"Opportunity is knocking." That's been the mantra of estate planners recently as the first half of 2009 has been ripe for high-net-worth clients to consider some very robust estate planning.

In many ways, it's the "perfect storm" of conditions, a confluence of depressed stock valuations and unprecedented lows in interest rates that have created once-in-a-lifetime estate planning opportunities. Advanced estate planning techniques such as grantor-retained annuity trusts (GRATs), intentionally defective grantor trusts and charitable lead trusts can all be taken advantage of to transfer wealth to the next generation in a very tax-efficient manner.

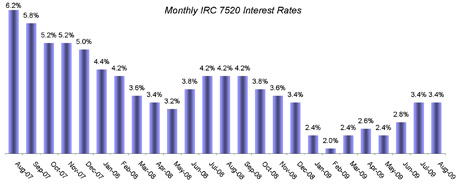

That's because the actuarial computations used for these vehicles are sensitive to an interest rate, published monthly by the government, which has plunged recently. Known under the Internal Revenue Code as the "7520 rate," the rate is derived from the average market yield on outstanding government obligations with a remaining maturity of between three and nine years. For January 2009, this 7520 rate dropped to an all-time low of 2.4%, shattering the previous low of 3.0% for June 2003. In February, the 7520 rate dropped even further to the new all-time low of 2.0%.

As indicated in the chart below, the 7520 rate began falling in late 2007, just as the stock market began declining. The old 3.0% low was first skirted last May and then again in December. But it was only after the Federal Reserve announced in December that it was cutting its target interest rate to historic lows (between zero and a quarter percentage) that the 7520 rate dipped to these new all-time low levels.

The Fed suggested that it may keep interest rates "exceptionally low" for some time, but procrastinators should be wary of missing out on this rare opportunity. Now that the economy has begun to show some signs of a gradual recovery, the 7520 rate has begun to rise gradually, but it is still historically low and planning opportunities are still available.

The estate planning strategies that can be used to best effect in the current low interest rate environment may be best understood as "freeze" techniques. Essentially, these strategies allow a grantor to transfer property in trust while freezing the value of the payments they will get back in return, based on an actuarial computation that is tied to the 7520 interest rate. A lower 7520 rate decreases the value of the payments the grantor gets back, and so it increases the likelihood that there will be leftover assets in the trust after the grantor has received the final return payment. This remainder balance of trust assets will pass to the grantor's beneficiaries as a tax-free gift.

Suppose, for example, that a client creates a Grantor Retained Annuity Trust (GRAT) when the 7520 rate is 3.4 percent, and transfers $10,000,000 to the trust in exchange for a right to receive fixed annual annuity payments over a five-year period. The transaction will typically be structured as a "zeroed-out" GRAT, meaning that no taxable gift is made upon creation of the GRAT because the grantor will receive annuity payments equal in value to the amount transferred ($10,000,000), plus the assumed 7520 rate of return (3.4 percent). In this case, the grantor would receive an actuarially determined annuity payment of about $2,209,000 at the end of each of the five years. If the trust assets are invested and outperform the 3.4 percent government rate, there will be a remainder balance to pass from the grantor as a tax-free gift after the five-year period has elapsed.

The size of the tax-free gift will ultimately depend on the rate at which trust assets appreciate during the duration of the GRAT. For example, if the trust assets grow at an annual rate of 7% over the five-year period, the trust will have a remainder balance of more than $1,290,000 to pass from the grantor as a tax-free gift. If the stock market snaps out of the current recession and the trust assets appreciate at an annual rate of 10%, the tax-free gift will be approximately $2,578,000. By comparison, a GRAT created and funded with the same amount as recently as August 2007 (when the 7520 rate was a much higher 6.2%) would have created a tax-free gift of only $300,000 at a 7% annual rate of appreciation, and only $1,500,000 with a 10% rate of appreciation.

The very worst that can happen with a GRAT is that the investments underperform the 7520 interest rate, in which case the annuity payments coming back to the grantor would completely deplete the GRAT and no gift would be made. But that outcome seems rather unlikely when the trust investments only need to beat the low hurdle rate of 3.4% to be successful.

Alternatively, our client could use an Intentionally Defective Grantor Trust (IDGT) to make an even larger tax-free gift. The IDGT is a more complex variation on the same "freeze" concept underlying a GRAT, but several factors allow it to produce more favorable results.

In this strategy, our client, starting with the same $10,000,000, would create a family limited partnership (FLP), or a limited liability company (LLC), and transfer the entire $10,000,000 to this newly created entity. The "fair market value" of a non-controlling interest in this entity would be determined by a qualified appraiser, who factors in combined valuation discounts (typically 30 to 40%) for the lack of marketability and lack of control. For this example, we will use a combined discount of 33 percent, which results in a discounted value of $6,700,000 for the entire FLP on a non-controlling, non-marketable basis.