529 plans restrict contributions once a specified aggregated account value is reached. Generally, these limits range from $300,000 to $500,000. Also, limits are aggregated across the same beneficiary under the same 529 plan, but not across different state 529 programs. So, in other words, you could theoretically have $400,000 in Nevada’s 529 plan, and another $400,000 in Virginia’s plan for the same child. Of course, that’s a lot of expensive schooling, but it illustrates the point. Most people don’t run into this issue, but they might if they contemplate funding $100,000 or so of K-12 expenses.

Parents should also be aware of how contributions to a 529 impact their annual gift tax exclusion. A parent can make an annual $15,000 ($30,000 for married couples) gift to a child not subject to a gift tax return filing. In fact, 529 plans allow parents to pull forward 5 years’ worth of gifts. So, you could make a lump sum $150,000 contribution to a 529 plan as long as you haven’t already or are planning to make other gifts to that child under the annual exclusion over the next five years.

3. Do You Have Available Funds?

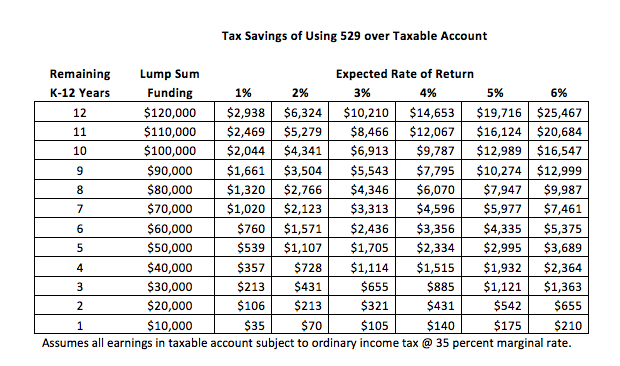

If a client is sitting on a lot of liquid funds and intends to send a child to private school, moving additional funds into a 529 plan is a practical thing to do. The tax savings, even if invested conservatively in a 529 plan, can add up over time, potentially making it worthwhile to add extra funds to the 529 for K-12.

The chart below illustrates the potential savings for a household in the 35 percent tax bracket. Again, since you can only use $10,000 a year for K-12, the tax savings are relatively meager at low rates of return that are only invested for relatively short periods of time. For example, if you have an 8th grader that is going to be attending a private high school, you could save $357 by depositing $40,000 in a 529 account (earning 1 percent tax free in a money market option vs. a taxable account) and paying $10,000 a year out over the next four years.