Julien Houdain, Global Credit Portfolio Manager, said: “The fragility of the recovery at present means central banks need to maintain policy support, which should be helpful to corporate bonds. One of the biggest foreseeable risks is that policy measures are reduced or withdrawn too soon.”

Search For Income

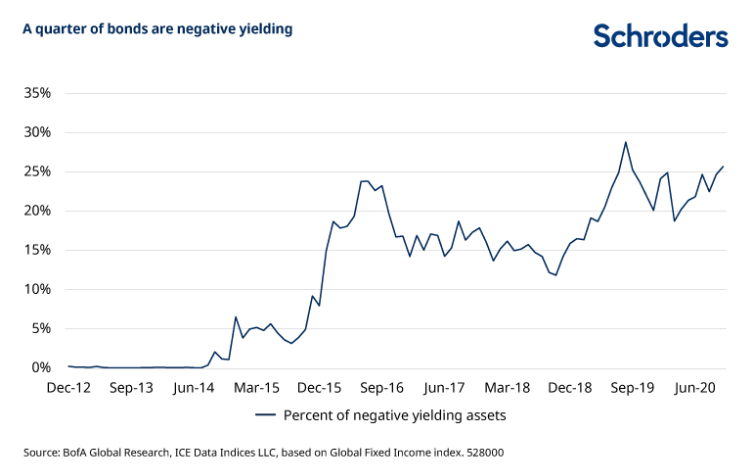

Interest rates and yields have been pushed even lower in 2020. For many investors, the usual income generating options, savings accounts, money market funds or government bonds, offer either negligible or zero income, or even negative yield (which means a guaranteed loss of capital, if held to maturity).

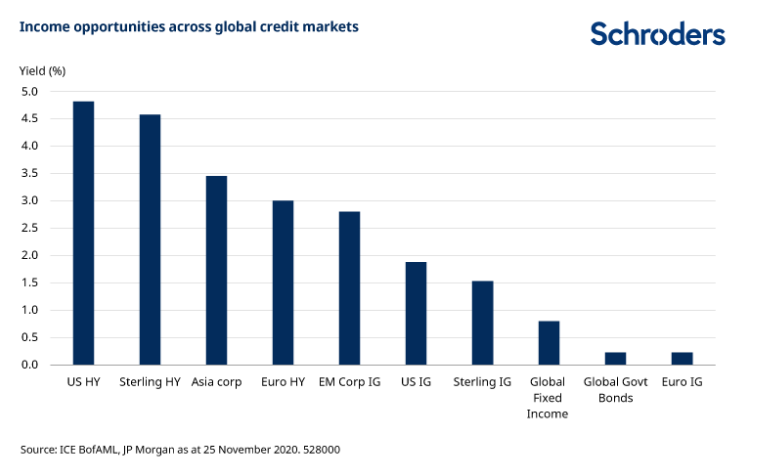

With income opportunities remaining at a premium, corporate bonds should remain in demand. Inflows into investment grade credit since March have been highly consistent. Yields have dropped as the market has recovered, to low levels in some cases, but credit remains a source of income, especially in the context of globally low yields.

Rick Rezek, Global Credit Portfolio Manager at Schroders, said: “We believe the search for yield will push investors out along the risk spectrum, as it has in previous years, and this will benefit investment grade corporate bonds.”

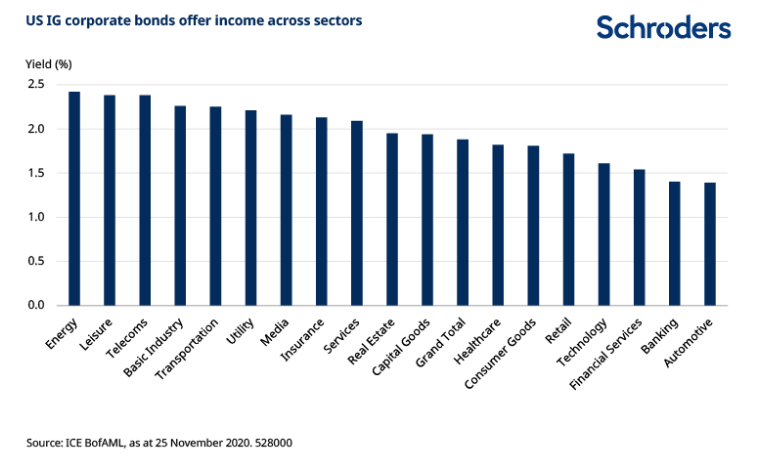

“While yields in certain parts of the global corporate market are quite low, particularly in Europe, other portions of the market such as US dollar do offer higher yields, even taking inflation into account. Positioning, at sector, regional and company level, will be a critical determinant of returns in 2021.”

Pockets Of Value Amid Growth Normalization

While credit has broadly rebounded strongly since March, there are still clear pockets of value. Some sectors have been affected worse than others by lockdowns, and have lagged in the rebound. These could perform particularly well, especially if vaccines are rolled-out quickly.