A fog has long shrouded the inner workings of 401(k) plans. This lack of transparency has prompted action by the Securities and Exchange Commission, the Department of Labor and Congress-who are working on new rules that will ultimately dictate how the fees in these plans will be applied and disclosed.

Among the items that have sparked the interest of regulators are 12b-1 fees, the status of fiduciaries and brokers, plan sponsor fee disclosure and participant fee disclosure. Ultimately, these regulators and legislators will converge on the source of the fog: revenue sharing. And their work could dramatically alter revenue-sharing practices. Advisors who work with qualified retirement plans had best be up to speed on the nuances because it will affect both their revenue and their liability.

Understanding Fees

Consider an investor, Sam, who makes a single purchase of $10,000 of "Bond Fund Class A" within an IRA or brokerage account via a fund company. Sam's purchase includes a sales charge of 4% that is netted from the $10,000. He also pays a 1% annual operating expense of the fund netted from the gross returns.

Where does the money generated by this fee go? Who is Sam paying?

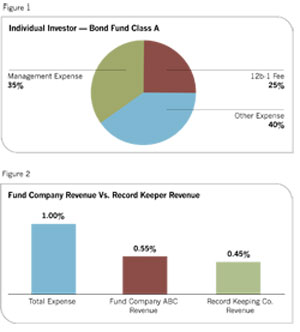

Figure 1 shows how this 1% annual operating expense is allocated when Sam makes the purchase in an IRA or brokerage account. While other expenses, such as the cost of purchasing the underlying investments, are netted from the returns, let's limit this inspection to the base annual operating expense.

Three components make up the 1% fee. Note that only 0.35% of the fee goes to the individuals who manage the fund.

"Other operating expenses," a somewhat vague category that can include any number of things, accounts for 0.40% of the fee. Generally speaking, this category refers to the administrative functions required to keep the fund operating.

A key element of the "other" category is "Fund Company ABC," the firm that runs Bond Fund A and is responsible for keeping tabs on Sam as an individual investor. When Sam has a question about his account, it's someone from Fund Company ABC that takes his call. When he moves and wants to have his statement sent to his new address, it's once again Fund Company ABC's responsibility. The company may be split into several affiliated companies to perform these services but, ultimately, it's still Fund Company ABC.

The remaining 0.25% is the "12b-1 servicing fee." The merits of this commission have been debated for years, and 12b-1 fees in excess of 0.25% might disappear if the SEC follows the path it has laid out.

These three components add up to the 1% fee netted from the gross returns of Bond Fund Class A. It's a bit of an oversimplification-but essentially accurate-to say that if the fund makes a gross return of 10% this year, Sam and the other shareholders will receive 9%.