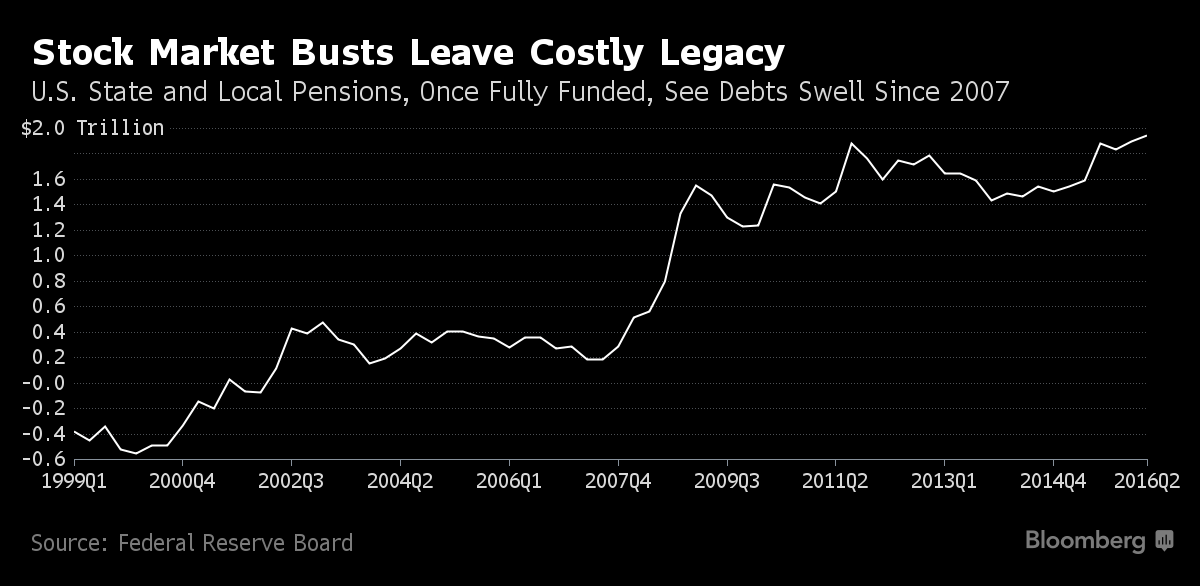

The $1.9 trillion shortfall in U.S. state and local pension funds is poised to grow as near record-low bond yields and global stock-market turmoil reduce investment gains, increasing pressure on governments to put more money into the retirement systems.

With the Federal Reserve deciding to hold interest rates steady at its meeting Wednesday, the funds will continue to be squeezed by rock-bottom payouts on fixed-income securities just as stocks fall overseas and post only modest U.S. gains. As a result, pensions in Illinois, Missouri and Hawaii this year have moved to roll back the assumed rate of return on their investments, joining the dozens that have taken that step over the past two years.

“There’s little light at the end of the tunnel as far as pension funding is concerned,” said Vikram Rai, head of municipal-bond strategy at Citigroup Inc. in New York. “I expect funded ratios will drop further. It’ll require increased pension contributions on the part of the states and local government, but most state and local governments don’t have the ability to do so.”

Pensions count on annual investment gains of more than 7 percent to cover much of the benefits that come due as workers retire. But public plans had a median increase of 1 percent for the year ended June 30, the smallest advance since 2009, when they lost 16.2 percent, according to the Wilshire Trust Universe Comparison Service.

The chief investment officer of the California State Teachers’ Retirement System, the nation’s second-biggest public pension, on Tuesday said it posted similar returns, falling short of its target for a third straight year.

When investments lag expectations, governments and employees can be called upon to increase annual contributions to make up for the shortfall that’s left behind. The decision by the Illinois Teachers’ Retirement System in August to cut its annual return forecast may increase the state’s pension bill by nearly half a billion dollars.

A reversal of fortune doesn’t seem imminent. The Fed Wednesday opted to hold the benchmark lending rate between 0.25 percent and 0.50 percent, which will keep yields low on mortgages, corporate bonds and other fixed-income securities.

“If there’s a real storm cloud on the horizon, then this is it,” said Dan Heckman, a senior fixed-income strategist at U.S. Bank Wealth Management, which oversees $133 billion. “The municipal-bond market at some point in time down the road will suffer from concerns over this level of underfunding. This is going to continue to be a source of problems for many municipalities, both at the state and local level.”

The decision to adopt more modest expectations from their portfolios has been welcomed by credit-rating companies, given than it will prod public officials to put more cash away instead of waiting for windfalls from the next bull run. S&P Global Ratings has praised the moves as positive, though it may lead to cutbacks in other types of spending.

“We continue to see states trying to balance their budgets and address growing long-term liabilities -- which are a fixed portion of their budget -- and the need to grow other areas,’’ said S&P’s John Sugden. “Some of these fixed costs are crowding out spending on some other pro-growth investment areas like transportation and education.”