A hidden war is taking place within your exchange-traded fund, and some of the biggest names on Wall Street are losing out.

Banks like Goldman Sachs Group Inc. have surrendered a once-lucrative type of market making amid an onslaught of regulation that’s wiped out profit margins. Nimbler firms -- so-called high-frequency traders -- have picked up the slack.

These speedsters have harnessed technology to gain an edge over banks as the U.S. ETF market surpasses $3 trillion in assets and trading explodes. That shift, though barely perceptible to the outside world, has made it easier and cheaper for everyone from mom and pop to the world’s biggest pension funds to buy and sell these increasingly popular products. But it’s also placed a market that’s 60 percent retail into the hands of less-regulated firms.

“Recent regulatory changes have caused many banks to re-evaluate their various lines of business, one of which was the trading and market making in ETFs,” said David Mann, head of global ETF capital markets at Franklin Templeton, and the firm’s main point of contact for market makers. “This allowed smaller firms who focus solely on providing liquidity in ETFs to gain market share.”

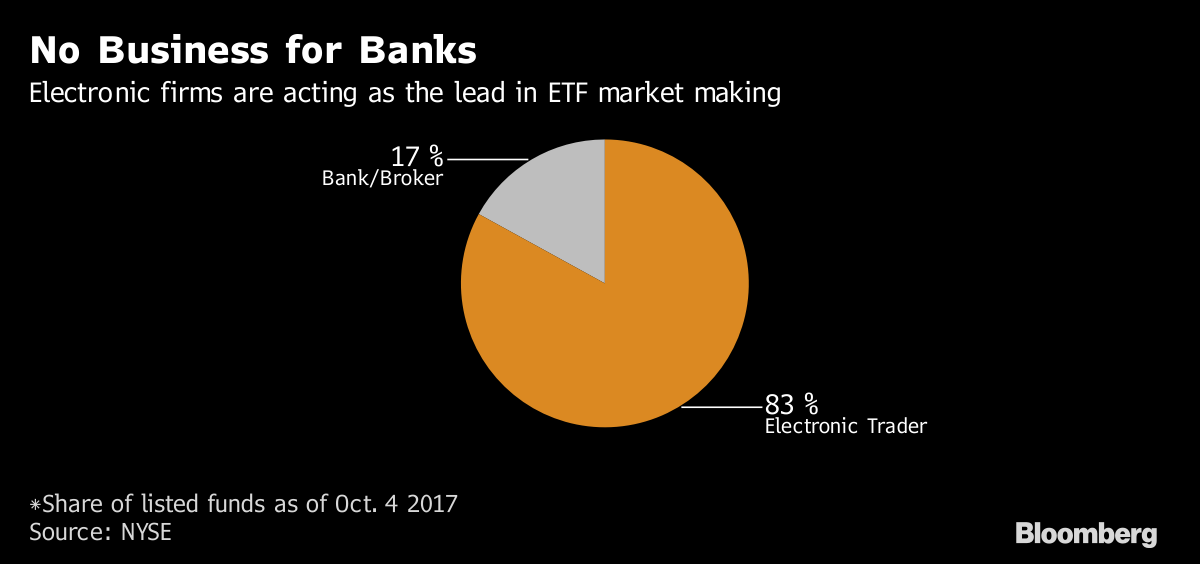

Over the last few years, high-speed traders have moved from quietly trading ETFs in the shadows, to overseeing much of the market. On NYSE Arca, which hosts the majority of U.S. ETFs, 83 percent of funds have appointed an electronic firm to the key role of lead market maker, instead of a bank or conventional broker-dealer.

Amsterdam-based IMC, for example, was the lead market maker for 125 ETFs on NYSE Arca as of Oct. 4, up from just one 17 months earlier. Other growers include Jane Street Group LLC, Flow Traders NV and Latour Trading LLC. Citadel Securities LLC is considering getting into the business.

Goldman Sachs has meanwhile backed away from this job over the last year and a half, resigning its lead role on more than 300 of the 359 NYSE-listed funds it used to assist, data from the exchange shows. Among the funds Goldman relinquished was the nearly $14 billion Guggenheim S&P 500 Equal Weight ETF, which went to IMC.

Goldman Sachs had been looking to exit the business for a while as the rewards didn’t offset the obligations, a person familiar with the matter said, asking not to be identified because the details are private. Tiffany Galvin-Cohen, a spokeswoman for Goldman Sachs, said “we remain committed to serving our clients as an active market maker in the ETF space.” Resigning as a lead does not stop a firm doing other types of market making.

Greater Constraints

Lead market makers are a fund’s linchpin, setting the price that investors pay to trade an ETF over an exchange. LMMs are required to post the “ national best bid-offer” -- the most attractive price at which an investor can buy or sell that fund -- for most of the day, and receive a rebate from the ETF’s home exchange in return.