In addition to being disarming, clever and extremely knowledgeable about the super-wealthy- all skills that will come in handy when dealing with his new clients- Doug Regan has an unerring conviction in Northern Trust's ability to provide exactly what these clients want, the way they want it. Regan is the new head of Northern Trust's Wealth Management Group, a closely watched role in the world of private wealth. To put his responsibility in perspective, it helps to understand a little about Northern Trust's history and structure. For more than 118 years, Northern Trust has been a leading provider of trust services, private banking and investment-related services to America's elite. As Northern Trust's relationships with institutions and individuals grew in size and number, the distinct requirements of each became clearer and a decision was made to bifurcate the service efforts so an equal amount of attention could be paid to two thriving businesses. In the early 1970s, the company established its Corporate and Institutional Services unit, also known as C&IS, to focus on asset administration, investment management, and information services to corporations, pension funds and other institutions. To facilitate the high-touch, high-service needs of its individual clients, Northern Trust formed Personal Financial Services (PFS). And today, the revenue and earnings split between the two businesses is fairly even. According to the 2006 annual report, C&IS delivered 55% of the revenue and PFS delivered 45%.

Today, PFS services $292 billion in assets through 84 offices located in 18 states- the most of any US private bank. Its product and service range was built around the core of traditional private banking and fiduciary and trust services, and now includes traditional and alternative asset management, financial planning, family business, real estate services and advanced technology. Historically, the minimum account size to be a PFS client has been $1 million but today's average account sizes are much higher.

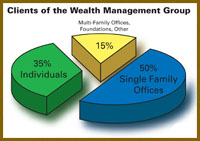

In the early 1980s, during a frenzied time of LBOs and business cash-outs, Northern Trust recognized a pattern among its clients with $100 million or more in assets. TheyTrust. ManagingLoad It weren't like a typical PFS client; they wanted a corporate delivery model on a personal basis. In response, Northern Trust created the Wealth Management Group in 1982 to service a small group of extremely wealthy families. These families remain the nucleus of the wealth management group, even as it has grown to service more than 370 families that have entrusted an average of $440 million a piece to Northern Trust.

Managing A Full Load

The scale of these relationships means that "all the resources of Northern Trust must be marshaled on behalf of a client," says Regan. This is accomplished through a three-person servicing model. Each client is assigned a relationship manager to oversee the strategy and pace of the relationship. The RM is backed-up by an account manager and a technology consultant. In essence, they're a tag-team that manages the nuts-and-bolts of the relationship on a daily basis. With three people collaborating to cover a single relationship, Regan can ensure that "each family gets the customized delivery and application of Northern Trust's capabilities that they expect." It also means that someone always has their finger on the client's pulse and can spot potential problems and opportunities. Regan acknowledges that the servicing model isn't unique to the wealth management group. "It's a system-wide approach for Northern Trust's individual clients. One that we believe delivers coverage and satisfaction to clients with all levels of wealth."

The service model isn't the only thing the wealth management group has adopted from the larger organization. "We leverage the technology and asset servicing capabilities of C&IS which is a distinct advantage. Our clients insist on institutional scale and quality." Regan believes that technology is one of the most important aspects of servicing the ultra-high-net-worth. "With technology, business is more scalable, even a business that embraces the individualism and uniqueness of its clients." He refers to Northern Trust's web-based technology platform, Wealth Passport as "one of the most sophisticated platforms in the industry today," and a "strategic advantage," indicating that his clients want real-time access to their accounts. "We can deliver daily valuations and daily net worth summaries for the most intricate accounts. I can think of one client with more than 40 portfolio managers and at least five global real estate parcels and we give him real-time access to his holdings." What's more, it allows Northern Trust to deliver full general ledger accounting and asset aggregation to its clients, even on the most obscure business structures.

Making Sense Of The Labyrinth

With a proven service model at his disposal and the most advanced technological platform, the next challenge is tackling the complexity of each relationship. "As the average net worth of our clients has increased, the complexities have gotten exponentially more difficult." The reality of helping a family with intertwined personal and business holdings can be tough, as can working with those that are experiencing nasty intra-family disputes. Operating within the restrictions of a highly tax-sensitive investment policy presents its own obstacles, but those can pale in comparison to the issues associated with owning residences in four different countries, each with its own tax code, currency and language. Regan takes these challenges in stride saying, "Our goal is to harmonize the trajectory of the market place with the customized needs of our clients."

Deploying Northern Trust's capabilities in the manner that befits each client is, of course, one of the keys. The range of services available to clients of the Wealth Management Group initially may appear relatively narrow, one mainly focused on private banking, money management and custody. Especially so when compared with established family offices, some of which manage things as diverse as hedge funds and household staff, or versus the major financial organizations that want to be one-stop providers to their clients. To its credit, Northern Trust has chosen to focus on the things it does well-asset custody, asset aggregation, money management, fiduciary and banking-the same things that helped it earn the reputation it enjoys today as one of the world's preeminent private banks.

Drawing From Experience

Regan assumed his new responsibilities in November. Just prior he was the chairman and CEO of the Southeastern region of PFS. "I've spent my whole career at

Northern Trust, and I've always had an orientation to serving wealthy

families," says Regan. "I bring the perspective of someone from the

field to my new role, and that's an advantage. I know what it's like to

work with clients every single day. It's a level of pressure that many

employees never experience."

CEO of the Southeastern region of PFS. "I've spent my whole career at

Northern Trust, and I've always had an orientation to serving wealthy

families," says Regan. "I bring the perspective of someone from the

field to my new role, and that's an advantage. I know what it's like to

work with clients every single day. It's a level of pressure that many

employees never experience."

Most people refer to time spent with clients as time in the trenches, but it's hard to reconcile that mental image with the one that is conjured from working with centi-millionaires. His clients may prefer a life of luxury, but Regan knows that serving the ultra rich is not just a bed of roses. "With clients this size, every problem is a big problem. How do you prioritize when every pending issue could cost your client or the firm millions of dollars? It's an intense activity."

Conversely, when things are going well Regan knows there is no better feeling than having done a good job for his clients. These days, Regan spends roughly half his time with clients and family office executives. "Very few of my conversations revolve around the hard, technical issues. Common themes are trending toward the more nebulous aspects of dealing with wealth," says Regan.

"These are families faced with moving massive amounts of wealth, wondering how to transfer it to succeeding generations without undermining the fundamental, capitalistic principal of going to work and being productive."

Those are heavy issues for an older generation, but Regan notes that the younger generations have their own problems. "One family brought in an outside professional to meet with the teenagers and young adults," Regan remembers. "They called the program Life101 and it covered things like how to change a tire, how to apply for a credit card, how to set up an Internet connection. These types of kids just don't have exposure to things less wealthy people might consider basic."

In fact, education on a variety of subjects is extremely topical for the wealthy. "Some of our families are partnering with universities or experienced educators to tailor the program to the sophistication level of the family members." This type of one-on-one relationship between wealthy families and educational institutions allows for total customization at a pace that works for the family members, while avoiding the canned curriculum of conferences and annually staged gatherings. Regan adds, "We're seeing more interest in networking among families. Individuals with similar levels of wealth are seen as a way to share experiences and access new information and ideas, so we create forums to facilitate that process." Northern Trust also helps its family office clients by helping to educate the executive directors. Keeping the senior staff up to speed on investment, tax and regulatory issues can help the relationship run more smoothly, as can providing critical insights on the latest compensation and equity ownership structures for non-family executives.

Regan notes that other lifestyle services have emerged as important in recent years. "At some point there will be a health issue and we'll get inquiries about concierge medicine services. There's no question our client will want access to the best medical professionals in the world." Similarly, interest in personal security services and business continuity planning and protocol is frequently prompted by an unpleasant experience. And when clients turn to Northern Trust for guidance or a professional referral, Regan and his team can provide one.

Sharing The Bird's-Eye View

Given his vantage point, Regan has some pointed thoughts on the private wealth industry. "Every meaningful financial institution is looking for a way to move up-market. We've already witnessed the deals between US Trust and Bank of America, Bank of New York and Mellon, City National and Lydian. I predict heavy industry consolidation as firms try to grow their share of this market." He goes on to reference a projection from the Family Office Exchange that expects families with $30 million or more to be the fastest-growing segment of wealth, expanding at an annual rate of 9% in the five years between 2004 and 2009. "This is the market the big banks and brokerages want-Northern Trust and a handful of our competitors are already there."

Regan expects to secure the lofty stature of the Wealth Management Group through global expansion, thoughtful planning and some good, old-fashioned hard work. Today the Wealth Management Group has 12 professionals in London and 25 UK-based relationships. Regan has already made his first of many trans-Atlantic trips to assess the opportunity and is optimistic. "2008 will be the year we focus on growth in the UK and the continent. We have offshore operations in the Channel Islands, and I think we're effectively positioned."

He also has his eye on other growth opportunities that will allow him to leverage the core competencies of the Wealth Management Group. Regan has watched the number of multifamily offices increase with a clear understanding of the issues facing these newly formed organizations. "We have 27 of them as clients today, and I know our experience has proven beneficial to them. With some specific enhancements to our service structure, I believe we can capture even more of the growth in the market."

As any service provider knows all clients change, and the wealthiest ones have the ability to change more rapidly and more radically. Regan acknowledges this with an intention to stay abreast of the curve. "We have to anticipate our clients' needs in order to keep their business, and one of my priorities is to define what our delivery structure will look like over the next three to five years."

As our conversation about the satisfactions, frustrations and opportunities associated with a super-affluent client base drew to a close, I reflected on my day. I'd started the morning with Paul Viollis, a private security specialist (and the author of this issue's article on identify theft) who spends his days helping his affluent clients deal with the harsh realities of crimes like impersonation, kidnapping and burglary. Later I spoke with a European family that had just sold a major stake in their family business for slightly more than US $500 million and was in the process of setting-up a family office. After lunch I headed uptown to see Susan Hirshman, a managing director at JPMorgan, to hear about their efforts to help advisors leverage the firm's experience servicing wealthy clients. And my penultimate meeting was with Russ Prince, my partner and the editor of Private Wealth, to debate the open items in our next book about marketing luxury to the super-rich, The Sky's the Limit. Each of my meetings focused on a single, unique aspect of serving wealthy clients- personal security, family offices, the role of advisors and lifestyle priorities. Doug's broad and experienced perspective was the ideal complement to a day I consider a nearly perfect kaleidoscope of the world of private wealth.

Regan is clearly enthusiastic about his charge of serving Northern Trust's wealthiest clients. "A lot of families have placed a lot of money and a lot of faith in Northern Trust. More than anything, I want to keep doing what we do well for our clients. We owe them that." And so it goes... clients put their faith in Northern Trust and Northern Trust has put its faith in Doug Regan.