It was a balmy December evening in Fort Lauderdale. Two financial planners and old buddies, one from a large wirehouse and the other an independent practitioner, were reminiscing over a happy hour beer about how kind the year 2007 had been to their practices. Their practices were flourishing, their firms had done well and the performance bonuses were lighting their Christmas tree with holiday gifts. Inevitably, the subject of retirement planning kept cropping up, as many of the existing clients were in positions to retire and be comfortably well off for the rest of their retirement lives.

Inevitably, too, the discussion swerved back on the asset allocation methods that each advisor had used to plan retirement income distribution models. It was inevitable because this discussion had happened many times before and the buddies liked to quarrel over their methods of allocation-one advisor was all about Modern Portfolio Theory (MPT) and Efficient Market Hypothesis (EMH) and considered anything outside the Markowitz Efficient Frontier to be archaic-especially her buddy's model, which included the use of a ridiculously simple rule of thumb (ROT) where the retiree's age decided the allocation between 30-year Treasury bonds (or TIPS, international gilts or some high, guaranteed fixed annuity product) while the rest was invested in global large-cap stocks. In this model, if the client were 65 at retirement, then 65% would be in bonds and 35% in stocks.

The MPT asset allocator buddy loved to tease her friend about her naïve model and crow about the robustness of the MPT. For most of the well-off clients, the 30-year diversified income distribution model for 65-year-old retirees was suggesting about a 60% dedication to risky securities (stocks, emerging markets, commodities, currencies, real estate, etc.) and a 40% fixed-income securities (including T-bonds, high yielding debt, etc.) asset allocation along with an actively managed portfolio.

The discussion turned to clients who were retirement-ready and about 65 years of age. Such clients had done well over the past four to five years and had accumulated all the means to live the next 30 years in a conveniently luxurious life. They couldn't care less if their expected Social Security payments stopped materializing fully after 2019. They had enough in their retirement and personal portfolios to live their dream lives-to do what they wanted to do and be with whom they chose to be with wherever they wished to be-i.e., their ideal retirement. So they wished to retire.

Both the financial advisor buddies had counseled their clients that a withdrawal rate of 4% per year of their retirement funds (given the expected portfolio earnings rates) was such a safe rate that it would ensure they would not outlast their funds. Then, the summer of 2008 happened!

The clients had never imagined that they could be out on a limb, or even if they did, that the limb could ever be chopped. Now, half their wealth and all their dreams are shattered. And ... they could not get their livelihood back.

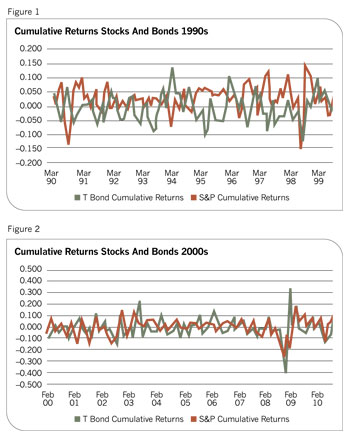

There are nightmares that sometimes come true, but few could probably be worse. In this event, they were the victims of the worst-case scenario of a type of retirement risk, a risk that has been coined as "sequence risk." Unfortunately, looking back at the very recent past, we know that the MPT buddy and her clients were in much hotter water than the ROT buddy and her clients in terms of sequence risk. The following figures show cumulative asset class performance in the last two decades-cumulative in the sense of what a dollar would have grown to in ten years. (See Figures 1 and 2.)

In most cases, the effects of sequence risk are neither this immediate nor this dreadful. Before we do go into describing the more common occurrences of this risk type, it is useful to describe sequence risk in a little greater detail. First, let's look at the actual and very real world effects of sequence risk as found by contemporary studies.

An Employee Benefit Research Institute (EBRI) report finds that the vast majority of 401(k) plan participants have regained the ground lost since 2008, (thanks primarily to ongoing account contributions); it is well-known that people who were about to retire or had already retired had not been able to recoup their losses. Another recent EBRI survey reports that a quarter of workers have postponed their retirement in the past year, or worse, are being forced back to work if they're lucky enough to find and healthy enough to work in their old age.