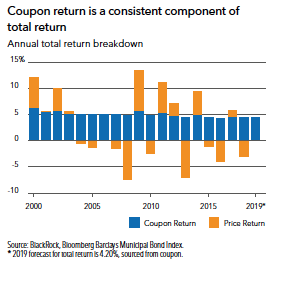

Another driver of demand for munis is a renewed appreciation for the stability of the asset class as the prolonged period of ultra-low volatility is clearly behind us. Municipals tend to have higher credit quality and provide consistent levels of income over time. While price return is sensitive to macro trends across fixed income markets, coupon return has historically provided a stable portion of total returns in the municipal market.

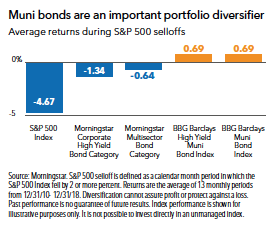

The S&P 500 Index lost more than 4 percent in 2018, while the S&P Municipal Bond Index posted a 1.36 percent gain. The negative correlation of municipal bond and equity returns underscores the importance of muni bonds as a portfolio diversifier and a ballast to equity and equity-like risk.

Credit Perspectives: What To Watch In 2019

State and local government sectors could come under pressure this year if the U.S. economy slows enough to constrain revenues from sales and income tax receipts. State governments may be forced to rein in their spending, most likely impacting Medicaid and K-12 education, and pension underfunding remains a significant concern. At the local level, property tax receipts tend to perform relatively well during a slowdown; however, local governments often bear the brunt of state spending cuts. We prefer revenue bonds over general obligation bonds as the latter can be vulnerable to risks stemming from state and local budget negotiations.

The high yield municipal market may experience a period of minor spread-widening due to an influx of supply as Puerto Rico returns as an investable name. Upon finalization of the bankruptcy process in mid-January, the restructuring of the commonwealth’s government debt and sales tax bonds, known as COFINA bonds, will result in an exchange whereby holders of defaulted debt will receive new bonds. We expect Puerto Rico bonds will gradually regain acceptance with traditional market participants over time. Any weakness caused by the supply increase could create attractive buying opportunities in the short term; however, certain credits that were bid up while Puerto Rico was absent from the market may experience a longer term negative impact. Broadly, we believe high yield muni bonds are an important contributor to income generation in a diversified portfolio.

Hospitals and health-care providers are facing headline risk due to the Affordable Care Act (ACA) having been ruled unconstitutional at the end of 2018. If the ruling is upheld, the loss of Medicaid coverage and consumer protections for many patients would have a negative effect on these industries as the potential for bad debt increases and patient volume declines. No immediate impact to ACA exchanges is anticipated in 2019 as the Act remains in effect throughout the appeals process, which will not conclude until 2020 at the earliest.

Investment Ideas For 2019

Municipal Bonds: Great Expectations For 2019

January 11, 2019

« Previous Article

| Next Article »

Login in order to post a comment