RIAs find themselves forced to keep up with a world changing on many fronts—an evolving client base, shifting regulations, new technological possibilities and demand for new services. Even as financial markets provide a tailwind for their firms, new technologies and new business models are surfacing to continuously challenge them.

That said, the independent advisor channel continues to balloon and the largest RIAs are accumulating large sums of assets. But they’re also forced to be nimble to keep up with the industry’s evolution.

To view FA's 2018 RIA Ranking and the 50 Fastest Growing RIAs, click here.

The RIA channel eclipsed $70 trillion in registered assets under management in 2017, according to a study sponsored by the Investment Adviser Association. In the 17 years the IAA has tracked RIA growth, AUM has grown by a cumulative 220% and at a compound annual growth rate of 8.1%.

There are more than 680 RIAs with at least $1 billion in client assets, according to a November 2017 Cerulli Associates report. This club accounts for less than 4% of the total number of RIAs, but controls 32% of the RIA channel’s workforce and 60% of its assets.

Larger RIAs have grown in part because the entire RIA segment is attracting new advisors, many of them breakaways from wirehouses who bring assets to the channel by joining an RIA or starting their own firm.

The main draw to the channel is the idea that they will be placing the clients’ interest ahead of their own, a development the public is increasingly aware of. The fiduciary model actually allows them more flexibility to find investments, says Erik Morgan, senior partner and advisor with Freestone Capital Management, a Seattle-based RIA founded in 1999 that has grown into a $4.2 billion firm, largely by working with high-earning technology workers in the Puget Sound region.

That ability to serve clients better is one of the reasons advisors moving from a brokerage firm to the RIA channel end up happier and wealthier, according to the March 2018 “Independent Advisor Sophomore Study” from Charles Schwab.

High-net-worth clients are especially aware of the difference in models, says Drew McMorrow, president and CEO of Boston’s Ballentine Partners, which serves such elite clientele. “There’s a simultaneous growing awareness that a tax-sensitive, risk-aware investment approach can be a very successful strategy, and that’s adding to our ability to market,” says McMorrow, whose firm has garnered some $6.7 billion in AUM since its 1984 founding.

Out Of The DOL Frying Pan

The Department of Labor’s fiduciary rule, which would have deemed any advisor rendering recommendations within retirement accounts as fiduciaries, has fallen by the wayside. On March 15, the U.S. Fifth Circuit Court of Appeals vacated the rule.

Still, many RIAs supported it as an important consumer protection measure and they think consumers’ awareness of the higher standard is growing. The DOL rule may be DOA, but it created clearer distinctions between sales-oriented brokers and advisors held to the fiduciary standards.

It’s not good for consumers that the rule has gone away, says Deb Wetherby, CEO and founder of San Francisco-based Wetherby Asset Management. It imposed discipline on advisors, she says. Still, she thinks the trend is here to stay. “This trend away from a sales-based model to more of an objective advice model was in place long before the fiduciary rule.”

According to the “2018 RIA Sentiment Survey” from TD Ameritrade Institutional, RIAs named regulations as their largest potential roadblock, but that survey was fielded in 2017, before the DOL rule judgment and before the SEC came forward with its own proposal, “Regulation Best Interest.” The SEC version prevents brokers from calling themselves advisors, but leaves the door open for them calling themselves “financial planners” or “wealth managers.” (Separate agency proposals mandate continuing education, account statements, minimum capital and fidelity bond requirements.)

“With the SEC’s proposals, I think there is some confusion that will exist between retail investors as to the difference in best interest rules for broker-dealers versus the fiduciary duty for RIAs,” says Eric Kittner, chairman of Clayton, Mo.-based Moneta Group Investment Advisors and partner in the Sheehan-Kittner team of the Moneta Group. “I don’t know that any of it provides a lot of clarity for the end consumer.”

At the end of the day, the brokerage industry has more resources, clout and organization than RIAs, says McMorrow. What many see as a pro-Wall Street tilt at the SEC may result in more regulatory burdens for RIAs and fewer for brokers. “I am worried that the regulation may end up being turned against RIAs at some point because of the power of that [broker] lobby,” says McMorrow. “I already see that those of us who subject ourselves to the fiduciary standard are beset with a lot of regulations. It feels like the pressure is mounting on us, when it should be mounting in favor of the consumer interest.”

Growing Industry, Growing Firms

While growth is important for financial advisories, some worry about growing too quickly.

“At what rate can we grow and have it not be at the expense of our existing clients?” asks Wetherby, whose firm, founded in 1990, has expanded into a $4.7 billion AUM RIA with multiple specialties, among them ESG and impact investing offerings. The firm also aims its services at women and clients going through life transitions.

Sustainable growth is typically organic growth—the ability to attract new clients and assets—and the Moneta Group, an $18.5 billion firm, encourages its partners and teams to grow this way. Each of the firm’s 22 teams of advisors retains autonomy over its book of business, depending on Moneta mostly for enterprise back-office support.

“We have a very entrepreneurial culture and environment,” says Kittner. Now the firm’s 40 partners are re-examining whether to move more responsibilities from the teams onto the enterprise.

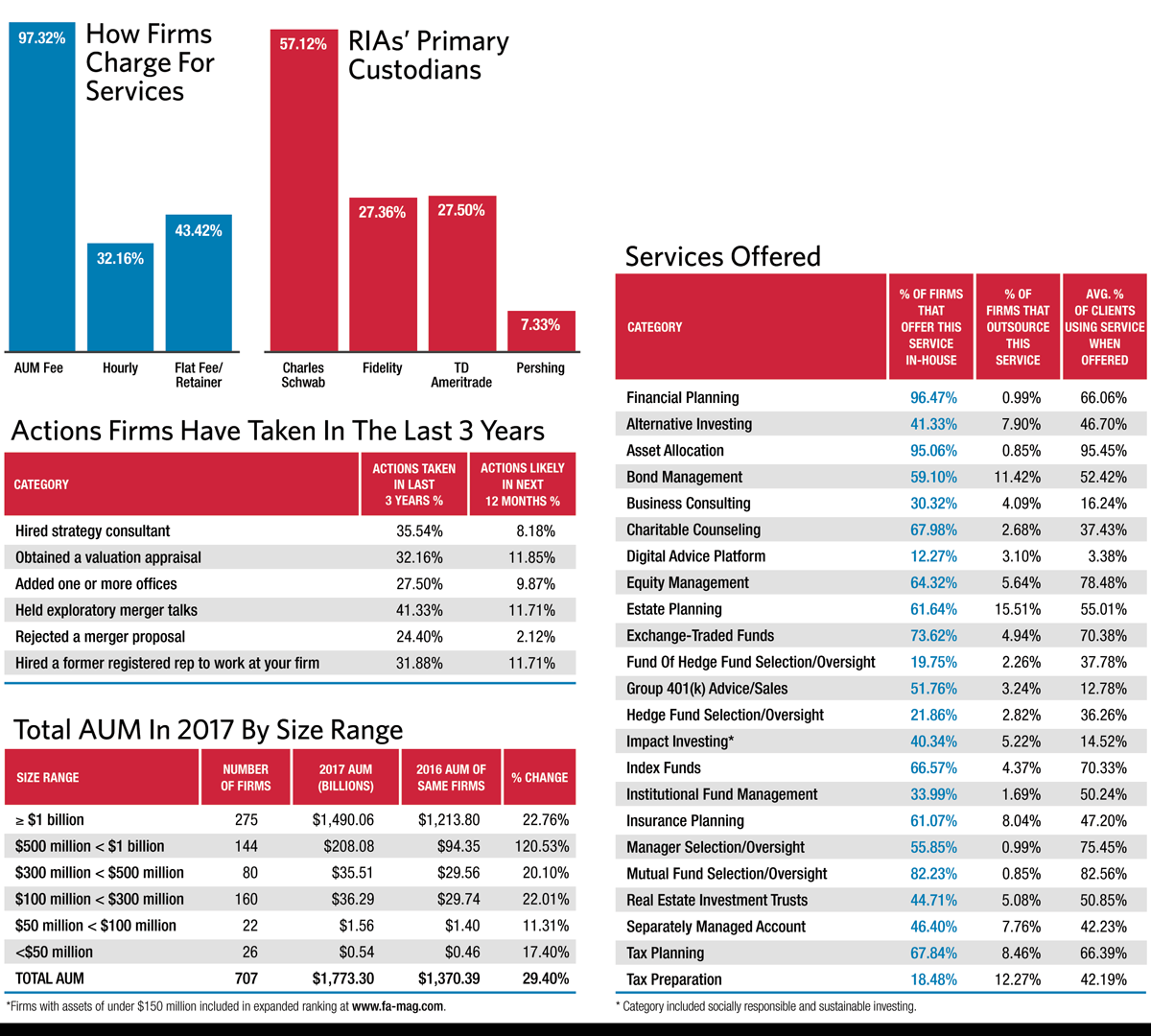

In 2017, there were a record of 153 mergers and acquisitions among RIAs, according to RIA Deal Book. According to Echelon Partners’ 2017 RIA M&A Deal Report, the average assets under management for transactions topped $1 billion for the second year in a row.

Moneta is pursuing acquisitions too. “We’re in a growing marketplace with a significant amount of merger and acquisition activity out there,” says Kittner.

Cleveland-based MAI Capital Management is pursuing its own advisory purchases using an influx of private equity cash. Last July, the firm sold a 40% non-voting interest to Wealth Partners, which itself is partly owned by Affiliated Managers Group (AMG).

“That’s been phenomenal for us,” says Rick Buoncore, an MAI managing partner, of joining the AMG orbit. The firm’s new PE partner has helped it identify 70 possible target firms, he says. Rather than renting out its back office and technology capabilities to the firms it buys, MAI wants to create symbiotic links to other advisors. (The firm currently has $4.6 billion in AUM.)

Changing Times, Changing RIAs

While many firms are adapting to the changing times, older, well-established RIAs like Newtown Square, Pa.-based Veritable LP are also innovating because it’s in their blood.

“We don’t want to be doing what everybody else is doing,” says Veritable’s founder, Michael Stolper. With $15.6 billion in assets, Veritable has a large research and development department that is given free rein to investigate new investment and planning concepts.

In 2017, the firm developed Archean Capital Partners, a joint venture with Moelis Asset Management to provide early capital to private market fund managers trying to launch their own firms and strategies. “It’s a classic example of where there’s lots of demand but not a lot of supply of capital, which is exactly where we and our clients want to be investing,” says Stolper. Veritable’s clients get access to early-stage private funds, while select managers are able to focus on investments, and Archean provides the capital they need to start their strategies.

Many RIAs offer new investment options or services in response to client demand, while others, like Ferguson Wellman Capital Management, a $5.2 billion AUM firm based in Portland, Ore., evolve in an attempt to broaden their client base.

Five years ago, Ferguson Wellman launched West Bearing Investments, a division that lowered the minimum asset mark for new clients from $3 million to $750,000.

“We thought that we would create West Bearing and attract more emerging wealth, like physician couples who are accumulating before they got to the $3 million mark,” says George Hosfield, the firm’s CIO. “That’s not how it’s played out demographically over the past three years. The clients skew slightly younger than the average Ferguson Wellman client, but they just have less money. On the other hand, the reach and the brand-building it has enabled has been super-valuable to us.”

Success Requires Succession Plans

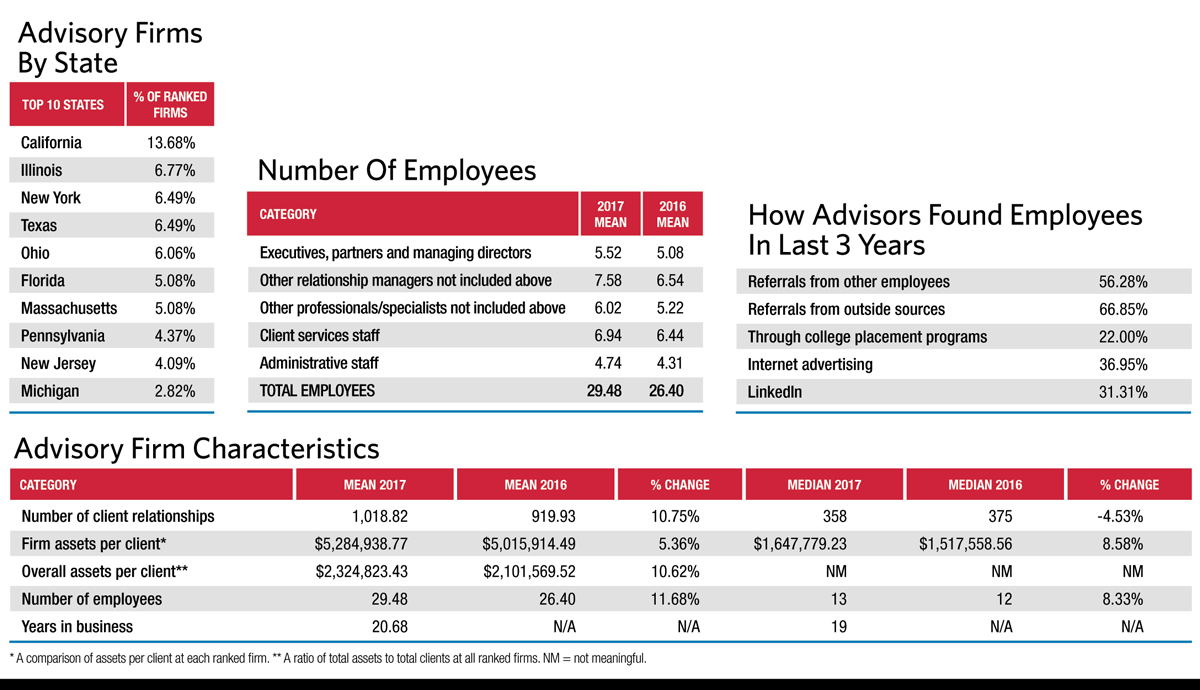

Large RIAs also have pressing succession concerns as the older generation of advisors face retirement. Some firms prefer internal succession, hoping to hand over the baton to their current employees to maintain their culture and clientele. That means they must build sustainable management structures as well. According to TD Ameritrade, 30% of RIAs are hiring younger advisors, and 24% hire college interns.

Veritable LP was founded by Stolper in 1986 and grew into a powerhouse under his management. He remains instrumental in Veritable’s business strategy, but he has also taken steps to make sure he isn’t the only important person in the firm.

“True success in business means that when I retire, nobody cares,” he says. He has no current plans to retire, but the firm is now run by an executive committee and managed by an operating committee, which would leave the firm in experienced hands if he did go.

Ferguson Wellman has experienced several business transitions of its own in its 43-year history, and it is planning for the next shift in ownership. “We’re embarking on a 10-year process of our next transition right now,” says Steve Holwerda, the firm’s chief operating officer. “We started that about 12 months ago. We’ve brought in the next generation of owners over the past 10 years, and now the current principals of the firm are starting this process that will take another 10 years to complete.”

Succession planning is key to serving a client’s best interest, says Freestone’s Morgan, as multi-generational wealth demands continuity in financial advice. It also may help keep firms on the track of innovation and evolution.

Firms like Freestone are also looking not just to hire young but promote junior advisors into positions of leadership and responsibility early in their careers to establish strong internal succession plans. “We’re always looking for ways to make senior management less important by putting high quality young people into situations that will challenge them,” says Morgan. “Our goal is to be in a position where the business is a collection of owners and is run by people in their 30s and their 40s, not by the folks in their 50s and 60s.”

Moneta Group has created a partner-in-training program to encourage younger hires to move up through the firm and take over teams of their own. “We’ve continued to add to the younger advisor base who will continue to take care of our clients, but they’re also adding new clients themselves,” says Kittner.

Who’s Next?

As baby boomer clients transition to retirement, next generation issues are a central concern to many of the largest RIAs. According to TD Ameritrade’s 2018 RIA sentiment survey, 42% of RIAs are working to change their marketing and networking to attract younger clients.

At Moneta Group, many young, new clients are “Henrys” (high-earning, not rich yet) looking for foundational advice upon which they can build a financial future.

While many large RIA firms also have sizable 401(k) businesses serving the next generation, the primary draw of younger clients is as heirs of current clients or inheritors of wealth previously established elsewhere. Firms like MAI work to retain multi-generational family wealth by offering education and other wealth advisor services to families.

“We go out of our way to offer education for the next generation,” says Buoncore. “We find them ways to engage with us, and we start dealing with them young. When they get their first jobs, we help them start to invest some of their money. We keep great relationships with them.”

A big carrot for younger and more diverse clientele is the offering of impact and ESG investment options. Many large RIAs have thus developed those strategies in house.

Wetherby is one of the pioneers in the impact investing space, having developed and run impact and ESG strategies for a decade or more.

“We had clients who are very interested in reflecting their values in their portfolios, so we faced a decision: We either have to be able to do this well, or we have to refer those clients to someone else who can do it well,” Wetherby says. “We spent 10 years figuring out how to do it well.”

The firm has implemented impact reporting into its standard reporting system so that clients can look at their portfolios and see how much CO2 they have offset or prevented from being released into the atmosphere or how many small-hold farmers their investments have helped support. Impact reporting is also available on the firm’s client portal.

Ballentine has also been engaging in ESG and socially responsible investing; the firm hired a director of impact investing in 2010.

Looking Forward

While impact investing seems to increase in popularity, financial advice is still focused on money and markets. In TD Ameritrade’s sentiment survey, advisors were confident about continued growth in global economies and financial markets. That confidence remains as midyear 2018 approaches.

Still, advisors are also talking to their clients about increased volatility, and they’re keeping an eye on the prospects for a recession in the next several years.

“We’re going to experience challenges in meeting client expectations and needs as they move into the next phase of their lives,” says Morgan. “Potential returns are probably going to be lower than what they had hoped for, but dealing with that probability is part of doing an advisor’s job.”

Lower returns mean a more difficult climb to meeting clients’ financial goals, says Morgan, and potentially more headwinds for RIA growth.

As baby boomers retire and unwind their assets, they give RIAs another reason to attract sustainable wealth from younger generations, says Buoncore. “The easy part of the game is over,” he says. “The industry is at an inflection point where the majority of clients are starting to decumulate assets as opposed to accumulate assets.”

Standing still is fatal, says Morgan. “If you’re the RIA of 10 years ago, you’re out of luck,” he says. “If you’re not great in technology, changing your service offerings and deepening your relationships, you’re going to be put out of business by either the consolidators or the new firms coming up behind you. I don’t think these are the gravy days: You have to evolve and change or be left behind.”