After recording two double-digit drops in equity prices over the last three trading days, the global pandemic of COVID-19 has sent world equity markets into bear market territory. The result is a cumulative 30% drop in the S&P 500 Index in just under 30 days. Though daunting, once the market finds a bottom, which is where the index begins to consistently move higher than the previous market low—and we believe it is “when” not “if” the market finds a bottom—it may provide an attractive opportunity for long-term investors to consider adding risk to portfolios.

Given all the uncertainty, which can raise questions and result in emotional reactions from many investors, LPL Research believes that it is important to take a systematic approach to determine when that bottom might be found, enabling markets to reverse course and move higher. To guide long-term investors toward what to focus on in order to hone in on that timing and those potential buying opportunities, LPL Research has compiled a Road to Recovery Playbook.

Latest Perspective

These are extraordinary times. The global pandemic has caused significant worldwide economic disruption, driving stocks into a bear market for the first time in over a decade and sending U.S. Treasury yields plummeting. Major U.S. cities have effectively gone into quarantine, entertainment and sporting events have been cancelled, large gatherings of people have been banned, schools have closed, and the list goes on.

While the health of those close to us remains our top priority, as investors, we also must try to assess the economic and market impacts. Recession odds have risen sharply, as it is becoming clear the impact on economic growth and corporate profits—though temporary—may be significant. Powerful monetary and fiscal stimulus actions and more aggressive containment measures may likely help mitigate the impact, but it’s tough to see the other side from where we sit today.

The Playbook

Before getting to our investor playbook, we would first encourage long-term investors to consider staying with your long-term investment plans.

We believe having a systematic playbook to follow can help us manage through these tough times. When those difficult times are caused by bear markets, a playbook can make clear what to watch as “leading indicators” of a potential market bottom that may signal the start of a sustained move higher. This playbook may help ease concerns by taking some of the emotion out of investment decisions and facilitating a measured approach. We all want to know when and where the market will bottom, the likelihood of a potential recession, and when the outbreak will be contained. These are extremely difficult questions to answer—but this playbook is designed to provide some clarity.

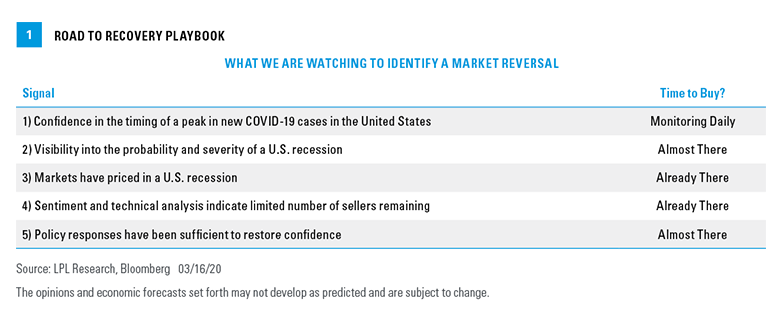

Foremost, we need to identify the most important signals, shown in Figure 1, that can help us determine when the market may find its footing. It’s important to note that having all five of these signals turning positive is not required before attractive entry points might be considered. Currently, the majority of these signals are either already or close to signaling that a potential bottoming process may not be that far off.

Key Signals For The Playbook

Confidence in the timing of a peak in new COVID-19 cases in the United States. The number of new U.S. cases continues to rise, and we don’t know when or at what level they will peak. Based on the experiences in China and South Korea, we think the peak is coming within the next month. However, the experience in Italy suggests perhaps it could take longer. The key is not to wait until the peak in new cases has materialized, but rather developing the confidence in the predictability of the pandemic’s outbreak path using sophisticated epidemic models, like Farr’s Law, which has successfully modeled disease spread through populations in past pandemic episodes. We see confidence in the timing of a peak as a major milestone in the stock market bottoming process as in past pandemics, the market has usually found its trough in prices tied to the stabilization of new cases, not necessarily the visibility of declines. We continue to monitor new cases daily and watch for signs of what path the U.S. may take to.

Visibility into the probability and severity of a U.S. recession. We won’t know for sure if the U.S. economy has entered a technical recession for many more months—since you only know you’re in a recession in hindsight. However, we will likely see data that indicates the timing and severity of a potential recession very soon. We will be watching the most timely data points to help gauge the depth and severity of a possible recession, including the March Institute for Supply Management (ISM) surveys, consumer confidence, jobless claims and the Leading Economic Index, among others.