What Is Real?

In times of inflation, real rather than nominal values grow far more important. How well has a price or return delivered for you, after taking inflation into account? In markets, it’s real rates that most matter. But how exactly do you measure reality?

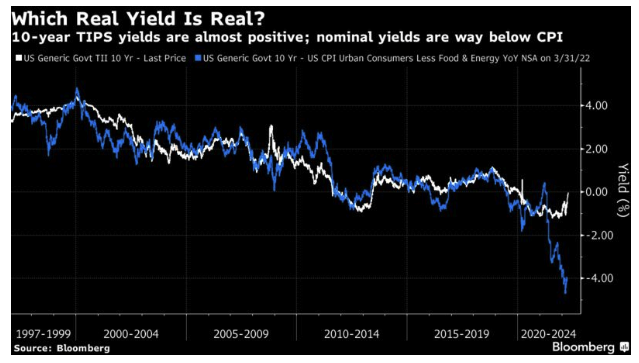

The issue matters because real yields have stayed incredibly low for much of the last year as nominal yields have risen. With real yields low, financial conditions hadn’t tightened so much. But that is fast changing. At the time of writing, the 10-year TIPS (Treasury Inflation-Protected Securities) yield is above zero. True, it’s still only positive by less than one basis point, which is scarcely restrictive, but the speed of the adjustment in the last few weeks has been impressive. It challenges the assumption that real yields will forever stay accommodative.

However, there’s an argument that TIPS embody unrealistic expectations for inflation. A brutally simple version of the real yield would subtract the current rate of inflation from the nominal yield. Over time, this has been very similar to the TIPS yield. But no longer. The nominal 10-year yield is four percentage points lower than core inflation (and even further below headline inflation):

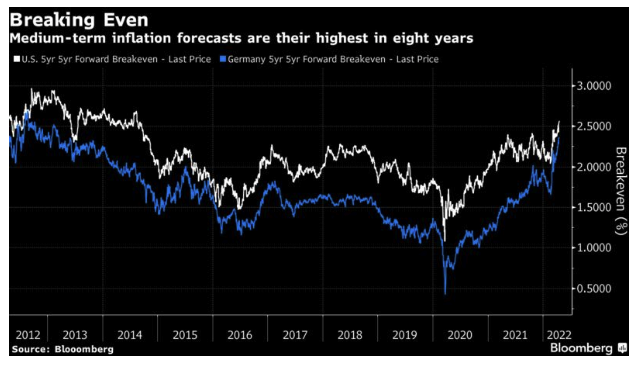

So are we paying a real interest rate for long-term money or not? Another abstruse corner of the bond market muddies the picture further. The Federal Reserve’s favorite measure of market-based inflation forecasts is the five-year/five-year breakeven, which captures expected average inflation for the five years starting five years hence. Like the 10-year TIPS yield, this has been a source of comfort throughout the inflation scare of the last year. Inflation expectations on this basis have remained steadfastly under control. Whatever the fears in the present, this measure has said the market is confident that the Fed can rein in the price pressures over the next five years.

But that is no longer so comfortable. This breakeven is now at its highest since 2014. The level isn’t scary, but the fact that it has now plainly broken out of the low-inflation regime of the post-crisis era is disquieting:

Even more disquieting is the speed with which the market has abandoned its fixed assumption that German inflation had been anesthetized. It’s coming around now, with the German five-year/five-year breakeven suddenly almost equal to the U.S. If market forecasts can change so quickly, does that mean we should ignore them? Quite possibly. But however measured, a lot is riding on continued negative or very low real yields. To quote Jim Reid, financial historian at Deutsche Bank AG:

I’m not convinced the bond market’s prediction of future inflation is particularly useful. Spot real yields should rise from here as spot inflation falls, but I’m still not convinced inflation falls anywhere near enough over the next couple of years for real yields to get anywhere near positive. I’m also still convinced real yields on this measure stay negative for the rest of my career due to financial repression. If I’m wrong (maybe due to nominal yields rising more than I think and inflation falling faster), run for the hills given the global debt pile.