Our political leaders of both parties seem to have agreement that our military forces need more than just a facelift. Some serious allocation of funds has been included in the budget to the tune of hundreds of billions of dollars.

The investment community from institutions to hedge funds and individual investors are tempted to cash in on what seems to be a bonanza. We would like to give a word of caution that not all defense companies are created or treated equally. While we believe that many of these companies will benefit from the contracts they already have and the ones they are expecting, we suggest that advisors and investors seek the ones with adequately diversified portfolios that can weather the large fluctuations in revenue resulting from military contracts, which are lucrative, but subject to change as the needs of the end users change.

Companies that do not rely solely on military contracts and have robust and diverse portfolios can maintain high revenue and profitability during the cycles of defense contract droughts. It is important not to forget, however, that companies with highly technical, innovative and unique systems will also continue to do well.

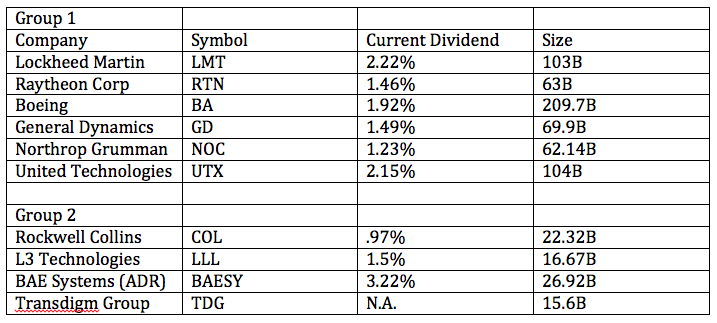

We put together a list of companies which are defense related that will do well in the next few years.

We classified them in two tiers or groups based on size, history and financial strength. We think these two groups will fair well in the next few years, however advisors and investors should do some homework and consult.