U.S. equity markets rallied to record highs in July despite rising medical risks that caused some mid-month volatility. The Nasdaq Composite gained 1.19% in July, while the Dow Jones Industrial Average rose by 1.34%. The S&P 500 led the way with a 2.38% gain during the month. As we continue to hit new highs, what are the risks going forward?

Recession Risk

Recessions are strongly associated with market drawdowns. In fact, 8 of 10 bear markets have occurred during recessions. The National Bureau of Economic Research declared that a recession started last February, as markets plunged, but also recently announced that it ended shortly thereafter. Despite that and the ongoing expansion, economic risks still remain. The primary ones are the economic damage from the growth in Covid cases last month, as well as the continuing shortfall in total employment.

While on the whole the economic recovery continues to be healthy, given these risks we have kept the economic risk level at a yellow light for now. There is the potential for an upgrade to green in the upcoming months, especially if we see the pace of hiring remain strong despite the rising medical risks.

Economic Shock Risk

One major systemic factor is the price of money, otherwise known as interest rates. This drives the economy and financial markets and has historically had the ability to derail them. Rates have been causal factors in previous bear markets and deserve close attention.

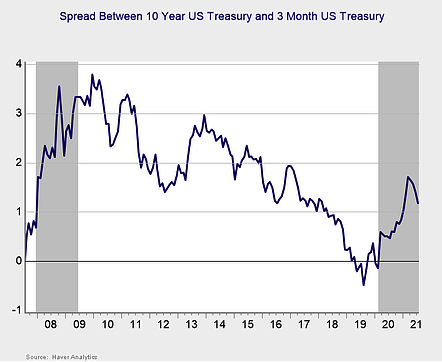

Risk factor #1: The yield curve (10-year minus 3-month Treasury rates). We cover interest rates in the economic update, but they warrant a look here as well.

The yield curve flattened for the fourth month in a row. This result was primarily driven by a decline in long-term interest rates. The 10-year Treasury yield fell from 1.45% at the end of June to 1.24% at the end of July. The decline in long-term yields was largely driven by investor concerns about the rising risk from the Delta variant of the virus.

The three-month Treasury yield increased modestly from 0.05% at the end of June to 0.06% at the end of July. While short-term rates are expected to remain low until at least 2023, longer-term rates had previously recovered back to pre-pandemic levels before the recent decline. Long-term rates remain well above the pandemic-induced lows we saw throughout much of last year. But the recent decline is worth monitoring, as it could signal rising investor concern about the pace of the economic recovery due to the worsening public health situation.

Given the fact that long-term yields remain above the 2020 lows, we have kept this signal at a green light for now. With that being said, if long-term rates continue to decline, we may see further yield curve flattening and a potential downgrade to yellow.

Signal: Green light

Market Risk

Beyond the economy, we can also learn quite a bit by examining the market itself. For our purposes, two things are important:

1. To recognize what factors signal high risk

2. To try to determine when those factors signal that risk has become an immediate, rather than theoretical, concern