Ray Dalio, billionaire philosopher-king of the world’s biggest hedge fund, has a checklist to identify the best time to sell stocks: a strong economy, close to full employment and rising interest rates.

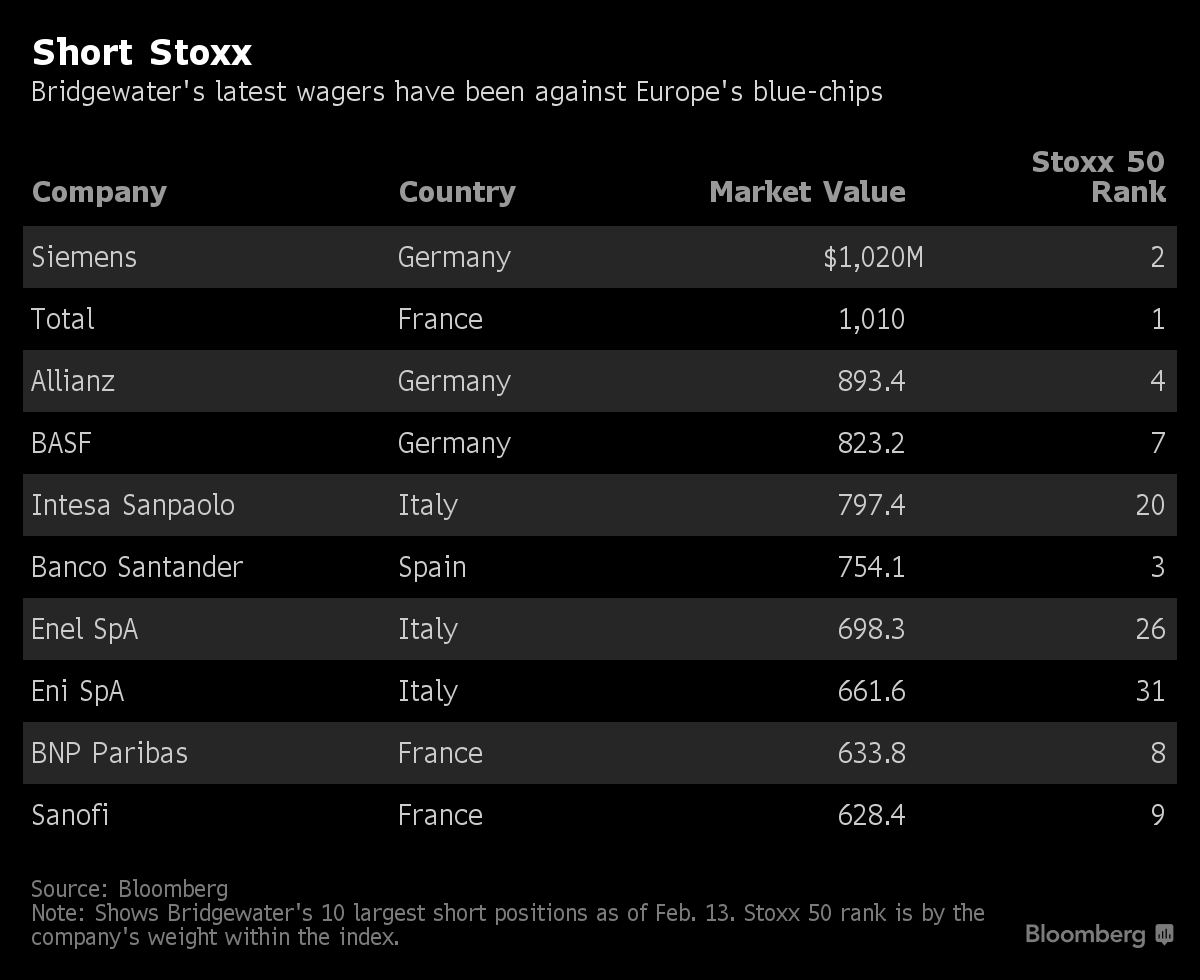

That may explain why the firm he created, Bridgewater Associates, has caused a to-do the past two weeks by quickly amassing an $18 billion bet against Europe’s biggest companies. The firm’s total asset pool is $150 billion, according to its website.

Economic conditions in Europe appear to fit Dalio’s requirements. Last year, the continent’s economy grew at the fastest pace in a decade, and European Central Bank President Mario Draghi has indicated he’s on a slow path toward boosting rates as economic slack narrows. Factories around the world are finding it increasingly hard to keep up with demand, potentially forcing them to raise prices.

But Dalio is leading his firm down a path that few other funds care to tread.

Renaissance Technologies, most recently famous for its association with Breitbart donor Robert Mercer, is only $42 million short in Europe. Two Sigma Investments is betting even less than that. Kenneth Griffin’s Citadel has less than $2 billion in European company shorts.

So Dalio will rise or fall virtually on his own.

Bridgewater didn’t respond to requests for comment.

Wonder Why

“It is not unusual to see strong economies accompanied by falling stock and other asset prices, which is curious to people who wonder why stocks go down when the economy is strong and don’t understand how this dynamic works,” Dalio wrote in a LinkedIn post this week.

Read more: Understanding short selling -- a QuickTake explainer