The trust beneficiaries can also minimize the tax bill if they qualify for the stretch IRA through the trust (if the IRA trust qualifies as a “see-through” trust under the tax rules). This allows trust beneficiaries to spread RMDs they receive from the trust over the lifetime of the oldest trust beneficiary.

Two Types Of IRA Trusts

IRA trusts can either be conduit trusts or discretionary trusts. Both of these will be in peril under the tax proposals.

A conduit trust as the name implies pays out the RMD each year from the inherited IRA to the trust and from the trust to the trust beneficiaries. The trust is merely a conduit to the trust beneficiaries. The tax on the RMDs is paid by the trust beneficiaries, say, the children, at their own personal rates. They receive only the annual RMDs while the lion’s share of the inherited IRA remains protected in the trust for possibly decades depending on the ages of the trust beneficiaries.

A discretionary trust (a/k/a accumulation trust) also pays the RMDs from the inherited IRA to the trust, but here the trustee has discretion to pay the funds out to the trust beneficiaries or to hold part or all the funds in the trust to protect those funds. If funds are paid out to the individual trust beneficiaries, they will pay the tax at their personal tax rates. But if the funds are held in the trust, then the RMDs are taxed at high trust rates.

Both of these IRA trust planning mechanisms that currently employed will be drastically diminished if the stretch IRA is eliminated. Conduit trusts would essentially cease to exist.

Under the proposals in the SCEURE Act, there would no longer be RMDs each year based on a life expectancy. Any balance remaining in the inherited IRA at the end of the 10-year payout period would be the RMD at that point. All the funds would have to be paid out to the trust beneficiaries. That would cause all of those funds to be exposed to taxation, but even more important, the funds would lose their trust protection, which was the reason the trust was set up in the first place.

Conduit trusts would no longer work, and that includes Trusteed IRAs which some financial institutions use. Trusteed IRAs are conduit trusts, so inherited IRA funds would lose their trust protection in Trusteed IRAs, too. They would have to be scrapped or converted to discretionary trusts so that distributions could at least be spread out over the 10 years to somewhat lessen the tax impact. But with large IRAs this still might not be enough to avoid a big tax bill.

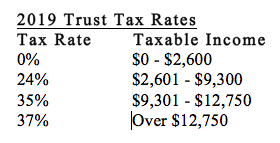

The only way to keep the inherited funds protected in trust would be to use discretionary trusts where the trustee can hold funds in the trust well beyond the 10-year period, as is the case under the current stretch IRA rules. But here too, at the end of the 10 years, all of the inherited funds will be forced into the trust and any funds maintained in the trust (not paid out to the trust beneficiaries) would be subject to tax at the high trust rates. The tax on these multi-million dollar IRA payouts would be exorbitant.

Why The IRA Trust May No Longer Work

July 8, 2019

« Previous Article

| Next Article »

Login in order to post a comment

Comments

-

I see the highly respected Ed Slott omitted the "qualified annuity contract" SECURE Act exemption from the non-spousal Beneficiary RMDs discussion from what would have been a thorough discussion of this proposed legislation. I don't get it. What is it with these experts and annuity contracts? Is it just some anti-annuity bias? I have now read dozens of SECURE Act summations by some every prominent authors Jamie Hopkins Esq., LLM, CFP®, ChFC®, CLU®, RICP®Ed Slott, CPA , etc. and all skip the qualified annuity contract exemption the SECURE Act explicitly provides for. Either they didn't read the entire act or they read the entire act and didn't understand the annuity exemption or they just plainly hate annuities. And why aren't the Home Offices weighing in here? Too busy mainlining FIAs and VAs to bother with the annuities exempted by the SECURE Act? Frustrated in the sticks, all I hear is crickets. All you estate planning attorneys out there, the annuity door is still open for business. https://www.linkedin.com/pulse/stretch-ira-conundrum-golden-spia-opportunity-gary-mettler/

-

I think rather than just post on how to cope with this proposed change in IRA distributions, it is our responsibility to contact our elected representatives and encourage them NOT to pass this change in the law. This is not a done deal and there is always the possibility it will be rethought--even if the only change is to change the 10 year period to 20 years. This is how we can attempt to protect our clients who will be impacted by the change. It should not be assumed to pass!

-

This is a good article right up until the suggestion that money should be transitioned into cash value life from the IRA. Life insurance for death benefit is fine (traditional IRA rescue), but it is a mathematical loser to move money from an IRA to cash value life in hopes of receiving more after-tax money in retirement. Go check out www.stopirarescue.com.