He also learned about some of the risks involved in investing in global gold mining companies. An important one is geopolitical risk, which measures the impact of governmental policies and regulations on the business. Such risk has kept the fund out of companies with operations in several Latin American and African countries, as well as China and Russia. Even in the U.S., state-by-state regulations can vary widely and influence investment decisions. “Nevada has a long-established mining industry. It’s the second-largest industry in the state, and it’s a strong part of its heritage. California, on the other hand, has very restrictive laws that are hostile to mining companies.”

He says that companies have been successful navigating through political turmoil. He points to fund holdings B2Gold Corp. and Barrick Gold Corp., which both have mines in Mali. Even with a military coup and a pandemic in the country this year, their production remained steady and operations in Mali did not shut down. The mines are located far from the capital, where the unrest is taking place, and the companies have become adept at nurturing government relationships. “No matter who is in power in Mali, everyone knows it is in the country’s best interest to keep the gold mines running,” he says.

Beyond politics, mining companies also have environmental and social issues to contend with. Many investors think gold miners fall short in those areas, but Foster says that isn’t the case. “Gold miners must have reclamation plans for mines, and they operate under a huge number of environmental regulations,” he says. “They are typically located in smaller communities, where they play a pivotal role in providing health care, job training and employment.”

Although the stocks of gold miners have had an extraordinarily strong run this year, Foster does not think they are overvalued. In past rallies, he says, mining stocks have experienced roughly double the percentage increase in the price of gold. The current rally falls short of that pattern. Price-to-cash flow numbers, a key measure of how well a gold mining company is doing, have also fallen well below the levels of previous gold rallies.

The industry is also in better shape than it was just a few years ago. Many companies have lower debt and better financial discipline than they did a decade ago, and Berkshire Hathaway’s new stake in Barrick points to increased interest among general investors. “Barrick and many other companies we invest in have every intention of maintaining their discipline by controlling costs, controlling debt and using conservative gold price estimates as the benchmark for evaluating capital projects,” Foster says.

The industry is beginning to bifurcate between dividend-paying companies with high quality, low-cost mines and those with lower quality projects and higher risks. “Until there is confirmation that higher gold prices are here to stay, it seems too early in this cycle to speculate on companies that aren’t maintaining the discipline learned from the mistakes of the last cycle.” Chief among those mistakes, he says, was basing new mining project profitability on high gold prices that prevailed when those projects started. Because it takes up to seven years to get a mine running, such assumptions can be disastrous for companies if prices drop.

“We are forecasting gold prices of over $3,000 per ounce, and if correct, all companies will win,” he says. “However, it would be reckless to build a mine and risk a company based on such forecasts.”

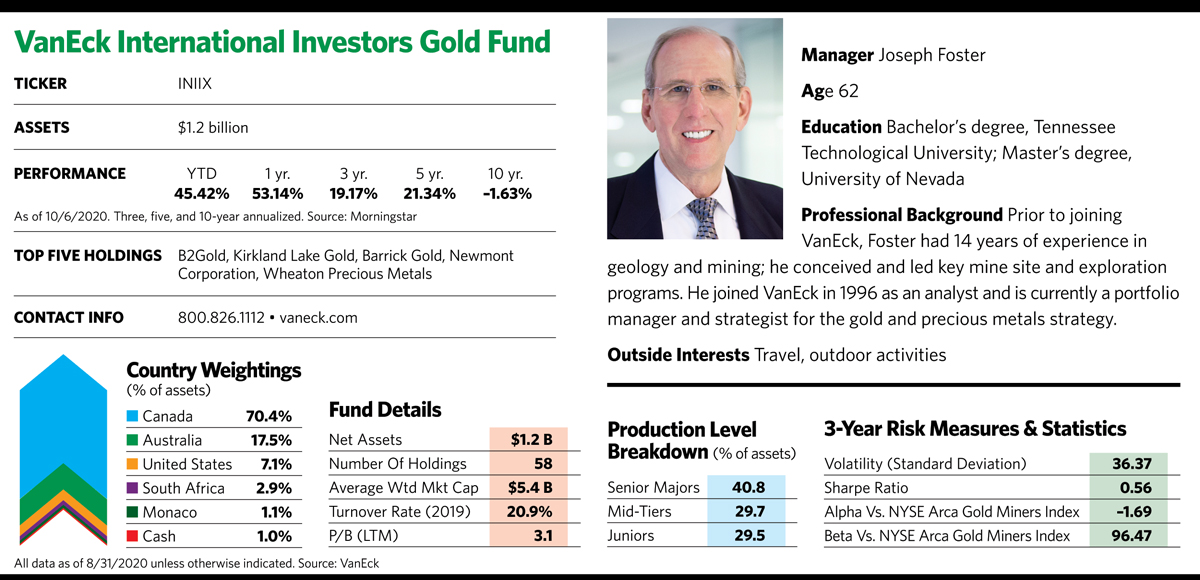

Instead, the fund gravitates toward companies that are undertaking projects based on more realistic assumptions, and that have the financial stability to withstand a price drop. It divides its 58 holdings into major, mid-tier and junior mining companies. The major group, which includes Newmont Corp. and Barrick, are some of the more familiar names in the industry. They’re able to generate substantial cash and increase dividends, especially with gold prices at current elevated levels.

The mid-tier group, which accounts for around 30% of assets, consists of companies with smaller mining operations that are looking to expand their footprint through exploration and discovery of new gold deposits. B2Gold falls into this category.

The junior group, which makes up another 30%, consists of companies in the nascent stages of drilling and exploring. Fund holding Liberty Gold, a Canadian exploration and mining company, is in the process of redeveloping a local gold mine in southeastern Idaho that was shut down in the 1990s when prices dropped.

If the tumult of 2020 extends into next year, a similar scenario may not unfold for a while.