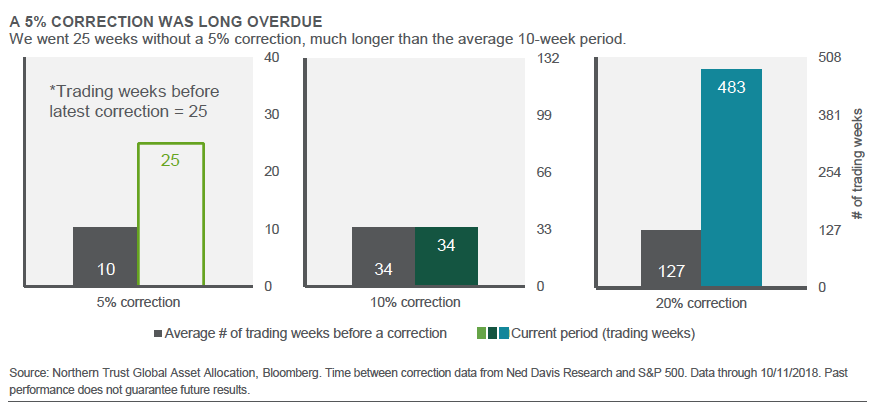

Central bank policy is usually a fixation of markets, rarely more so than during a tightening cycle. Recent commentary from Federal Reserve Chair Jerome Powell, along with that of regional bank presidents, has increased market volatility as investors worry that the Fed may go too far. As shown below, the recent 5 percent drop in equity prices was overdue and is therefore not unusual. Is the Fed’s move the primary cause of the market volatility, as President Trump has suggested, or are other worries driving investor behavior? Diagnosing specific catalysts behind individual corrections is challenging, and made more difficult by the increased trading done by rules-based investors. In our strategy meetings this month we highlighted two material changes that we think will drive markets over the next year.

The first change is that we now believe U.S. monetary policy will be restrictive in one year. Recent Fed commentary indicates that it thinks something on the order of an additional 125 basis points of tightening is in order, due to the strength of the economy. Fed funds futures currently incorporate roughly 75 basis points of this over the next 18 months, indicating some skepticism about the Fed’s ability to raise rates to this extent. If our expectation for slowing growth through 2019 comes to pass, that may help bring the Fed’s plans closer to market expectations. But the current rhetoric indicates a strong preference to continue the rate hikes, which we think will be harmful to growth and investor risk appetites – especially in emerging market economies. Other major central banks are sticking to their scripts, and the European Central Bank remains on track to end its asset purchase program this year but not raise rates until later in 2019.

The second change is our downgrade of emerging market political leadership from strengthening to weakening. China remains the epicenter of emerging markets, and the government is easing policy to support domestic growth. Recent policy changes such as cutting bank reserve requirements and income taxes will provide some offset to slowing growth. The Chinese government finds itself in a tougher place as a lonely voice for globalization at a time where countries are becoming more wary of the terms of trade – be it through the One Belt, One Road initiative or taking advantage of multilateral trade agreements. In the wake of this, China may need to recalibrate its approach to global affairs as it faces more resistance from the United States and possibly other countries over time.

Interest Rates

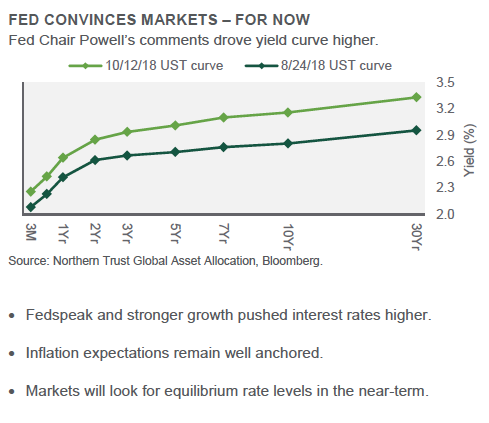

A more hawkish Fed – punctuated by Powell’s comments that “we’re a long way from neutral” – combined with firmer economic data and market technicals to drive U.S. interest rates higher. Fundamentally, higher interest rates have been driven more by higher growth expectations than inflation concerns. The 10-year U.S. Treasury yield increased by 0.35 percent over the past two months; higher real yields – generally driven by the growth outlook – represented 0.33 percent of that increase, while rising inflation expectations represented the other 0.02 percent. Technical pressures, including less overseas buying (as currency hedging costs increased) also played a part.

We believe U.S. interest rates have found a new, higher channel for now – but with risks of a return to lower levels over time. Economic growth over the past two quarters has been strong, but we expect this growth to slow as the effects of earlier-year tax reform begin to wear off and weaker growth in China and Europe pulls the United States down too. We worry the Fed is too anxious to extrapolate recent strong growth into the future – and views it as a green light for further rate hikes. If the Fed keeps pushing, longer-duration yields will eventually reverse course – and the Fed will be forced to as well.A more hawkish Fed – punctuated by Powell’s comments that “we’re a long way from neutral” – combined with firmer economic data and market technicals to drive U.S. interest rates higher. Fundamentally, higher interest rates have been driven more by higher growth expectations than inflation concerns. The 10-year U.S. Treasury yield increased by 0.35 percent over the past two months; higher real yields – generally driven by the growth outlook – represented 0.33 percent of that increase, while rising inflation expectations represented the other 0.02 percent. Technical pressures, including less overseas buying (as currency hedging costs increased) also played a part.

Credit Markets

The recent rise in interest rates, combined with our expectation for continued credit fundamental strength, has increased our attraction to taking on credit risk in the portfolio. We most recently increased our allocation to investment grade fixed income by 3 percent, leaving us now 1 percent overweight. This combines with our continued 8 percent overweight to high yield.