My parents lived through the Great Depression, so their attitude towards debt was simple: Take on as little as possible, and pay it back as quickly as possible. Thrift was a virtue stressed at every turn. We took Saturday trips to the bank to update our savings passbooks, and we consumed leftovers regardless of their age.

Nations have also valued the ethic taught to me at home. Keeping a balanced budget is evidence of efficient use of taxpayer funds; avoiding excessive debt minimizes the burden placed on future generations. Countries that become too deeply indebted risk losing control of their destinies.

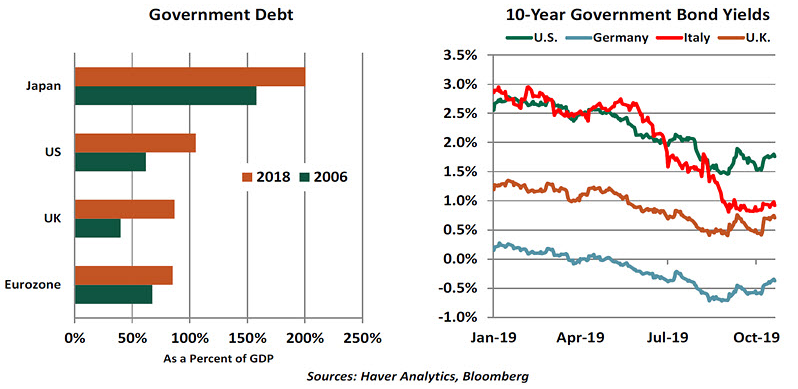

But you’d be forgiven for thinking that the world has forgotten about the virtue of thrift. Despite a ten-year expansion, the amount of sovereign debt outstanding around the globe has risen to a staggering level. What’s more, some leading economic thinkers are suggesting we should be borrowing even more aggressively. Have they lost their minds, or are they onto something?

The main catalyst behind recent increases in government borrowing was the 2008 financial crisis, which prompted substantial countercyclical spending. The expansion that followed has been long, but cumulative growth over the past decade has been modest relative to past cycles. This has made it difficult for budgets to get back into balance.

Yet even as governments have gone more deeply into the red, the cost of carrying the debt has fallen. Long-term interest rates in developed countries have collapsed this year, counter to what many expected. This makes it appear, at least for now, that the consequences of all of that borrowing are not that severe.

The proper size of deficits and debt has always been the subject of differing political perspectives. On one side are fiscal conservatives, who feel governments govern best when they govern least. They fear borrowing done by the public sector can absorb capital that could be used more purposefully by the private sector (a process known as “crowding out”).

On the other side are fiscal liberals who see the national budget as a tool that governments can employ to achieve a broad range of economic and social objectives. In many countries, there have been renewed calls for additional spending to address income inequality, climate change, and infrastructure.

The steep fall in interest rates has created common ground for the two groups. Even fiscal conservatives acknowledge that in the present situation, budget expansion is much less objectionable. This line of reasoning was championed earlier this year in a paper by Olivier Blanchard, the former chief economist at the International Monetary Fund (IMF).

Blanchard’s thesis is that when the rate of economic growth is higher than the rate on government borrowing, the ratio of debt to gross domestic product (GDP) will decline over time. Viewed another way, if a government can generate economic returns that exceed its cost of capital, then additional debt is worth taking on.