Retirees and their advisors should thoughtfully establish a spending plan to balance the desire to maintain a consistent lifestyle with preserving assets for a retirement that could last 30 to 40 years. To achieve this balance, a spending policy should be developed to determine what percentage of the retirement savings will be spent initially and how this amount will change over time to reflect the effects of inflation and the performance of the underlying investment portfolio.

When they retire, individuals will choose a spending amount based upon a percentage of their retirement portfolio's market value. A spending amount is defined as the amount of money withdrawn from retirement savings to cover expenses. All too often they increase this amount annually by a cost-of-living adjustment as measured by the Consumer Price Index (CPI). This spending policy is referred to as a "lifestyle" policy, since it is intended to provide for a consistent standard of living indexed to inflation. The lifestyle spending policy, although attractive due to its simplicity, is flawed in two important areas.

1. This policy does not tie the spending level to the performance of the underlying investment portfolio. As a result, the lifestyle policy never requires the retiree to slow or reduce the spending level during an extended bear market.

2. In periods of high inflation, spending amounts may increase too rapidly, placing a retirement portfolio at risk of premature depletion.

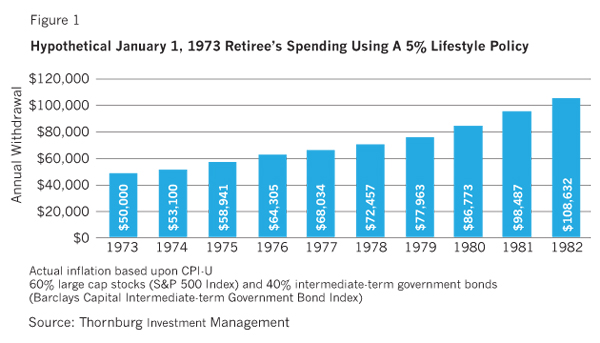

A good illustration of this can be seen in Figure 1, which shows annual spending amounts for a hypothetical retiree who retired on January 1, 1973, with a $1 million retirement portfolio and a 5% lifestyle policy. Academics have shown that this was one of the most difficult retirement periods in the last 80 years because of an extended period of high inflation coupled with a significant bear market. Inflation during this ten-year period averaged 8.75% yearly, which resulted in the spending amount doubling from $50,000 to $108,632.

For this retiree, high inflation was only half the story. The stock market was experiencing a severe bear market, with the S&P 500 Index losing approximately 37% during the first two years following the retirement date.

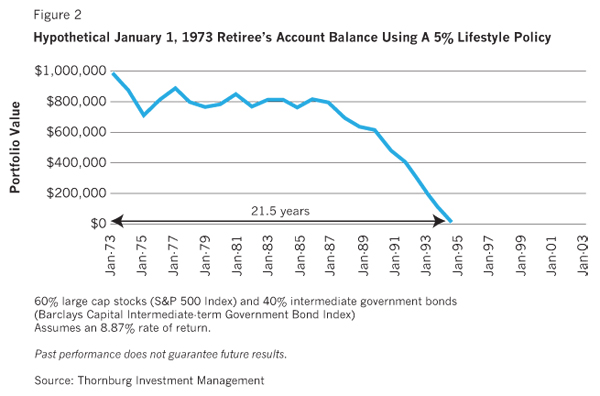

The combination of the lifestyle policy in a high inflation environment and the losses from the 1973-74 bear market resulted in the investment portfolio being depleted in just 21.5 years, as illustrated in Figure 2.

While the lifestyle policy is flawed and can lead to a retirement portfolio being prematurely depleted, it continues to be widely used due to its simplicity. Another alternative is used by some college and university endowments, which we will refer to as the "endowment" spending policy. This policy is a blended approach: It uses a percentage of the prior year's spending amount together with a percentage based upon the current portfolio value. When blended together, these two values determine the next year's spending amount. Having a percentage of the spending tied to the performance of the portfolio will increase or decrease the spending amount in tandem with the value of the retirement assets. A decrease in the spending amount during an extended bear market is a vital concept for improving the sustainability of a retirement portfolio. While the endowment policy is designed to lower the spending amount during a bear market, it does so on a gradual basis, thereby allowing the retiree time to adjust spending and stay on plan. Like the university endowments that use a similar policy, it can provide a balance between funding current operations while also preserving assets to cover future operations.

To begin using an endowment policy, retirees and their advisors must decide on two factors: what spending rate is appropriate and what smoothing rule should be applied.

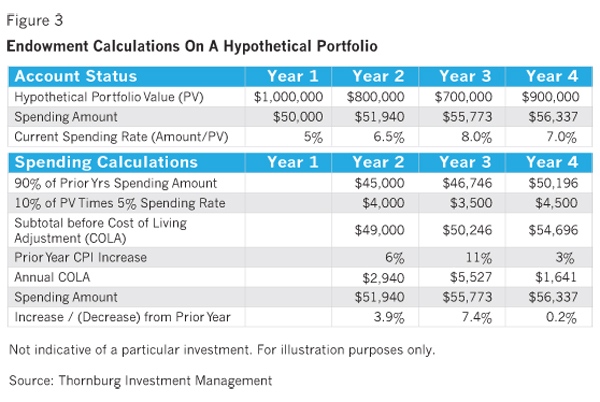

Spending Rate is the percentage of the portfolio value the retiree will use to determine their annual spending. Much has been written by academics on the subject of sustainable spending rates, with a consensus of somewhere between 4% and 5% being the prudent balance between providing a consistent retirement lifestyle and allowing the portfolio the opportunity to grow. For our hypothetical, we will choose 5% as our spending rate which equates to

Smoothing Rule determines how quickly to increase or reduce the retiree's annual spending amounts based upon the portfolio's investment performance. Selecting a 90/10 smoothing rule assumes that 90% of the spending amount will be based on the prior year's spending and the 10% will be based upon the portfolio's current valuation.

Let's use a hypothetical four-year time frame, with high annual inflation to illustrate how the endowment policy calculates spending. In Figure 3, we assume a $1 million retirement portfolio with a 5% spending rate and a 90/10 smoothing rule. The hypothetical shows the portfolio value on January 1 of each year and the annual spending calculation.

Note how the spending amount actually increases during the two years of a bear market, but does not keep pace with inflation since the underlying portfolio value does not warrant it. This willingness to reduce the spending amount at times when the investment portfolio is not performing well is key to having a sustainable retirement portfolio. Using an endowment policy assists in maintaining a reasonable current spending amount in both bear and bull markets.

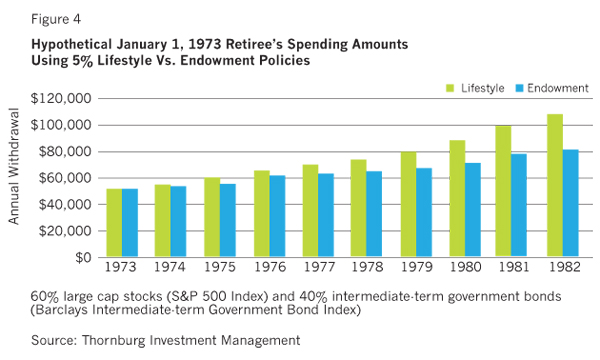

Let's return to the January 1, 1973, retiree and see the difference using an endowment policy can make to the sustainability of their retirement portfolio. Illustrated in Figure 4 is a hypothetical comparison of the annual spending amounts for the first ten years of retirement using the endowment and lifestyle.

Again, note how the endowment policy reins in the spending amounts, as compared to the lifestyle policy, during this high inflationary bear market. In fact, over the ten-year period, the spending amount was lowered by almost $102,000 in he aggregate (10% of the initial portfolio value), allowing this amount to remain invested in the portfolio for future periods.

The reduced spending amount allowed the portfolio time and increased assets with which it could take advantage of market conditions as they improved.

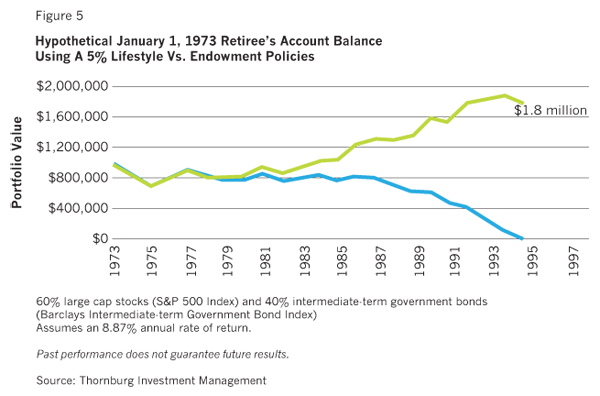

The net effect of the change to an endowment policy for our January 1, 1973, retiree is quite dramatic. In the hypothetical in Figure 5, which compares the impact to the retirement portfolio value using the lifestyle versus endowment policies, the lifestyle policy results in an exhausted portfolio in 21.5 years, while the endowment policy portfolio had actually grown to $1.8 million during this same time frame.

When using the endowment policy, retirees and their advisors can expect that spending amounts may not keep pace with the cost of living, unless the performance of the underlying investment portfolio grows sufficiently to support it. This slow "tightening of the belt" during bear markets is one of the keys to a sustainable retirement portfolio.

Jack Gardner, a Certified Investment Management Analyst and Accredited Investment Fiduciary Analyst, is the president of Thornburg Securities Corp., distributor of the Thornburg family of mutual funds, and a managing director of Thornburg Investment Management, the advisor to the funds. To read part I of this series, click here.