The 2017 Fidelity RIA Benchmarking Study of 408 firms showed that fees may be down as much as 20 to 30 basis points when discounts are included, said David Canter, head of the RIA segment for Fidelity Clearing & Custody Solutions.

Midsize and larger firms are more likely to be discounters than small firms. The average discount across all firm sizes is 21 basis points, but the discount jumps up to 28 basis points for firms with more than $1 billion in assets.

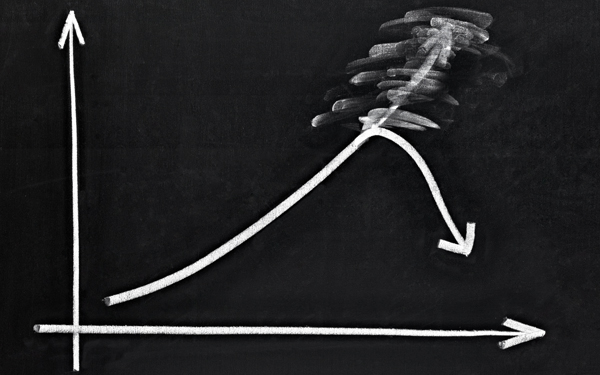

RIA revenue yield has dropped 3 basis points, revenue growth has fallen to 7 percent, and client growth is down to 5 percent, the lowest level in five years, according to the study. To combat that downward pressure on revenues, some advisors have adopted or are considering adopting digital solutions to managing portfolios. But Canter said he is surprised more are not doing so.

Only 8 percent of advisors have adopted digital solutions, and another one-third are considering doing so in the next 18 months.

“If we check those numbers in a year, I bet they will have doubled or tripled,” Canter said. “Despite the declines in revenues, RIAs are having a great year because of the good market. Most are operating on a 50 percent profit margin, which is great for any business.”

Competition is increasing among advisors, and advisors are beginning to adapt, the study said. In addition to the 64 percent offering discounts on their fees, many are starting to formally unbundle their fee structures. The study found there has been a 57 percent increase in the number of advisors saying client segmentation is a top focus area.

Advisors using digital solutions work with nearly three times the number of clients that non-users do; they have two and a half times more assets under management and three times the revenue, the study said.

According to the study, RIA productivity is at or near its highest level in five years with assets under management per client remaining steady at $1.1 million and assets per advisor and clients per advisor up 11 percent.

An area that needs work, according to the study results, is increasing the number of women in the profession, although some improvements are being made. Thirty-seven percent of all financial firm employees are female, but only 12 percent of owners, 18 percent of advisors and 21 percent of executives are female. Fees are being compressed and revenues are down, so RIAs are looking for new ways to survive and thrive, according to a study by Fidelity Clearing & Custody Solutions, a division of Fidelity Investments, released Monday.

Fees are being compressed and revenues are down, so RIAs are looking for new ways to survive and thrive, according to a study by Fidelity Clearing & Custody Solutions, a division of Fidelity Investments, released Monday.

RIA Fees And Revenues Down, Fidelity Says

December 18, 2017

« Previous Article

| Next Article »

Login in order to post a comment