The strongest 50-day rally in the S&P 500 Index in over 70 years has sent a signal that the economic recovery is gaining steam and may look more like a “V” than a “U,” a square root, checkmark or swoosh. We assess the probabilities of these various scenarios for recovery and reiterate our 2020 economic growth forecasts.

As Goes The Virus, So Goes The Economy

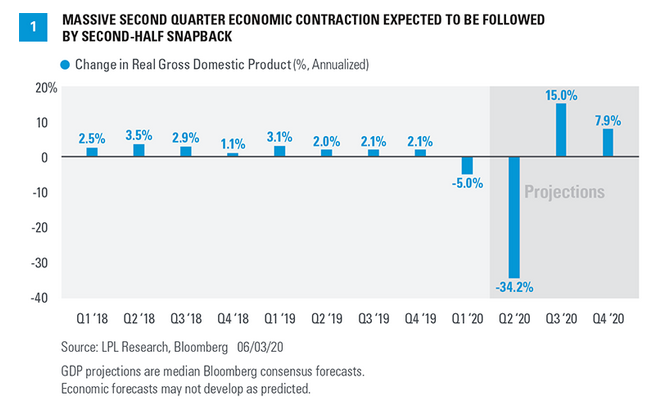

The U.S. economy almost certainly entered a recession in March 2020 as a result of the lockdowns and business closures to contain the COVID-19 pandemic. After gross domestic product (GDP) contracted by 5% during first quarter 2020 on an annualized basis, consensus expectations for the second quarter are calling for a mindboggling 32% contraction on an annualized basis [Figure 1]. We see a strong second-half rebound in economic growth as more of the economy opens up, and this recession may end up as one of the shortest ever, but the recovery is unlikely to be strong enough to return economic activity to 2019 levels by year-end.

The path of the economy over the rest of the year depends on whether COVID-19 infection rates continue to fall, facilitating more and faster re-openings and a return to some semblance of normal consumer behavior. Alternatively, a potential second wave of the virus could lead to lockdowns being put back in place and consumers staying home. This recession has been consumer led and consumers—with help from the government, medical professionals, and perhaps Mother Nature—will have to lead us out.

Encouraging Signs, But Next Phase Gets Tougher

Signs that the recovery is underway are encouraging. Policymakers have taken a depression off the table. Improvements in the timeliest data over the past several weeks are encouraging as states have moved their re-opening plans ahead. We have seen increases in vehicle and air travel, hotel occupancies, restaurant dining, and public transportation use, though from depressed levels. There is some pent-up demand.

But a large portion of the U.S. economy cannot be easily socially distanced, which may limit the pace of the recovery by capping the amount of economic activity that can be recovered quickly. Capacity limits for restaurants and restrictions on large gatherings are two examples. Per the U.S. Bureau of Labor Statistics, over 10% of U.S. jobs are in leisure and hospitality, and some of those jobs unfortunately won’t come back. More broadly, it will take time for stranded assets and affected employees to be re-tooled and re-deployed. More disruption may come as stimulus runs out.

Even with the surprising improvement in the June 5 employment report from the U.S. Bureau of Labor Statistics, the true unemployment rate is likely several percentage points higher than the reported 13.3% rate after adjusting for those classified as employed but absent from work. For perspective, the unemployment rate peaked near 11% during the 2008-2009 financial crisis.

Swoosh-Shaped Recovery

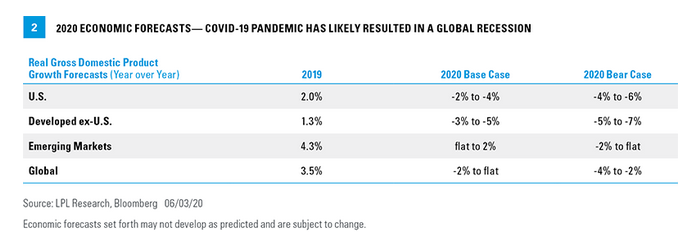

The timing and pace of the economy rebound remains uncertain, but based on the depth of the contraction and a staged recovery, our 2020 GDP forecast is calling for a sizable contraction [Figure 2]. Drags on the pace of recovery suggest a swoosh-shaped recovery, or, if you prefer, a check mark. A quick, sharp decline and—after a small snapback—gradual recovery over the next 12 to 18 months. We believe the square root symbol is too pessimistic by implying a flat phase of recovery after the initial bounce, and a U shape does not capture the multiple stages of recovery. This characterization assumes a COVID-19 vaccine is not widely available for another year or so. Verifiable progress on an earlier arrival could help sustain the momentum of the initial rebound and move the economy closer to a V-shaped recovery.

Consumer Outlook

Consumer spending composes about two-thirds of U.S. GDP, which makes jobs, incomes, and consumer confidence vitally important for economic recovery. With higher unemployment than at any time since the Great Depression, and 22 million net jobs lost in March and April, the hit to consumers’ spending power evident in recent economic data might have been significant. But stimulus efforts helped plug the hole, including direct checks to individuals, unemployment benefits, and financial support for businesses to help them keep employees on their payrolls. We saw the impact of the stimulus in the 10.5% increase in consumer incomes in April and record 33% consumer savings rate, according to the U.S. Bureau of Economic Analysis. The stimulus has bridged many consumers to the other side of the crisis, but structural unemployment in industries more challenged in a socially distant society will delay consumer spending’s return to 2019 levels.