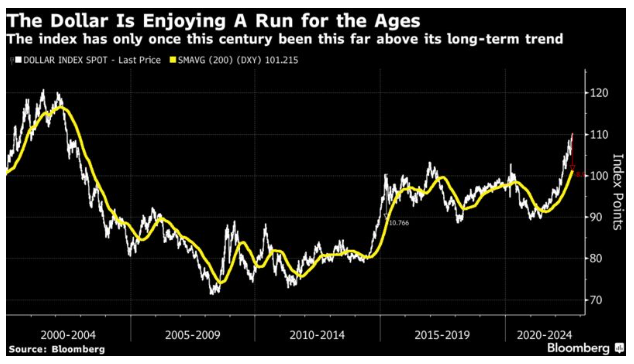

Global imbalances are growing ever more intense, and that’s visible most clearly in the incredible strength of the U.S. dollar. It’s becoming quite extraordinary.

To see the strength of its upward trend, look at how the dollar index (comparing the U.S. currency to a few of its biggest developed-market peers, led by the euro and Japanese yen) is performing compared to its own 200-day moving average, a widely accepted measure of the long-term trend. Only once before in this century has the dollar been so far ahead, and that was in 2015 as foreign exchange markets adjusted to the epic fall in the oil price that had started the previous year:

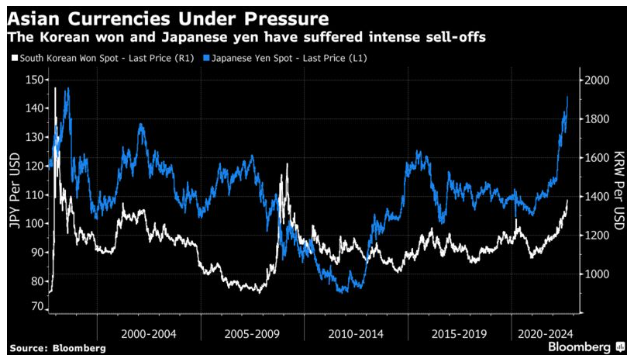

Everywhere the dollar’s power is apparent. Against the currencies of two major Asian exporters, Japan and South Korea, the dollar has now almost topped its extreme from 1998, set in the aftermath of the Asian financial crisis. Korea’s won is still far stronger than during its disastrous devaluation in 1997—but has still sold off to its lowest level since the Global Financial Crisis of 2008:

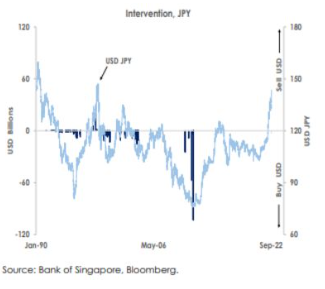

Will this provoke a response from central banks? The yen is nearing the point where the Bank of Japan might decide to act. The following chart is from Mansoor Mohi-uddin, chief economist at the Bank of Singapore Ltd.:

The yen is now very close to its level the last time the BOJ intervened to strengthen it (there were several interventions to weaken it, especially in the wake of the GFC). The market is testing the central bank’s resolve to avoid such a move, and also its determination to continue with yield curve control (intervening to keep 10-year bond yields low) at a time when everyone else is tightening. This could vitiate any attempts to strengthen the yen. Mohi-uddin offers this lesson from the last time the yen was this weak:

In 1998, the JPY plunged as local banks struggled to recover from the bursting of Japan’s 1980s bubble and the worsening Asian Financial Crisis kept the BOJ dovish. The USD was also supported by the hawkish Fed keeping its fed funds interest rate high at 5.50% to counter inflation. In response, the Bank of Japan, on behalf of the Ministry of Finance, intervened to defend the JPY by selling USDs. But the action was unsuccessful. The USD rose to 147-148 and only peaked when Russia defaulted on its bonds. The shock forced hedge funds to cover their losses in Russia by unwinding their profitable JPY shorts, causing the USD to tumble and to end the year around 115 against Japan’s currency. In 2022, the JPY is set to plunge again towards its 1998 lows of 147-148 unless a shock makes the Fed or the BOJ shift stance.

Even direct intervention didn’t work—the key was the global economic framework. As the BOJ knows that intervention won’t achieve much if it stays dovish while the Fed is hawkish, the odds are that it tries to ride out the storm. The risk named by Mohi-uddin and other strategists is that there will be nothing to stop speculators pushing the yen even further down—and strengthening the dollar still further in the process.

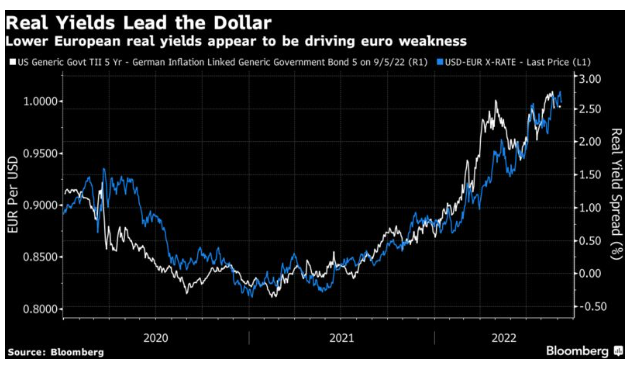

Then of course there is the euro, which has recently dropped below parity to the dollar for the first time in two decades. With the European Central Bank meeting due shortly after you receive this newsletter, note that the difference in real yields between the U.S. and eurozone appears to drive the dollar’s gains. The correlation between the growing disparity in the United States’ favor, and the strength of the dollar, is glaring:

But in the case of Europe, it’s possibly misleading to attribute this to the interplay between different central banks. Instead, the driving force, as ever, is the war between Russia and Ukraine and the differential effect this has on European and U.S. energy prices. This energy shock has played out very differently from all predecessors by afflicting Europe far worse than the U.S. Usually, the dollar has a direct inverse relationship with the oil price, which is natural as all oil transactions are denominated in dollars. The oil crash after OPEC discipline broke down in 2014 was directly matched by a strengthening dollar. This time around, the dollar has strengthened even as the energy prices have risen. The reversal of the relationship over the last 12 months is nothing short of astonishing: