Risk-Omicr-Off

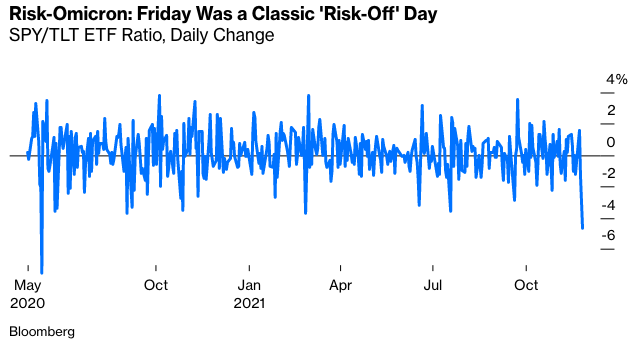

Some Thanksgiving break that was. Friday, with the U.S. markets only open in the morning as Americans digested their turkey, was the most dramatic “risk-off” day in more than a year. Not since June 2020 had U.S. stocks (represented by the SPY exchange-traded fund that tracks the S&P 500) fallen so far compared to long Treasury bonds (represented by the TLT ETF). This was a return to the old financial crisis days of “risk-on" and “risk-off” where all assets would move according to the perception of whether the environment had grown safer or more dangerous. Friday was a day when risk was off:

All readers will surely know by now that the reason for this can be summed up in one Greek letter: omicron. Thursday brought the first trickle of news stories that a new variant of Covid-19 had been identified in South Africa, while the following day brought confirmation that it had found its way into a number of European countries. There are plenty of other places to read up on this. These are the key questions as I see them, along with the state of our knowledge at present:

Omicron is more infectious than previous variants. That means that, like the delta variant before it, it could have the potential to speed the course of the pandemic once more. Any given wave, like last summer in the U.S. and the U.K. or the one gathering force in continental Europe, will be that much worse. It gives a reason to believe that the pandemic will drag on longer than previously expected, and to fear that more restrictions will be necessary.

There’s no evidence as yet that omicron is any more lethal than previous variants. There is even some anecdotal evidence, from a much-quoted South African doctor, that symptoms tend to be milder than in previous strains. But be cautioned that most of her patients were relatively young and healthy. It’s not clear whether it would have a more aggressive effect on people more at risk.

Omicron might well be resistant to current Covid vaccines, but it will take several days to be sure about this. The degree to which this variant has mutated, as many will have read, does suggest that it might well be able to infect the fully vaccinated. But for now, this is a theory.

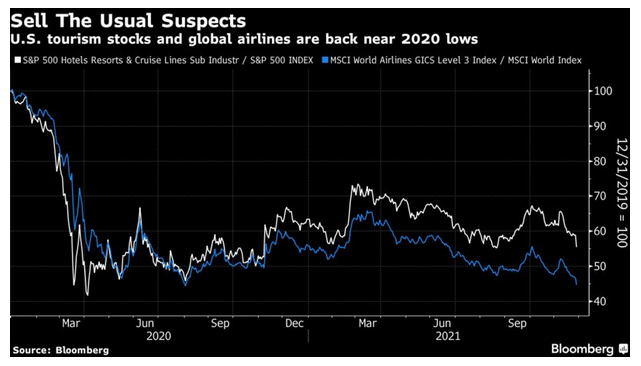

This didn’t happen in a vacuum. The most Covid-sensitive stocks had already been under pressure as cases refused to decline in the U.S. and a new wave took shape in Europe. Airlines and leisure stocks were already doing very badly before Friday, when they took the brunt of the omicron sell-off:

If this variant does prove to be vaccine-resistant, the chances are that we face a long and angry winter as governments try to persuade people to restrict their movements yet again. For those prepared to take the vaccines, however, it looks like they may be ready in a matter of months. Investors have known for some time that the real potential game-changer would be the emergence of a vaccine-resistant strain, which explains the drastic market reaction. But Big Pharma seems confident that a new vaccine should be forthcoming quite quickly, and there is no sign that omicron is particularly dangerous (although a lot of weight seems to have been put on one anecdote from one doctor in South Africa).

As a result, the indications as I write are that investors have already decided that Friday’s risk-off day was overdone. Israel’s stock market, which was closed then but open on Sunday, reflects how sentiment moved over the weekend: