Health insurance has emerged as a central issue in the Democratic presidential primary contest. The major candidates are divided between those who favor a national health-insurance system -- commonly referred to as Medicare for All -- and those who favor letting the government compete with private insurers, sometimes known as the public option. Either way, Democrats seem certain to make a big push for some sort of expansion of health insurance.

The typical justification given for national health insurance is that it would make coverage universal. Though Obamacare reduced the uninsured population significantly, about one out of 10 non-elderly Americans still lack coverage. Another oft-cited advantage is that national health insurance would require lower out-of-pocket payments -- deductibles and co-pays -- than most private plans, reducing hassle and anxiety. A third selling point is that national health insurance would be funded largely through taxation, meaning that there would lots of redistribution, with the wealthy and the upper-middle class paying for the health care of lower-income Americans.

National health insurance thus seems designed to appeal to socialists and other skeptics of the market economy. But it also might appeal to capitalists, because taking health insurance out of the private market could boost entrepreneurship and make the labor market more flexible.

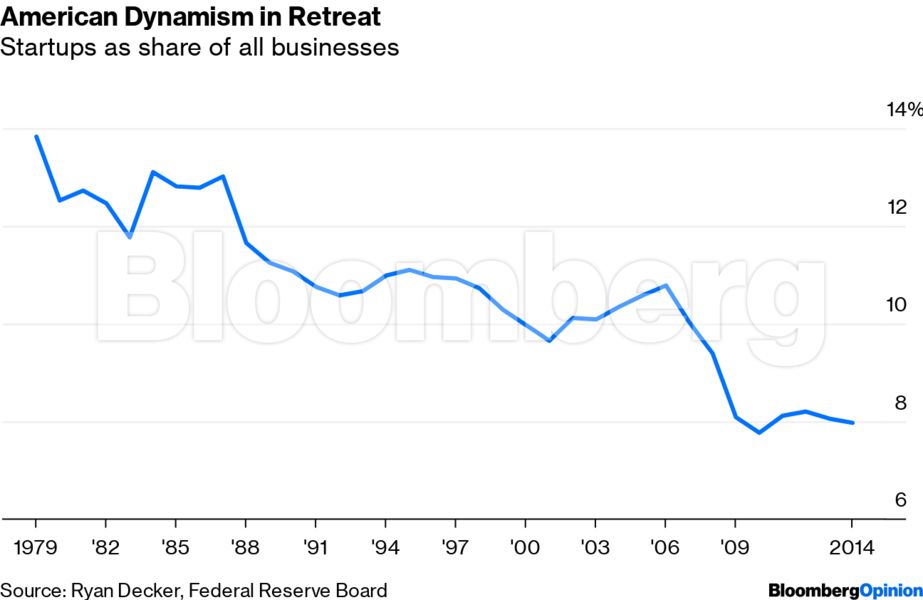

The U.S. private sector has grown less dynamic in recent decades, marked by a decline in new business formation:

Entrepreneurship is the soul of capitalism; it holds the potential to make normal people rich. Without that promise, capitalism loses much of its appeal.

Health care might have something to do with this decline. A majority of non-elderly Americans now get health insurance through their employers:

.png)

The employer-based insurance system tilts the playing field against entrepreneurs in two ways. First, someone starting a new business will have to search for and select a plan filled with arcane and technical language that can be almost impossible for an untrained person to grasp. But even more importantly, the employer-based system absorbs many of the costs and risks of coverage, which then tend to shift to the entrepreneur who strikes out on their own.

Starting a business is a risky proposition, and half fail within five years. There’s also a huge commitment of time, and usually a major commitment of personal wealth. If a business fails, an entrepreneur will suddenly be without an income, and most or all of the capital invested will vanish. No income and no employer means no health insurance.