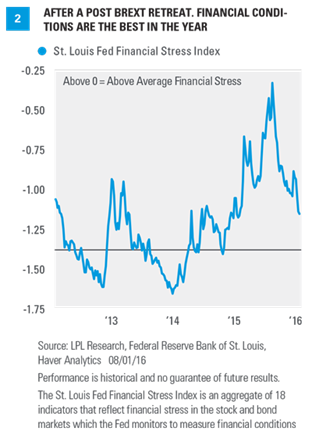

FINANCIAL CONDITIONS

Financial conditions are also likely to play a key role for the Fed over the next seven weeks. In a sense, tighter financial market conditions do the Fed’s work for them, and policymakers won’t want to “overtighten” policy in the current, somewhat fragile economic environment. As measured by the St. Louis Fed’s Financial Stress Index, financial conditions in early August 2016 are the most accommodative since just prior to the spike in financial stress following the Chinese yuan revaluation in August 2015. Over the final few weeks of July 2016, the initial post-Brexit tightening of financial conditions seen in late June and early July 2016 has more than reversed, and if that trend continues — aided by a weaker dollar, stabile oil prices, more bank lending, and narrower credit spreads — the Fed may be in a position to act in September.

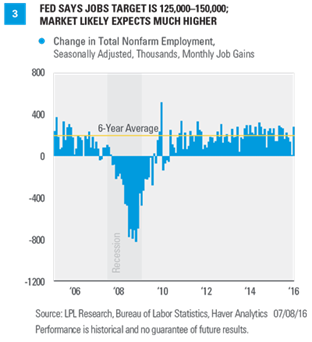

LABOR MARKET & WAGE INFLATION

Further progress on the labor market and wages also remain key to a Fed rate hike in September. This Friday, August 5, 2016, the U.S. Bureau of Labor Statistics (BLS) will release its July employment report. The August employment report is due out on Friday, September 2, 2016. In addition to those two crucial reports, the weekly readings on initial claims (released every Thursday morning), along with the July and August Job Openings and Labor Market Turnover Summary reports (JOLTS) due on August 10, 2016 and September 7, 2016, will provide the FOMC with plenty of information on the health of the labor market and the pace of wage pressures in the economy for July, August, and early September. We continue to expect that monthly job growth, which averaged 200,000 per month from mid-2010 through early 2016, will continue to decelerate and move into the 120,000 to 150,000 range by the end of the year.

Despite that deceleration, the pace of job gains should still be enough to tighten the labor market and push up wages, and ultimately, inflation, and help prompt the Fed to act to raise rates in December. However, if there are strong (200,000+) readings in both the July and August jobs reports, initial claims remain near 250,000 per week, wage inflation moves from 2.6% in June to closer to 3% by August, and the JOLTS data continue to show record high levels of job openings and quit rates (the percentage of job leavers who leave their jobs voluntarily), the Fed may be in a position to raise rates in September. The Fed’s next Beige Book, due in early September, will also contain key information on wage pressures in the economy that will be closely watched by Fed officials. (The Fed’s Beige Book is a qualitative assessment of economic, banking, consumer and labor market conditions in each of the 12 Fed districts.)

TIMELINE: LABOR MARKET

• August 5, 2016: July Employment Report

• August 9, 2016: July JOLTS

• September 2, 2016: August Employment Report

• September 7, 2016: July JOLTS