The Nasdaq Stock Market will list its first cannabis shares on Tuesday, marking a key milestone for an industry that has been rejected by the Trump administration.

Cronos Group Inc., which already trades in Canada, will be the first marijuana company on a major U.S. exchange -- right alongside Nasdaq stocks such as Apple Inc., Microsoft Corp. and Starbucks Corp.

The listing could help expand the so-called Green Rush. U.S. investors who were previously uncomfortable or restricted from putting funds abroad or into over-the-counter stocks now have a mainstream option that has passed muster with the Securities and Exchange Commission.

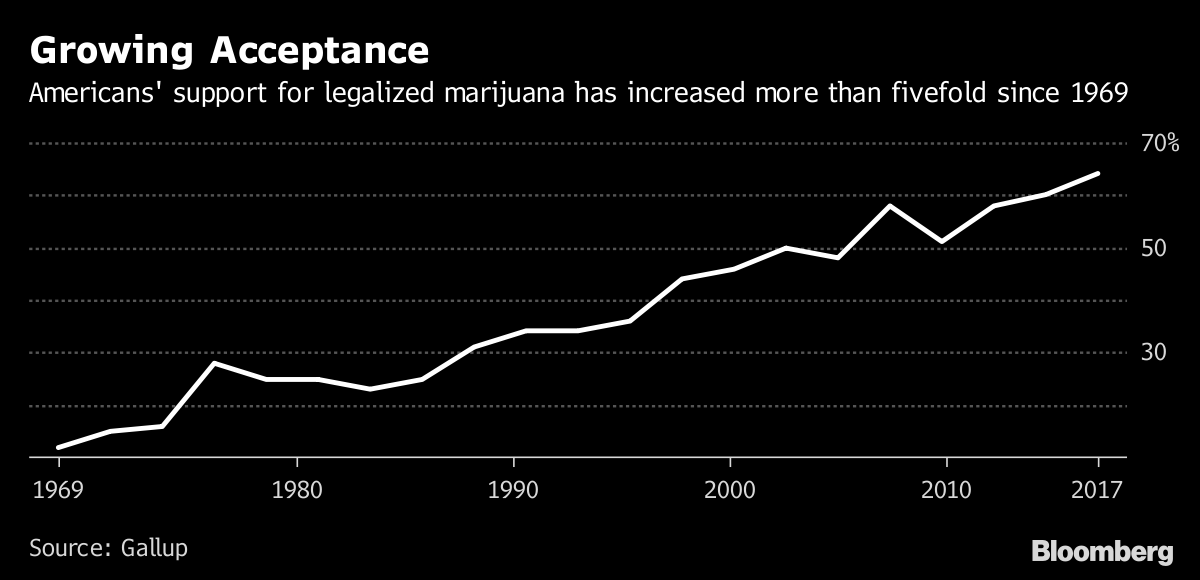

“It’s very significant for the company and the whole industry,” Mike Gorenstein, Cronos founder and chief executive officer, said in an interview. “It’s a huge moment -- just shows the stigma is continuing to erode on cannabis.”

The move comes as the marijuana industry is expanding across the world. Uruguay has legalized cannabis federally for all adults, and Canada is expected to follow suit later this year. Germany is among about 30 countries that allow medicinal sales of the plant.

In the U.S., nine states and Washington, D.C., have legal recreational pot, and 29 states have legal medical cannabis. The American market alone is expected to reach $50 billion by 2026, up from $6 billion in 2016, according to investment bank Cowen & Co.

Cronos is taking advantage of the international opportunity. The Toronto-based company produces and sells medical marijuana in Canada. It also ships its products to Germany, where they are distributed by G. Pohl-Boskamp GmbH.

Israel Partnership

Cronos is also building a growing facility in partnership with a kibbutz in Israel and has received a license through a joint venture in Australia. Eventually, the company hopes to have a presence in the U.S. too, Gorenstein said, but not until it’s legal at the federal level.

Nasdaq’s approval came after Cronos spent six months doing preparatory work, leading up to an application for listing filed this year. The company had worked with Nasdaq to get approval for an over-the-counter listing last year.

For Cronos, listing in the U.S. could open the doors to significant capital. It will also clear up confusion surrounding legal investment, Gorenstein said. About one of every three calls and discussions he’s had with American investors has focused on whether they can legally invest in the Canadian entity.