Whether a midstream energy mutual fund is taxed as a C-corporation or a regulated investment company (RIC) can have a meaningful effect on its portfolio composition, performance characteristics and after-tax returns. In the current market environment, we believe RIC funds offer structural advantages due to their better flexibility to invest across the broad midstream universe, greater tax efficiency and potential for increased total return.

According to Morningstar, more than 70 percent of the assets in open-end mutual funds devoted to midstream energy investments are in funds taxed as C-corps. These C-corp funds often appeal to income-seeking investors, but they have several drawbacks not found with RIC-structured funds. We believe these considerations are particularly important today for three key reasons, amid improving midstream fundamentals and a shift in business models away from master limited partnerships (MLPs).

#1 C-Corp Funds Tend To Own A Small Percentage Of The Midstream Universe

C-corp funds typically seek to maximize income and distributions paid, and in doing so they tend to own primarily MLPs. C-corp funds can own securities of midstream corporations, but they usually limit these holdings as these investments generally offer lower yields and add inefficient layers of taxation.

While C-corp funds’ focus on MLPs may not have been an issue several years ago, MLPs are now a shrinking slice of the midstream universe—a trend we expect will continue.

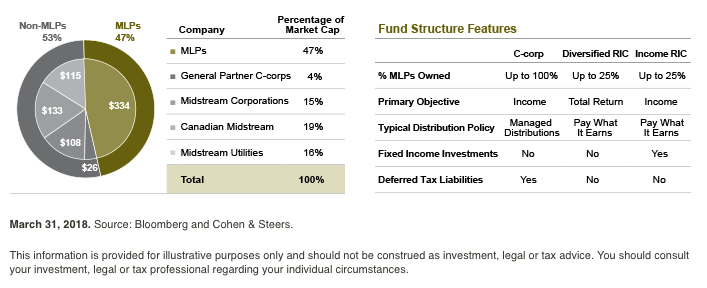

MLPs represent 47 percent of the midstream sector (Exhibit 1), down from 53 percent at the end of 2013. Increasingly, the sector consists of corporations, including general partners that manage the operations of MLPs, companies that own midstream assets, and Canadian-listed energy infrastructure companies. C-corp funds may therefore be underinvested in potentially attractive, non-MLP midstream opportunities.

Post corporate tax reform, we believe midstream companies will continue to move away from the MLP structure, as lower corporate taxes diminish its relative advantage. In addition, the recent Federal Energy Regulatory Commission proposal further reduces the incentive to utilize the MLP structure for companies that own certain regulated interstate pipelines.

RIC funds tend to have a broader mix of holdings, with no more than 25 percent of assets in MLPs. As a result, they tend to have lower yields than C-corp funds, but generally own more growth-oriented investments, potentially making RIC funds better total return vehicles.

RIC funds also have appeal to income-seeking investors due to distributions being partially tax deferred. RIC fund distributions generally consist of 50–80 percent return of capital, with the balance typically treated as qualified dividend income that is taxed at the long-term capital gains rate.

In essence, a RIC fund typically offers a similarly high tax-deferred rate on distributions as a C-corp fund invested entirely in MLPs—all while accessing a broader investment universe to achieve its goals.