Before purchasing a company, we look for metrics that indicate whether the stock is inexpensive relative to where it has been historically. Although potential future earnings are very important, small-cap value companies that have stumbled often have low current earnings. So the current P/E ratio may not be meaningful. Therefore, we also look at the price-to-book value and the EV (enterprise value)-to-sales ratios, which we consider to be more stable measures of worth — with smaller gyrations than seen in earnings. While earnings can be volatile, book value doesn’t usually change rapidly. If a company is selling near a five-year low price-to-book value or EV-to-sales ratio, we might consider the market price to be below the company’s intrinsic value. Moreover, since the EV-to-sales ratio takes into account the company’s debt load, this ratio is also very helpful because it provides a window into the company’s balance sheet and income statement.

When looking at a potential new company, we consider whether or not other investors will find it attractive. That’s why we consider earnings power and the company’s income statement. If the company recovers and earnings return, growth investors probably won’t be far behind, pushing the stock price up. In many cases, we look at companies that have been through the complete Wasatch investment process, including initial research, company visits and purchase of the stock in the Wasatch growth portfolios. If a company falls out of favor because it appears that growth prospects are diminished, the stock may drop into value territory and become an attractive candidate for us, as long as we see the possibility that growth will resume within one to two years.

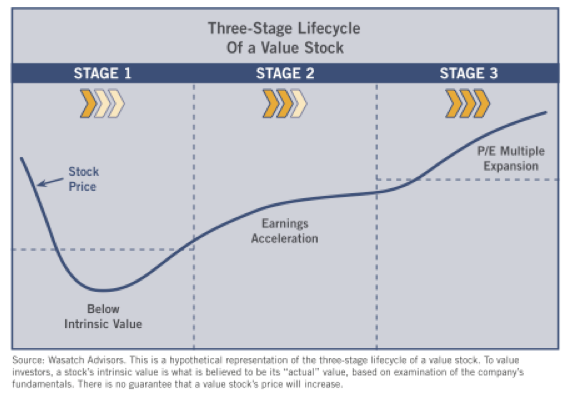

We take full advantage of the investment experience and proprietary research at Wasatch to identify value prospects. This enables us to buy in the first stage of the lifecycle, just after a company stumbles and many investors are running out the door. Other value managers, relying on routine quantitative screens, may not find these prospects until later in the cycle when the stock price has already begun to rise.

In the second stage of the value-stock lifecycle, earnings acceleration may not begin for several quarters after the initial investment. We find it often takes that long before the fundamentals improve and show up on the income statement. As earnings come back, the stock price usually advances.

In the third stage of the lifecycle, a value stock may begin to take on the characteristics of a growth stock, experiencing P/E multiple expansion. While many traditional value investors may exit their positions in the early part of the second stage, we prefer to hold companies a bit longer, and potentially capture the full earnings acceleration and the upside as the stocks trade at premium P/E multiples. The entire Wasatch investment-research group helps us navigate this third stage.

There are two things we do that most other value managers don’t. The first is that we buy broken growth names earlier than others, due to Wasatch’s institutional knowledge of many small-cap stocks. The second is that we’re willing to own the companies longer than other value managers. If we’ve done our job right, we’ll capture all three stages of performance in the lifecycle. For shareholders, it’s incredibly rewarding to buy a stock that’s undervalued, capture the earnings acceleration, and then sell at a premium P/E multiple. We’re not this savvy every time, but the challenge to capture all three stages for shareholders is what really energizes us. Our knowledge of the growth universe is a competitive edge that gives us insights as we invest throughout what we see as the three-stage lifecycle of a value stock. In the first stage, we seek to buy a company at a price below its intrinsic value, which we consider to be its earnings potential. For a company that has experienced a temporary setback, the earnings potential might be defined by the level prior to the setback. In the second and third stages, we seek to take advantage of earnings acceleration followed by price-to-earnings (P/E) multiple expansion.

Our knowledge of the growth universe is a competitive edge that gives us insights as we invest throughout what we see as the three-stage lifecycle of a value stock. In the first stage, we seek to buy a company at a price below its intrinsic value, which we consider to be its earnings potential. For a company that has experienced a temporary setback, the earnings potential might be defined by the level prior to the setback. In the second and third stages, we seek to take advantage of earnings acceleration followed by price-to-earnings (P/E) multiple expansion.

Lifecycle Of An Investment

September 26, 2014

« Previous Article

| Next Article »

Login in order to post a comment