Banks used to benefit from this model as much as other firms, but the financial crisis changed all of that. New rules designed to ensure lenders have a buffer to weather tough times have boosted the amount of capital they must set aside to cover these trades and constrained trading desks.

“You’re really dependent on increasing your trading volume to help manage and secure those fractions of a penny,” said Ryan Sullivan, vice president of Brown Brothers Harriman & Co.’s global ETF services. “That’s resulting in some of the shift that we’re seeing.”

Getting Harder

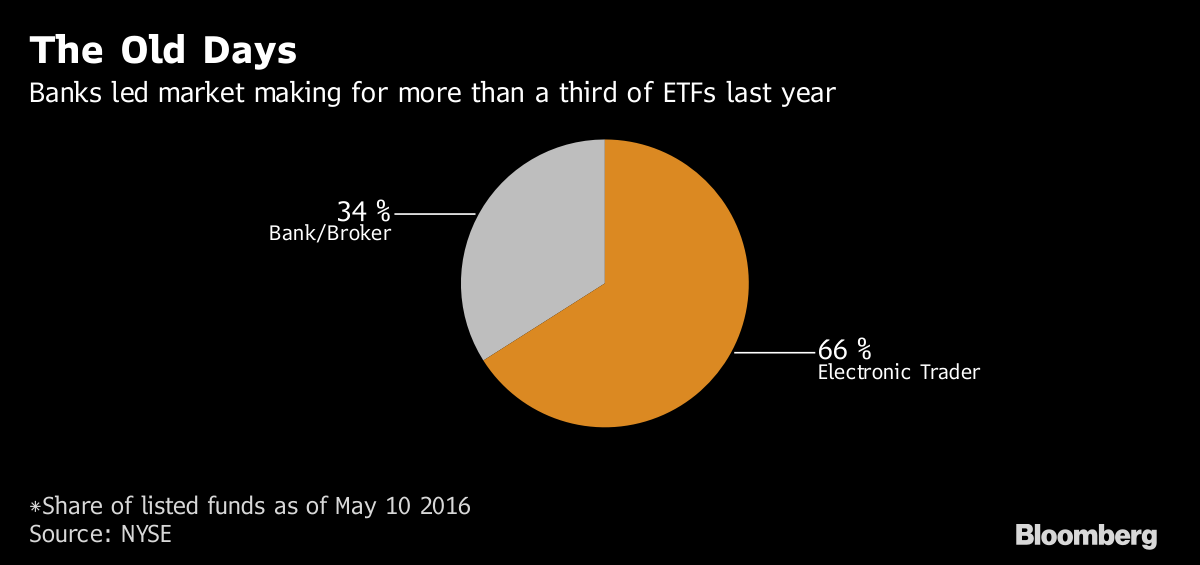

But that shift -- the rise of electronic traders at the expense of banks and conventional brokers -- may be set to slow. Lead market makers are usually expected to invest about $5 million of startup capital in the ETFs they support, and as the number of funds tops 2,000 in the U.S., that’s less and less sustainable.

“The concentration of firms that are providing lead market-maker services is the biggest systemic risk in the market,” said Phil Bak, chief executive of ACSI Funds and Exponential ETFs. “There are plenty of firms that could step in, but the incentives aren’t there. That’s the risk people should be looking at.”

From June 2018, the U.S. Securities and Exchange Commission will gather information about which firms are “creating” or “redeeming” ETFs by switching an agreed-upon bunch of securities for shares in a fund. While this role is distinct from making markets, many firms operate in both the primary and secondary markets, and the data gathered could inform future policy, according to the SEC.

That could give banks a second chance. Credit Suisse Group AG has, for example, already boosted the number of ETFs it works for over the last 18 months to “assist our strategic partners,” according to Robert Bernstone, a managing director in equities at the bank. Royal Bank of Canada’s RBC Capital Markets has also ramped up its business.

If market making becomes more of a relationship business, banks may find they have a place alongside the high-speed firms. But for now, their fast electronic counterparts have the upper hand.

“We are still growing and evolving our client offering in the ETF space, which includes evaluating whether we want to take a more active role in the LMM business,” said Cory Laing, head of ETF and one-delta institutional sales at Citadel Securities. “We’re working with a lot of sponsors to understand their needs and where they see a role for us to play in the rapidly evolving ecosystem.”

This article was provided by Bloomberg News.

Not so for the new guard. Protected from the capital burdens that plague the banks, these firms leverage lightning-fast technology and complex algorithms to do millions of trades a day. Each transaction earns firms mere cents, but do enough and it starts to pay off.