Dear Fellow Investors,

As an observer of ten presidential election cycles while working in the investment business, we thought it would be a good thing to give the current stock market environment some historical context. Revenue growth stories in tech are making what some would call “maniacal new highs.” Perceived losers in the 2016 cycle, like healthcare, have been purged by the stock market. Betting sites and many of the polls have had Hillary Clinton running ahead (before the reopening of the FBI investigation) and favor among the S&P 500 sectors is seemingly representative of her perceived industry likes and dislikes. Could this discounting prior to the election be symptomatic of a contrary indicator?

Since the stock market is a discounting mechanism, a look at the stock market in the 1980 election season could be a helpful comparison for contrarian investors. Ronald Reagan, a former movie actor and Governor of California, ran as a pro-business, pro-military, and marginal-tax-rate cutting Republican candidate. He was viewed as a forward positive for U.S. stocks. As his lot improved at the polls, a feeling of excitement about stocks grew (see chart below1) and the industries which were believed to be positively impacted by four years of his blessing, soared.

Defense stocks were the heart and soul of the excitement leading up to the election of 1980. My Dad called me the day before the election, a Monday, and asked if there was a stock which may go up if Reagan got elected. In those days, the New York Stock Exchange was closed every fourth year on Election Day. I had been a registered representative for two weeks and told him our firm, Drexel Burnham Lambert, liked the aerospace company, Loral Aerospace, at a price around $37 per share. We bought him 200 shares, my first purchase as a stock broker.

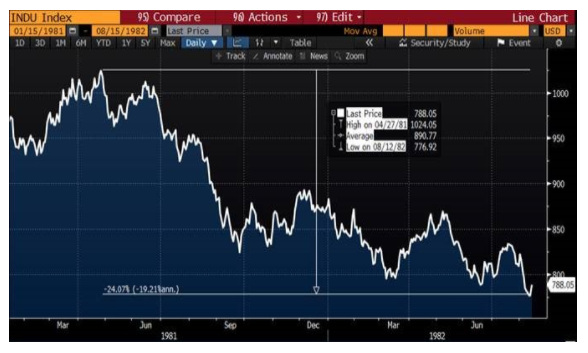

Reagan won in a surprisingly large way and the entire stock market soared on the Wednesday after the election. It took three hours to get the defense stocks opened for trading and we sold Dad’s Loral at $45 per share. It hit $50 a share on an intra-day basis before closing. Remember: the stock market spent all of 1980 warming up to a pro-business, pro-stock market, pro-defense spending president and prices soon reflected that fact. The chart below tells what happened in the next two years1:

Nineteen months into Reagan’s first term, stocks had fallen 22% from when he took office. The stock market discounted the expected positives from Reagan’s policies by January of 1981 and defense stocks have rarely been more popular.

Fast forward to today. A Democratic candidate, Hillary Clinton, who tacked left to pick up votes from a socialist/populist primary opponent, is out scaring the pants off of investors. She and more publicly audible party leaders vilify many businesses and seek to impose greater government control over numerous industries. This is especially true of pharmaceutical, biotech and the healthcare-related companies, which has led to dismal performance in the stock market (see chart below1). Over the last 16 months, healthcare as a category has lost money and the S&P 500 pharma and biotech industry segments have lost 23.73% and 25.5%, respectively.

As long-duration common stock investors, we are always looking for wonderful companies that get beat up by short-term circumstances. We reduced our position in healthcare-related shares about two years ago, as their popularity was high. It is safe to say that the popularity has disappeared and is being replaced by extreme fear.