While the designs and lifestyles around us are changing, the human experience is constant. We are born, we age, we meet many people (including for most our spouse(s)), we procreate, and we die. This chain has not been broken for 10,000 years! While this seems so simple on its face, many confuse their experience for something more unique. In academia, some may term this “chronological snobbery.” In the investment business, we call it financial euphoria. The number one cause of stock market failure!

They know that overstaying the festivities—that is, continuing to speculate in companies that have gigantic valuations relative to the cash they are likely to generate in the future—will eventually bring on pumpkins and mice. But they nevertheless hate to miss a single minute of what is one helluva party. Therefore, the giddy participants all plan to leave just seconds before midnight. There’s a problem, though: They are dancing in a room in which the clocks have no hands.

This is how Buffett described the experience that he witnessed in the 2000 Berkshire Hathaway Annual Letter, the last major episode of financial euphoria in the stock market and the S&P 500. These all seemed unique at the time. In 2000, the experience was that the Internet was going to change our lives. Oddly enough, this was true, but it was not unique for the individuals that believed it. It was shared by all that lived at that time and going forward.

What was unique about the investors in 2000 was their excitement. UBS noted then that their clients expected double-digit returns going forward in stocks. Again, it felt truly unique.

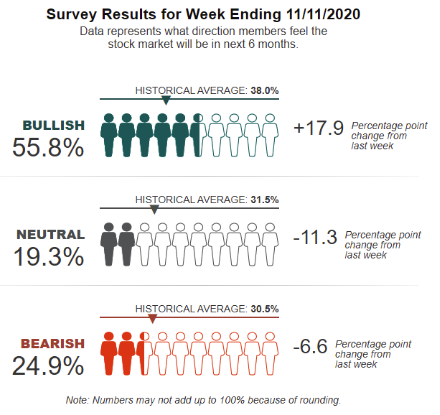

To understand today’s sentiment, let’s start with the individual investors from the American Association of Individual Investors (AAII) sentiment survey. Below is where these numbers were most recently reported.

This entire bull market has been marked by retail investors, noted by the AAII survey, not being bullish. Rather, they have been continually bearish. In some ways, their bearishness has been the jet fuel of this great move in equities over the last 11 years. These investors are more than two-to-one bullish as a group.

A note for those who care, I kid in our offices about the survey’s relevance today compared to 20 years ago. The survey’s members are baby boomers, so it is hard to draw a cross-section of investors from this survey. We do not believe this ruins its contrarian usefulness, as these are risk-averse people clamoring for risk for the first time in a long time!

Now that we’ve covered the retail portion of “giddy participants,” let’s move to the professionals. Investors Intelligence produces the Advisors Sentiment, which tracks newsletter writers based on bulls, correction and bears. The November 11, 2020 report stated, “The bulls jumped to 59.2%…bears to 19.4%.” The correction crowd was at 21.4%. This survey focuses in on the bull-bear spread, which came to 39.8%. The survey notes caution above 40% for this ratio. The nasty correction the market had in late 2018 started with the bull-bear spread at 43.2%. This sentiment isn’t at an extreme, but well within areas that cause problems for “giddy participants.”

Further on professionals, the freshly published BAML fund manager survey tracking the managers from November 6th through 12th showed investor optimism among its participants. “Cash holdings plunged to the lowest level since April 2015, while economic growth expectations jumped to a 20-year high.” The Bloomberg article that covered the release tip-toed Buffett’s words that, “they nevertheless hate to miss a single minute” when it reported that, “With the S&P 500 hitting a record high, fund managers face a moment of reckoning whether it’s worth taking profit or staying invested for potentially even more returns.” You can almost hear the Wall Street infomercial saying, “but wait, there’s more.”