Slipping markets have investors understandably nervous about when it will turn. Tariffs and trade wars, volatility that’s back with a vengeance and the recent election season aren’t making it any easier.

Other than flat fixed income or moving to the sidelines altogether—what, if anything, can advisors do to help clients weather the current market madness?

Equity options are one of, if not the, fastest growing investment products available on the market today.

While they have been around for decades, over the last 15 years, the daily volume of options traded has increased by an average of 12.6 percent per year.

The potential benefits of incorporating equity options into a portfolio have long been tainted by the perspective that options trading is “risky.”

Working with specialized money managers, advisors can implement options strategies that will add shock absorbers to a portfolio. While no investment strategy is without risk, options are primarily used as a vehicle for risk transfer—if employed correctly, they can transfer risk out of your portfolio and smooth out your investment returns while generating additional income at the same time.

The BXM Index

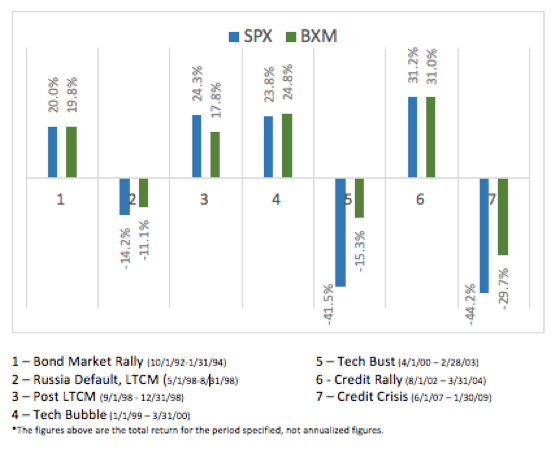

The CBOE Buy-Write Index (BXM) is the primary benchmark for covered call writing strategies.

Since its inception, the BXM has performed well compared to the S&P 500, and it has done so with less volatility.