funds focus on broad economic drivers. You might expect global macro to thrive in the opposite type of market that is good for long-short equity. If all stocks are going up and down together in response to macro news like inflation and currency regimes, you’d expect big-picture analysts to deliver more value than individual stock researchers. Global macro hedge funds delivered an annualized excess 7.2% from 2000 to 2016, 4.6% from 2016 to Sept. 2020, and 7.6% since then. So, the alleged stock pickers’ market hurt macro fund returns, but the end of that market merely returned them to their historical average performance.

The beneficiaries of the regime change in September 2020 were quant funds. The table shows the performance of five Fama-French factors. These are simple investment rules used as standards in academic finance. The “size” factor, for example, is the total return of a portfolio that buys the 30% smallest stocks and shorts the 30% largest stocks, rebalancing once a year at the end of June. (I have oversimplified, the actual construction is a bit more complicated, but this is the general idea.) The value portfolio similarly buys the 30% of stocks with the highest book-to-market-price ratios once a year and shorts the 30% of stocks with the lowest book-to-market.