We continue to expect mid-single-digit returns for the S&P 500 in 2016, consistent with historical mid-to-late economic cycle performance. As discussed in our just released Midyear Outlook 2016: A Vote Of Confidence, we expect those modest second half gains to be derived from mid- to high-single-digit earnings growth over the second half of 2016, supported by steady U.S. economic growth and stability in oil prices and the U.S. dollar. A slight increase in price-to-earnings ratios (PE) above 16.6 is possible as market participants gain greater clarity on the U.S. election and the U.K.’s relationship with Europe, and begin to price in earnings growth in 2017. Low interest rates continue to provide support for stock valuations. Key risks include a policy mistake from Washington or the Federal Reserve (Fed), geopolitics including political uncertainty in Europe, and a surprising pickup in inflation that leaves the Fed playing catch-up. We expect to experience more bouts of volatility given these risks and the age business cycle.

THE ROAD TO A BETTER TOMORROW THROUGH CORPORATE AMERICA

Is corporate America investing enough in its future? A popular worry on Wall Street—and even on Main Street out on the campaign trail—is that companies are returning too much cash to shareholders and not investing enough in future growth in the form of capital expenditures (or capex).

The current economic expansion, with a 2% average growth rate since the end of the Great Recession, has been sub-par. That slow growth has coincided with below-average growth of capex. But has corporate America been underinvesting? We would say yes, but the level of investment may be appropriate for an economy exhibiting slow growth. It does not appear that capex dollars are being crowded out by other competing capital allocation decisions, and the energy downturn is a big part of the weak investment story.

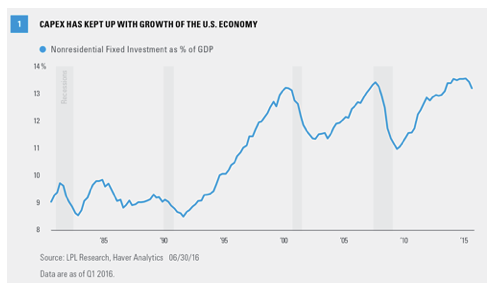

Figure 1 shows that our proxy for capex (nonresidential fixed investment) remains at the high end of its historical range relative to the size of the U.S. economy. By this measure, companies are investing in property, plant, equipment, and intellectual property at an even higher rate, relative to the size of the economy, than they have historically. When considering the more than 30% reduction in energy capex since oil peaked in June 2014, the level of capex looks much better. This suggests that the level of investment may be on target given the level of economic activity. That’s not great news, but it suggests that if economic growth picks up and the energy recovery continues, as we expect, capex would turn higher.

WHERE IS CAPITAL GOING NOW?

There are four primary potential destinations for companies’ excess capital:

• Share repurchases. We do not believe that companies’ desire to return more capital to shareholders through share repurchases is much of an impediment to capex. In dollar terms, share repurchases for S&P 500 companies are near record highs, with $572 billion returned to shareholders in 2015. But when measured against market capitalization to create a repurchase yield, share repurchases are below the 10-year average (3.0% versus 3.2%).

• Dividends. The total dollar amount the S&P 500 paid out in dividends in 2015 of $385 billion was an all-time high and 2016 is shaping up to be another record year. But the dividend yield on the S&P 500—the size of that dividend pie relative to the total market capitalization of the index stands at 2.1%, in-line with the 10-year average and well below the 50-year average of 3.0%. Looking at dividends another way, companies are paying out a slightly smaller portion of earnings than they have historically, suggesting dividends are not crowding out investment.

• Mergers. Buyers globally announced approximately $4.0 trillion in mergers and acquisitions in 2015, surpassing 2007 for the most on record. The environment in the U.S. remains ripe for mergers over the rest of 2016 and into 2017 with modest economic and earnings growth, low interest rates, and generally favorable credit conditions, although Brexit and U.S. election uncertainty remain wild cards.

• Debt repayment. Debt repayment was a popular destination for excess capital immediately after the financial crisis, as companies shored up weakened balance sheets and took advantage of lower interest rates to refinance existing debt and extend maturities. With those maturities extended at low borrowing rates, debt repayment is much less impactful.

We are hoping for more capital investment in the second half of 2016 and beyond, supported by these four factors:

• Stronger economic growth. More growth would lead to greater use of the economy’s excess capacity, which would eventually spark more capital investment. Fiscal policy may provide a boost in 2017 as both presidential candidates favor increased infrastructure spending, although protectionist trade policies and Brexit-related uncertainty could work in the opposite direction.

• An earnings rebound. We do expect a solid rebound in S&P 500 earnings in the second half of the year even in the event of potential modest upward pressure on the U.S. dollar. More earnings would mean companies have more to invest.

• Favorable credit conditions. Credit conditions remain generally favorable with low interest rates, strong corporate balance sheets, manageable debt service costs, and generally receptive markets for debt offerings. In general, we expect these conditions to remain favorable, although we are watching developments in Europe closely.

• More confidence. The lackluster economic recovery has left some CEOs lacking the confidence to invest. U.S. elections will likely bring greater policy clarity—we have very little now—and hopefully increase corporate confidence. Prospects for a relatively smooth transition for the U.K. out of the EU would also help.

THERE IS HOPE FOR EARNINGS

We continue to believe the conditions are in place for a solid rebound in corporate profits during the second half of 2016. After a slow start to the year, we expect 2–2.5% economic growth in the second half, as measured by gross domestic product (GDP). Nominal economic growth, which includes inflation and may exceed 4% during the second half, is highly correlated to corporate revenue. S&P 500 revenue is expected to rise 3.6% in the second half based on consensus estimates. The recent improvement in the Institute for Supply Management’s (ISM) Purchasing Managers’ Index (PMI) for manufacturing, which has shown high correlation to corporate profits historically, is encouraging.