What’s it all mean? According to Cerulli, these early-career motivations manifest themselves in the business models advisors gravitate toward as their careers progress. Specifically, women are more likely to run financial planning practices and less likely to focus exclusively on the asset management side.

In a survey done by Cerulli and its partners that looked at advisor practice types by gender, 31.3% of women identified themselves as a financial planner versus 21.6% of men. And 6.4% of women labeled themselves as a money manager versus 13.2% of men. In that vein, 2.9% of women considered themselves to be wealth managers compared with 6.2% of men. The fourth category of practice type identified in the survey—investment planner—was almost a dead heat, with 59.4% of women and 59.1% of men slotting themselves into that designation.

“For advisors who enjoy working with clients toward goals, the goals-based planning process allows them to navigate a client through the emotional trade-offs of investing and setting meaningful milestones,” Cerulli said in its report. “A comprehensive wealth management process is also more likely to emphasize the softer aspects of a client’s financial well-being, such as family dynamics. On average, women advisors tend to be more interested in engaging with clients holistically than measuring a product’s performance or constructing a portfolio in isolation.”

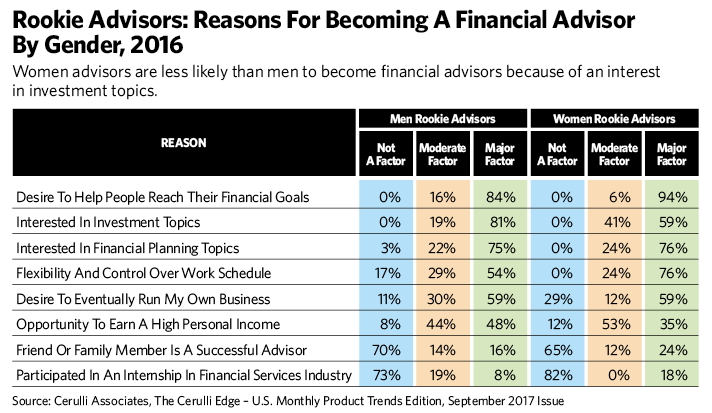

At financial advisor firms, research has found that women want to do planning work; men want to run money. OK, that’s a blanket statement that oversimplifies things, but a recent report from Cerulli Associates shows that a larger percentage of women (94%) than men (84%) cite their motivation to help people reach their financial goals as a major factor for entering the profession. At the same time, a larger number of men (91%) than women (59%) say an interest in financial topics was a major reason for becoming

At financial advisor firms, research has found that women want to do planning work; men want to run money. OK, that’s a blanket statement that oversimplifies things, but a recent report from Cerulli Associates shows that a larger percentage of women (94%) than men (84%) cite their motivation to help people reach their financial goals as a major factor for entering the profession. At the same time, a larger number of men (91%) than women (59%) say an interest in financial topics was a major reason for becoming

an advisor.

Men, Women Advisors Have Different Motivations

November 1, 2017

« Previous Article

| Next Article »

Login in order to post a comment