Not so in a public bankruptcy. The primary asset of a city, county, or state is future tax revenue from households and businesses within its boundaries. The taxpayers can walk away. Even without moving, they can bypass sales taxes by shopping elsewhere. If property taxes are too high, they can sell and move. When they take a loss on the sale, the new owner will have established a property value that yields the city far less revenue than it used to receive.

Cities and states don’t have the ability to shed their pension liabilities. They are stuck with them, even as population and property values change.

We may soon see an example of this in Houston. Here in Texas, our property taxes are very high because we have no income tax. Your tax is a percentage of your home’s taxable value. So people argue to appraisal boards that their homes are falling apart and not worth anything like the appraised value. (Then they argue the opposite when it’s time to sell the home.)

About 200 entities in Harris County can charge taxes. That includes governments from Houston to Baytown to Hedwig Village, plus 20 independent school districts.

There’s a hospital district, port authority, several college districts, the flood control district, a multitude of utility districts, and the Harris County Department of Education. Some homes may fall within 10 or more jurisdictions.

What about those thousands of flooded homes in and around Houston; how much are they worth? Right now, I’d say their value is zero in many cases. Maybe they will have some value if it’s possible to rebuild, but at the very least they ought to receive a sharp discount from the tax collector this year.

Considering how many destroyed or unlivable properties there are all over South Texas, I suspect cities and counties will lose billions in revenue even as their expenses rise. That’s a small version of what I expect as city and state pension systems all over the US finally face reality.

Here in Dallas I pay about 2.7% in property taxes. When I bought my home over four years ago, I checked our local pension and was told we were 100% funded. I even mentioned in my letter that I was rather surprised. Turns out they lied. Now, realistic assessments suggest they will have to double the municipal tax rate (yes, I said double) to be able to fund fire and police pension funds. Not a terribly popular thing to do. At some point, look for taxpayers to desert the most-indebted cities and states. Then what? I don’t know. Every solution I can imagine is ugly.

Promises from Air

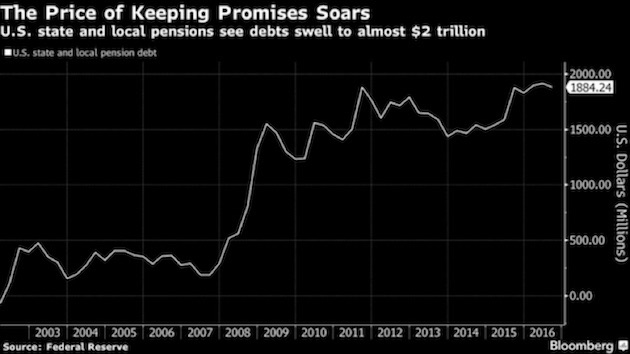

Most public pension plans are not fully funded. Earlier this year in “Disappearing Pensions” I shared this chart from my good friend Danielle DiMartino Booth:

Total unfunded liabilities in state and local pensions have roughly quintupled in the last decade. You read that right – not doubled, tripled or quadrupled: quintupled. That’s nice when it happens on a slot machine, not so nice when it’s money you owe.