This year’s record-setting market swings may cause even the most rational of investors to feel like they’ve lost their balance, leaving them vulnerable to counterproductive decisions. How can advisors help clients gain a solid footing and stay focused on long-term goals? Findings from recent research into investor sentiment show where clients may be the most vulnerable. Armed with insights from behavioral economics, we can help clients remain resilient during extreme market stress and economic uncertainty. Communication is key, trust is critical.

Headlines Shouldn’t Drive Portfolio Decisions

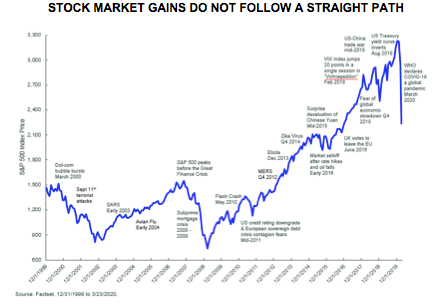

History shows that investment returns do not follow a straight path, but investors who focus on the downturns may lose sight of the upturns. Behavioral economics suggests that investors tend to experience twice the amount of psychological pain from losses compared with the psychological pleasure from gains.

Maintaining an asset allocation that is in line with a client’s willingness and ability to bear risk is a cornerstone of financial advice. However, reinforcing the fundamentals of portfolio diversification and regular rebalancing sometimes isn’t enough to settle their nerves during periods of extreme market turbulence.

Volatility can test even the most steadfast of investors’ confidence in their portfolios. This year’s market swings have led some investors to make decisions that directly conflict with their reasons for investing; others are left with a general sense of unease or feeling disengaged. Even when markets are operating smoothly and the economy is robust, downside risk can stoke anxiety. This is evident from research State Street Global Advisors conducted in late 2019 that revealed:

• Only 36% of investors believed they were prepared if the markets were to take a downturn and the value of their investments declined.

• Investors’ top five concerns included the rising costs of healthcare, potential investment losses, protecting current level of wealth, rate of return in the stock market and rising inflation.

• Only 29% of investors reported that they use their financial advisor as encouragement to help stay on track during market volatility.

Has investor sentiment changed significantly in the four months since this research was conducted? New research from State Street Global Advisors indicates some decline in optimism, in the four months between December 2019 and March 2020. The average investor seems to be balancing some personal optimism with general market pessimism:

• The percentage of investors optimistic about their financial future over the next 12 months declined from 88% in December 2019 to 71% in March 2020

• The percentage of investors optimistic about the country’s economic outlook in the next 12 months has fallen from 47% to 32%; an

• The percentage comfortable with the highs and lows of financial markets has dropped from 49% to 36% during this period of time.

We can help investors navigate these tumultuous times by providing emotional guardrails. Disregarding the emotional component of decision-making only undermines the advisor’s ability to help investors endure difficult times. Instead, taking the time to understand and empathize with investors’ emotions will enable more productive conversations and reinforce healthier decision-making.

To help clients become more effective and knowledgeable investors in all market cycles, advisors should: