China presents numerous opportunities for investors, but some are concerned about its debt, its property market, its old-economy companies and the possibility of devaluation. Is the bogeyman about to jump out from under the bed?

Debt?

One popular concern about China is that a rising debt-to-gross-domestic-product (GDP) ratio is a sign that a financial crisis is looming. And this ratio is widely used to gauge a nation’s financial vulnerability.

Certainly, China has a debt problem. The amount of debt per unit of GDP growth increased from 2014 through 2016. In 2016, it took 5.7 units of debt to generate one unit of GDP growth. Pouring more debt on the economy wasn’t generating much growth.

China is not ignoring its debt problem. It has taken action, shutting down excess capacity in coal and steel where it was unproductive and forcing some companies to go bankrupt. Today, it takes 3.2 units of debt to generate one unit of GDP growth.

Ghost Towns?

Another concern pertains to China’s property market. People often talk about the country’s under-occupied developments, or “ghost towns.”

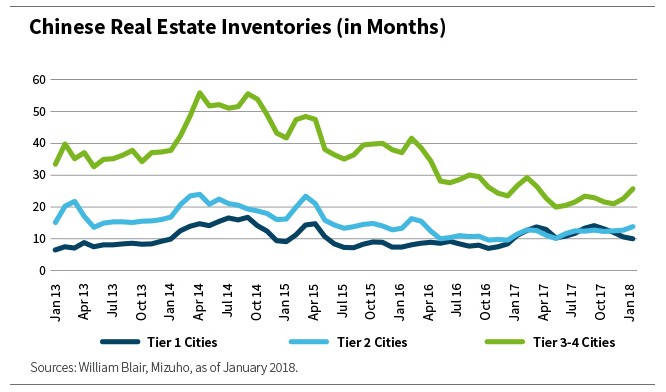

Certainly, there has been some overdevelopment in the past. As the chart below illustrates, in 2014 tier-3 and tier-4 cities had 30-month inventories, which is significant: When there were 12-month inventories in the United States, the property market collapsed.

But China depleted that inventory. It stopped construction, and levels are now average. We’re even seeing shortages in some cities, so property prices are rising.

Failing Old-China Companies?