In the face of a continued stream of positive economic data, resilient equity markets, massive Treasury bond auctions, and the passage of $1 trillion health-care reform legislation, bond yields have been pressured higher in recent weeks, setting off alarm bells among the investing public. After all, interest rates are at 50-year lows, so it seems inevitable that the only direction yields can go is up, and thus the only direction bond prices can go is down.

With Morgan Stanley calling for a 5.50% 10-year Treasury bond yield at year's end, and Bill Gross saying bonds have seen their best days, there is an understandable impulse to push the sell button on your clients' bond holdings.

Resist that urge, and consider for a moment just some of the reasons why rising rates do not necessarily spell doom for bond portfolios.

Rising Rates, Increasing Income

For one thing, when interest rates rise, income increases.

Income represents 70% of a bond portfolio's total return over the course of its lifetime, and income generation is perhaps the biggest advantage bonds have over other asset classes. When interest rates rise, the income increases as long as the portfolio is actively managed to maintain its duration (or interest-rate sensitivity measure) over time. An active manager can bring higher-interest-paying bonds into the portfolio, and thus take more income.

The caveat is that very long-term bonds will see the smallest income benefit from rising rates, since they will fall so much that fewer new income-producing bonds can be bought to replace older ones. Thus, to prepare for the rising rate environment, it may be wise to ensure that the average maturity and duration of your client's bond portfolio has a short or intermediate term-say, less than five years. Otherwise, principal losses will curb your ability to increase income and the total return.

No Straight Line

Another reason not to panic is that interest rates do not move in a straight line and do not go up indefinitely.

Like the economy, interest rates move in cycles. They rise for a few years, stabilize for a certain time and then fall at some point when the economic cycle matures. For this reason, an investor who liquidates his bond portfolio in a rising rate environment can miss a recovery, and that means selling in a panic may be a poor idea.

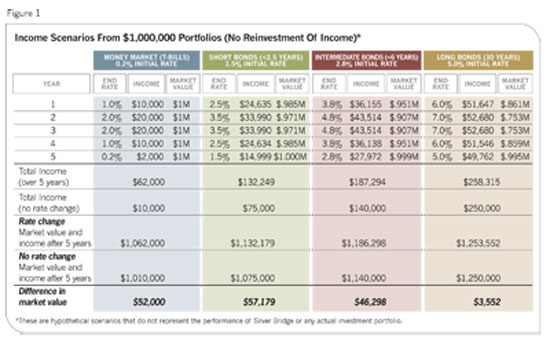

Consider the example in the first chart-four bond portfolios of varying maturity structures in which the manager does nothing more than maintain the portfolio duration over the course of an interest rate cycle. In each case, interest rates rise by 1% for two years, stabilize for one year, and then fall by 1% for two years, essentially round-tripping back to the original portfolio yield. As these hypothetical scenarios illustrate, regardless of the maturity structure of the bond portfolio, the total return (the combination of principal and income return) is higher for a portfolio held over the course of an interest rate cycle than it would be if there were no change in interest rates, even if you don't take into account the benefit of compounding reinvested income.