“New Growth”

Motamed believes that “old growth” companies in industries such as mobile devices and software are becoming tired and vulnerable to a downturn. Many of them have already penetrated vast markets, so their growth prospects are limited. And after a 10-year market that has favored growth stocks, the shift to value will intensify. “We’re in the late stage of a massive growth rally, but for many of these companies the growth story has already played out,” he says.

The fund’s large short position in Apple last year illustrates that point. Despite the tech giant’s huge market cap and deep analyst coverage, the company faces a mature marketplace for smartphones, numerous competitors and revenue growth driven largely by price increases rather than volume growth. By the end of the year, the stock had fallen substantially after a disappointing earnings report.

On the other hand, Motamed believes prospects for “new growth” companies, such as those involved in artificial intelligence and self-driving vehicles, have much better prospects for the future. At times, investors may simply be overlooking strong stocks with attractive valuations. That was the case with HCA Healthcare, the largest hospital group in the country, which was added to the fund in 2017. Even though the company had a great balance sheet, strong free cash flow, high profit margins and other favorable characteristics, it wasn’t on a lot of buy lists. The fund exited the long position in the company at the beginning of 2019 after it had appreciated substantially.

“We are not interested in buying stocks of companies in broken situations that are looking for change,” he says. “We want great, proven companies selling at great valuations.”

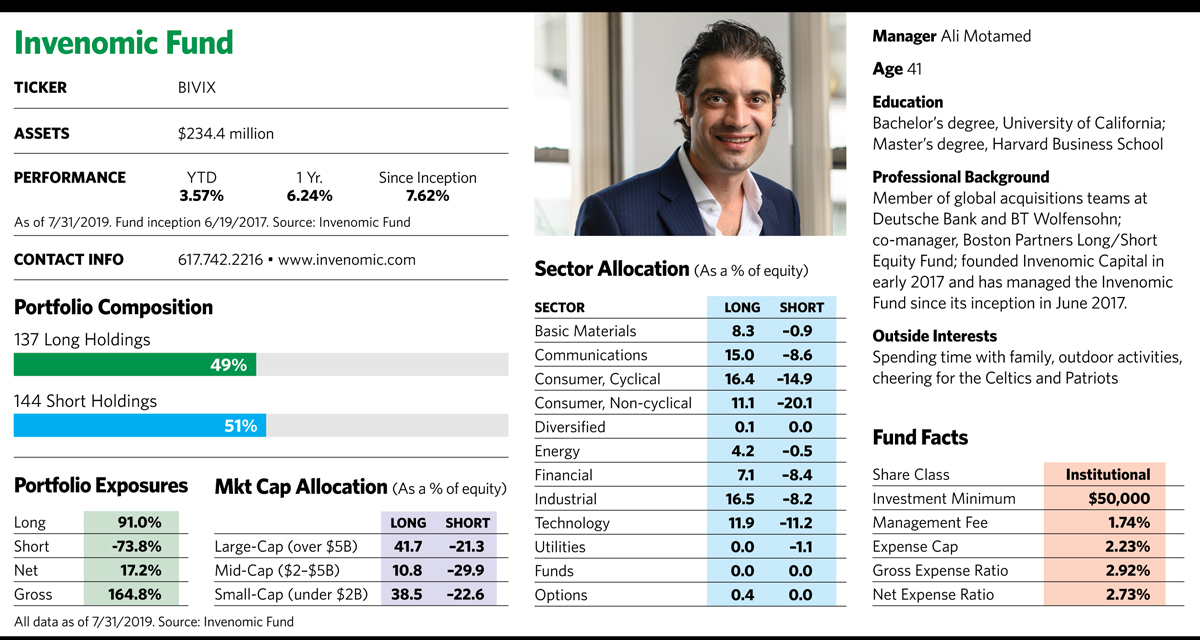

Typically, the fund has around 250 to 300 positions on both the long and short side. To winnow down their 4,000-stock universe, Motamed and his team of analysts use quantitative screens. For the long side of the portfolio, they like to see companies with reasonable valuations, strong cash flow and solid balance sheets. For the short side, they look for companies with weak cash flow and evidence of overpricing and inflated earnings. “There is a lot of misplaced enthusiasm and greater fool buying in the market,” he says. “About one-third of stocks in the Russell 2000 universe don’t even make money.” He says the holding period for stocks can vary anywhere from a few months to a few years.

Motamed, who doesn’t talk to corporate management because the pictures they paint are often rosier than their numbers suggest, says the process is grounded in research and very data-driven. “At one point a few months before the fund launch, our computers froze when we were using the Bloomberg database because we’d hit the data limit,” he recalls with a combination of amusement and pride.