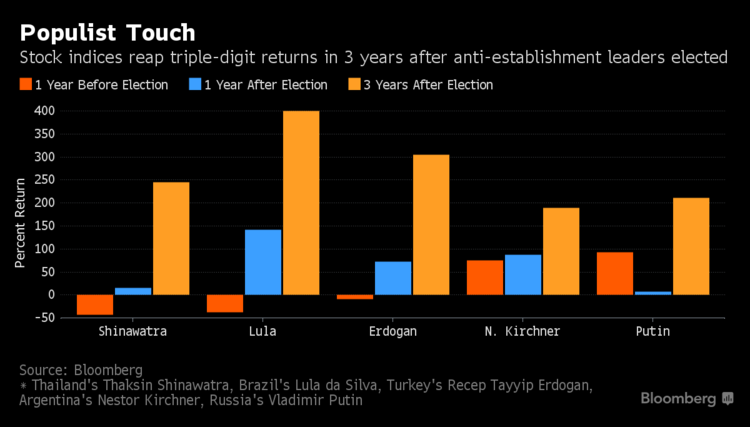

If the last two decades of anti-establishment rule are any guide, the world may be on the brink of some monster stock rallies as it takes a turn toward populism.

A look at 10 of the 21st century’s most recognized populist leaders shows that in the three years after their election, local equities soared an average of 155 percent in dollar terms. And the rallies often continued as long as a decade after the vote.

The explanation, according to Satyen Mehta, a money manager at Neon Liberty Capital Management who has researched the phenomenon, is that populists often create short-term stimulus that supports growth even as the nations’ debt burdens swell. (Their foreign bonds, it should be noted, tend not to perform nearly as well.)

Market performance under populist leaders is an issue front-and-center for investors as firebrand leaders who promise to put their people first go on the march from the U.S. to India to Turkey and the Philippines. Though economists say policies such as cracking down on imports, championing local industries and raising government spending will stifle growth in the long term, data compiled by Bloomberg shows that stock buyers can do quite well for years after a populist comes to office.

"While conventional wisdom suggests investors should be wary of populist leaders, equity markets were actually much more resilient when their policies turned out to be more benign than initially feared," Mehta said.

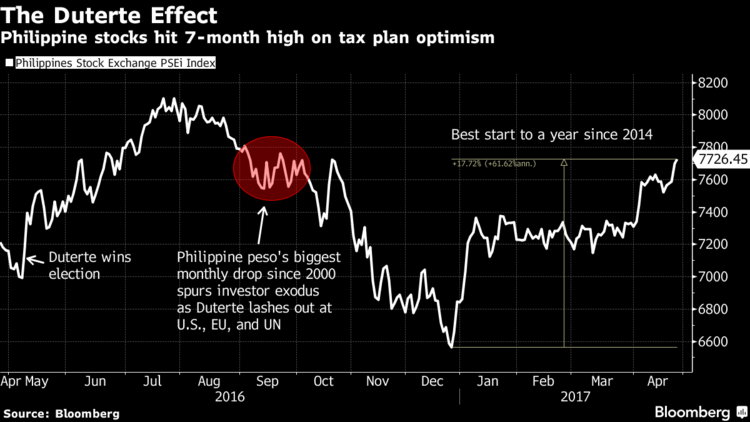

The Philippines seems to offer a textbook example of the policies that have led in the past to outsize gains. President Rodrigo Duterte is boosting spending on infrastructure, cutting taxes and enjoying the region’s fastest economic growth, even as he comes under intense criticism for human-rights abuses. And foreign stock traders are turning bullish, putting $198 million to work in the country’s stock market last month after withdrawals in February and March.

"Investors can’t afford to be off the train, for they could be missing out on a potentially sharp rally," said Noel Reyes, who helps manage $1.2 billion as chief investment officer at Security Bank Corp. outside Manila. “He’s been pursuing the reforms to sustain growth and he remains popular despite criticisms on his leadership style."

Investors in the Philippines willing to look past the extra-judicial killings that have earned Duterte the nickname “The Punisher” while drawing condemnation from Human Rights Watch and Amnesty International have seen stocks climb to a seven-month high.

Nomura Holdings Inc. recently initiated coverage of 15 Philippine stocks, citing the tax cuts’ potential boost to the banking, property and retail sectors.

Triple-Digit Returns