We remain neutral on U.S. equities, which means we recommend investors remain at their long-term target equity allocations, while using volatility to tactically rebalance around those levels. We believe the current bull market will continue but not without some additional drama. The nice thing about the past month is that it has allowed investors and policy makers alike to catch their breath following the chaos that followed the Brexit vote. The sharp selloff was followed by a steep rebound and move to new record highs for major indices. Investor sentiment had moved into excessive optimism territory, according to the Ned Davis Daily Trading Sentiment Composite, but it’s since pulled back toward neutral territory. And longer term sentiment remains relatively pessimistic, despite the move to new record highs. Investors pulled another $6 billion out of U.S. equity mutual funds and exchange-traded funds (ETFs) last week, bringing the year-to-date total to $95 billion, according to ISI Evercore Research—close to record outflows. This continued doubt among investors makes us feel more comfortable with our mildly bullish view—remember, investor sentiment tends to work in a contrarian fashion.

Steady Improvement In Economy

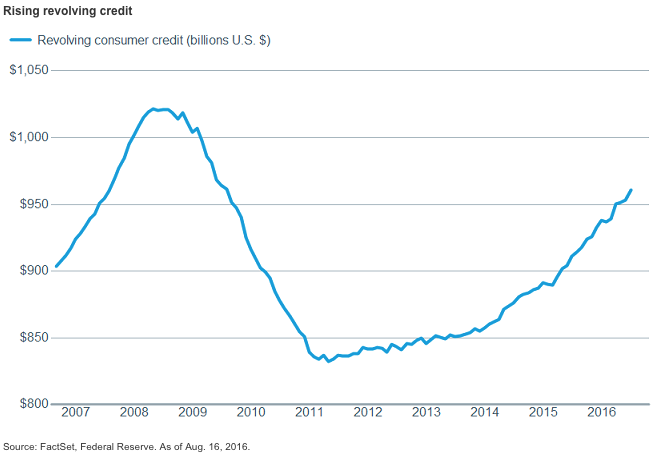

The latest batch of U.S. economic data doesn’t appear to presage an imminent recession, which would typically lead to a bear market. Consumer confidence has firmed, with the labor market continuing to improve, housing looking good, and wages finally starting to rise. Additionally, we’ve seen both revolving consumer credit and bank loans increase, indicating consumers may be more comfortable taking on debt.